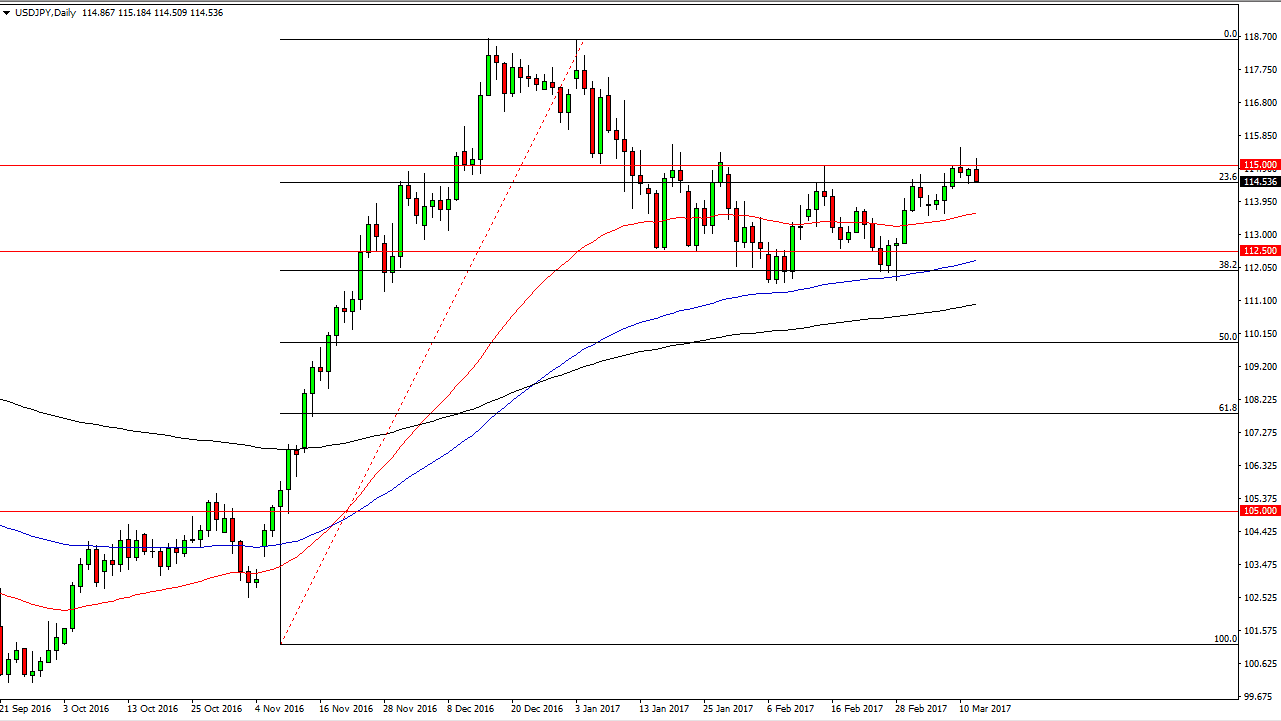

USD/JPY

The USD/JPY pair initially tried to rally on Tuesday, breaking above the 115 level. The fact that we found quite a bit of resistance above there and turned around is not much of a surprise me, because the 115 level has been so resistive. Having said that, the FOMC Statement coming out today could have massive ramifications in this pair. I still believe the pullbacks are buying opportunities, and if we can break above the 115 handle, and more importantly the shooting star from the Friday session, the market should then go higher and start aiming for the 118.50 level which has been my longer-term target. I believe that every time we pull back, you should start thinking about value in this market.

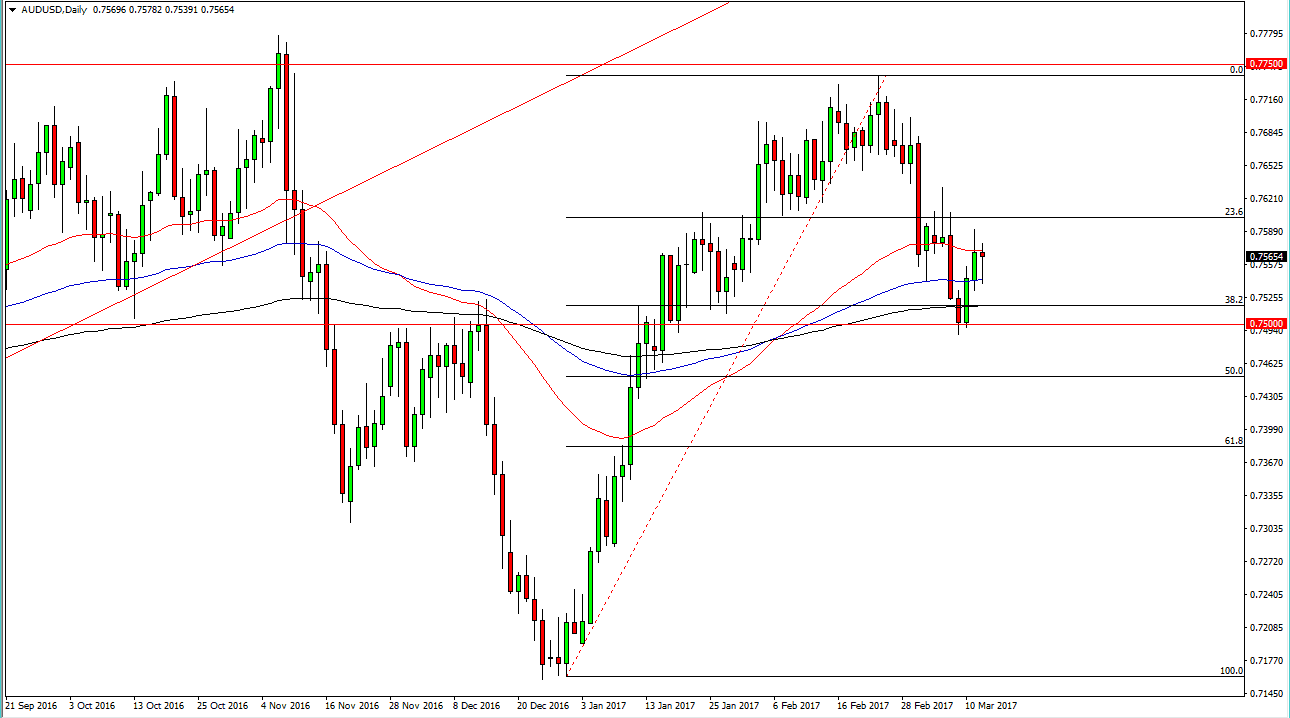

AUD/USD

The Australian dollar fell during the day initially but found enough support at the 100-exponential moving average to bounce and form a hammer. I believe that this is a sign that the buyers are trying to come back into this market, and I also recognize that a bounce off the 0.75 level is significant. Not only do we have support their due to the large, round, psychologically significant number, we also have the 38.2% Fibonacci retracement level. It’s not that is can be easy to go higher, but I’m waiting to see whether gold can rally because it tends to have a strong influence on this market. That would have a target of 0.7750 being likely, but it’s not necessarily going to be easy to get there. I think it will be choppy, but buying on pullbacks should continue to be the way going forward. I believe that the market has plenty of buying interest in it, and it’s only a matter of time before the bulls return every time we dip.