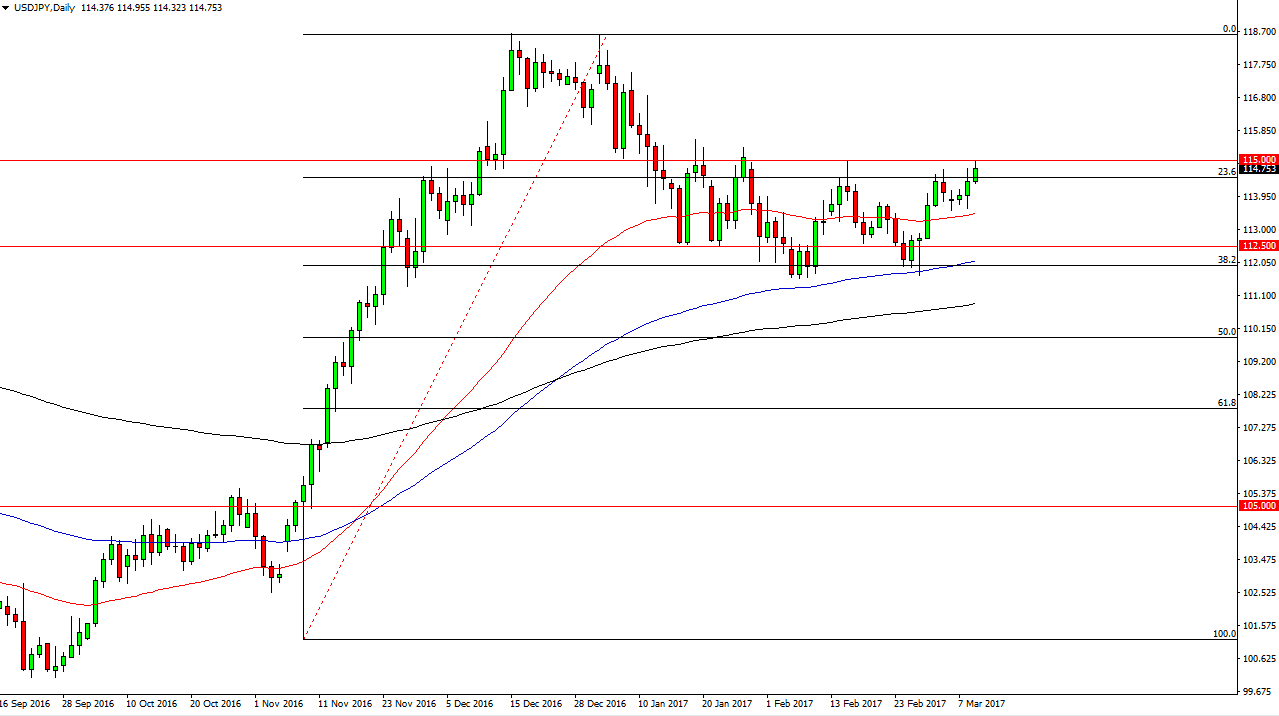

USD/JPY

The USD/JPY pair rallied during the day on Thursday, slamming into the 115 handle. I believe that this market will eventually break out, and this could be the session it happens due to the jobs number. With this being the case, I would be very bullish of this pair and I think we should then reach towards the 118.50 level. Pullbacks at this point should be buying opportunities, and thus I look at it is a one-way market. The most recent low has been higher, so I think that we are building up the momentum to finally break out. I have no interest in selling this pair, and believe that we should continue to see quite a bit of bullish pressure over the longer term.

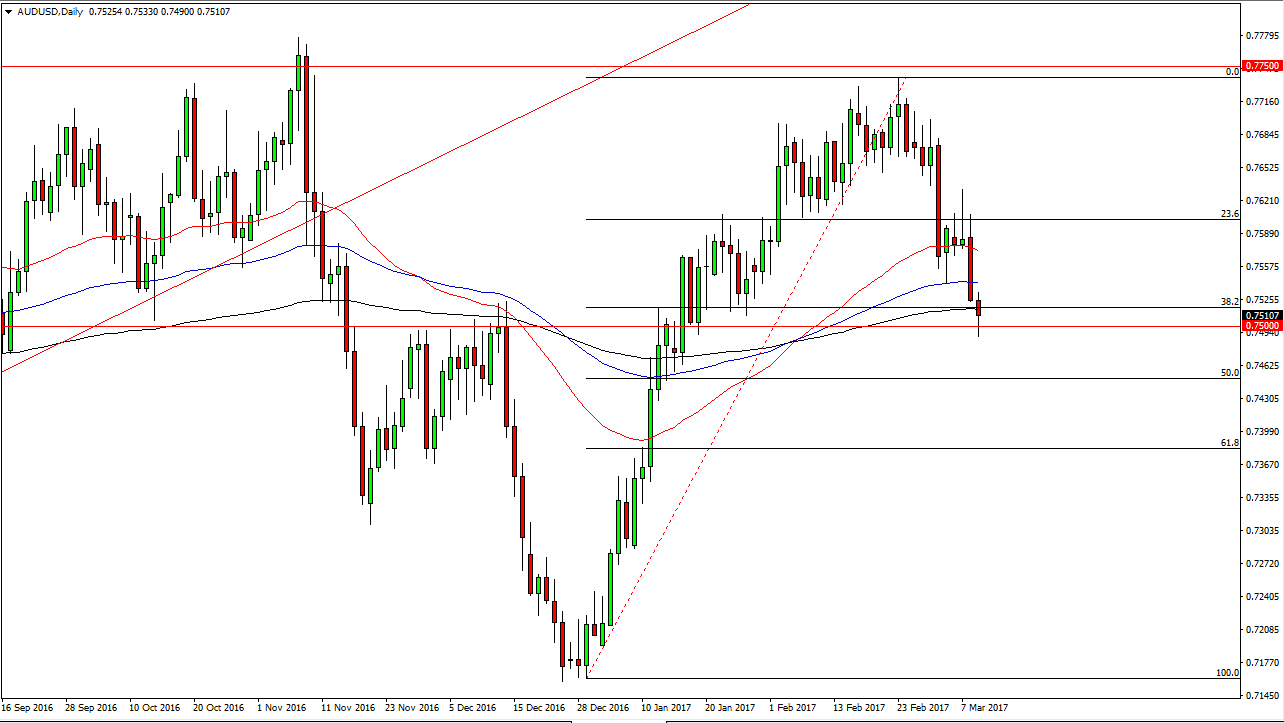

AUD/USD

The Australian dollar fell initially during the day on Thursday, but continues to find the 0.75 level to be interesting. That is an area where I think that a lot of traders will be interested, and it should be noted that the 200-day exponential moving average seems to be attracting a lot of attention to as well. The 0.75 level seems to have a significant amount of support just below and extending all the way to the 0.74 level. Because of this, I’m not interested in selling but I would be interested in buying on a break above the top of the candle. Pay attention to gold, it seems to be looking for support as well, and if it finds it today, then we should continue to go higher.

It’s not likely that I will be trading this market today, unless of course we get a significant bounce. Selling just isn’t going to be countable until we breakdown below the 0.74 level, and I don’t know that we get there today. However, this is certainly a market worth paying attention to.