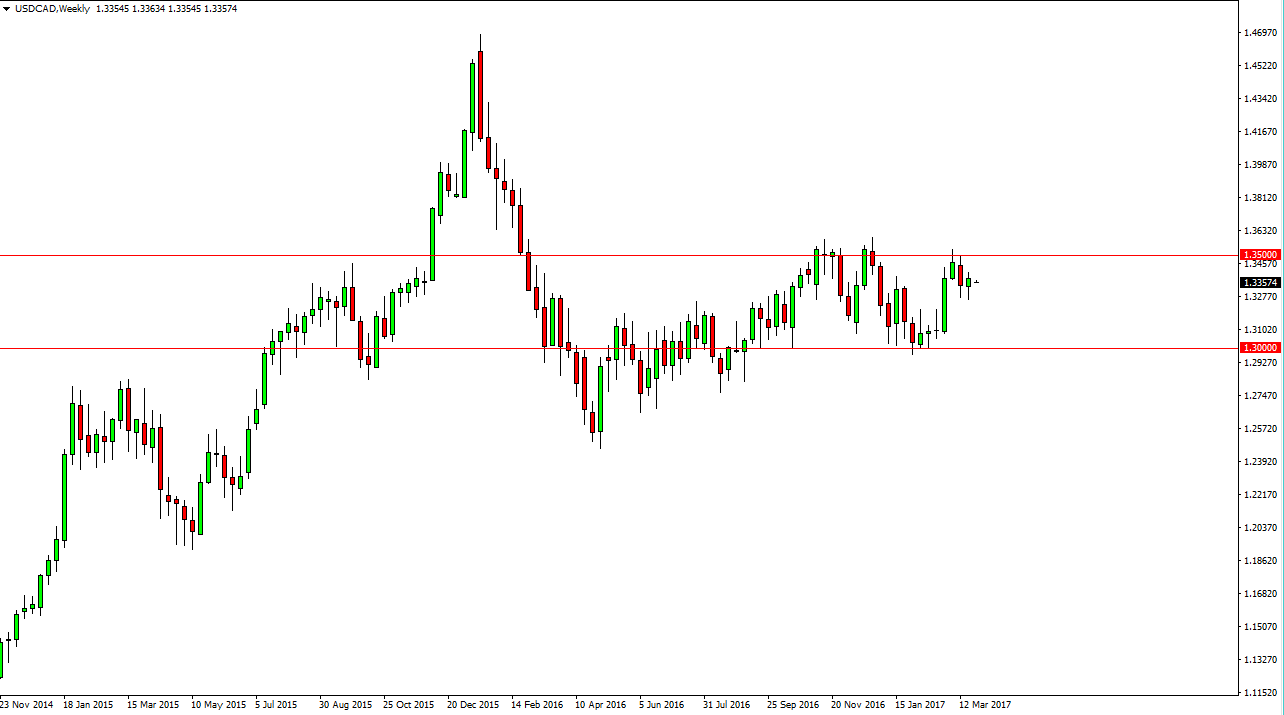

The USD/CAD pair fell during several weeks in March, but quite frankly I believe there is more than enough support to continue pushing this market higher. You can see that we have been in a longer-term grind to the upside, and we are approaching the 1.35 handle. If we can break above the 1.35 handle, and more importantly the 1.36 handle, the market will be free to go much higher, I believe possibly as high as the 1.46 level of the longer term.

Having said that, I believe that April will be a positive month but it is going to be very choppy. Short-term pullbacks will continue to be buying opportunities, and if there is bearish pressure on the crude oil markets, this move will make quite a bit of sense. We could drop as low as 1.30 during the month, and still look relatively well supported.

Oil

Keep in mind that you should pay attention to the oil markets, and currently they look as if $50 in the West Texas Intermediate market is going to offer a massive ceiling. If we broke above there, that could be good for the Canadian dollar, but it does not look like it’s going to happen anytime soon. Because of this, I believe that the move higher in this pair will be simultaneous to a breakdown below the $47 level in the WTI Crude Oil market, which would show a massive amount of support breaking down and giving way to the sellers.

With a massive oversupply, it makes sense that oil continues to struggle, and by extension the Canadian dollar will as well. I think you time that’s exactly what we see so pullback should be thought of as value in this market, especially of the Federal Reserve starts to speak in a more hawkish tone again. I have no interest in selling this pair until we break down below the 1.30 level.