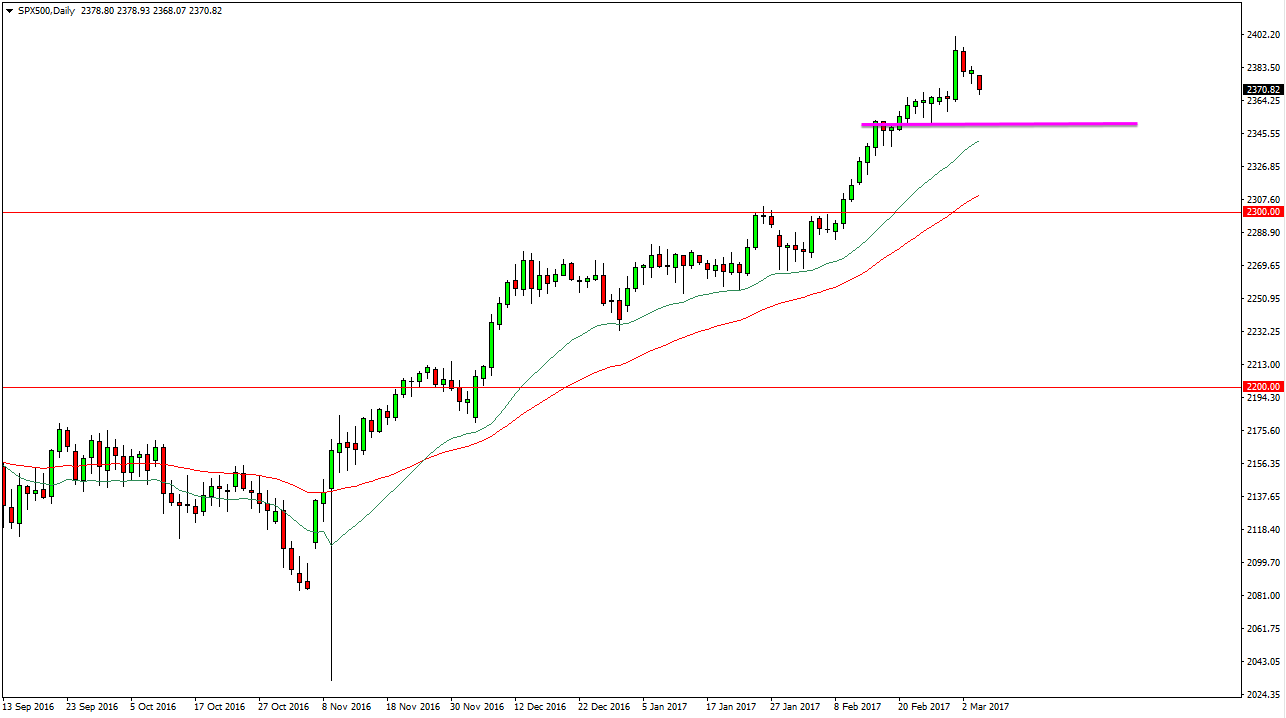

S&P 500

The S&P 500 fell slightly during the day on Monday, as we are bit overextended. The green 20-day exponential moving average continues to be supportive, so I think we will see a bit of a convergence near the 2350 handle that should be supportive due to recent price action and of course the moving average once it gets there. Because of this I believe that we will continue to grind sideways with a slightly negative bias and the short-term, but longer-term the market should continue to be very strong and I believe that the market will reach towards the 2400 level, and then eventually the 2500 level after that. I have no interest in selling this market as the S&P 500 has been so bullish.

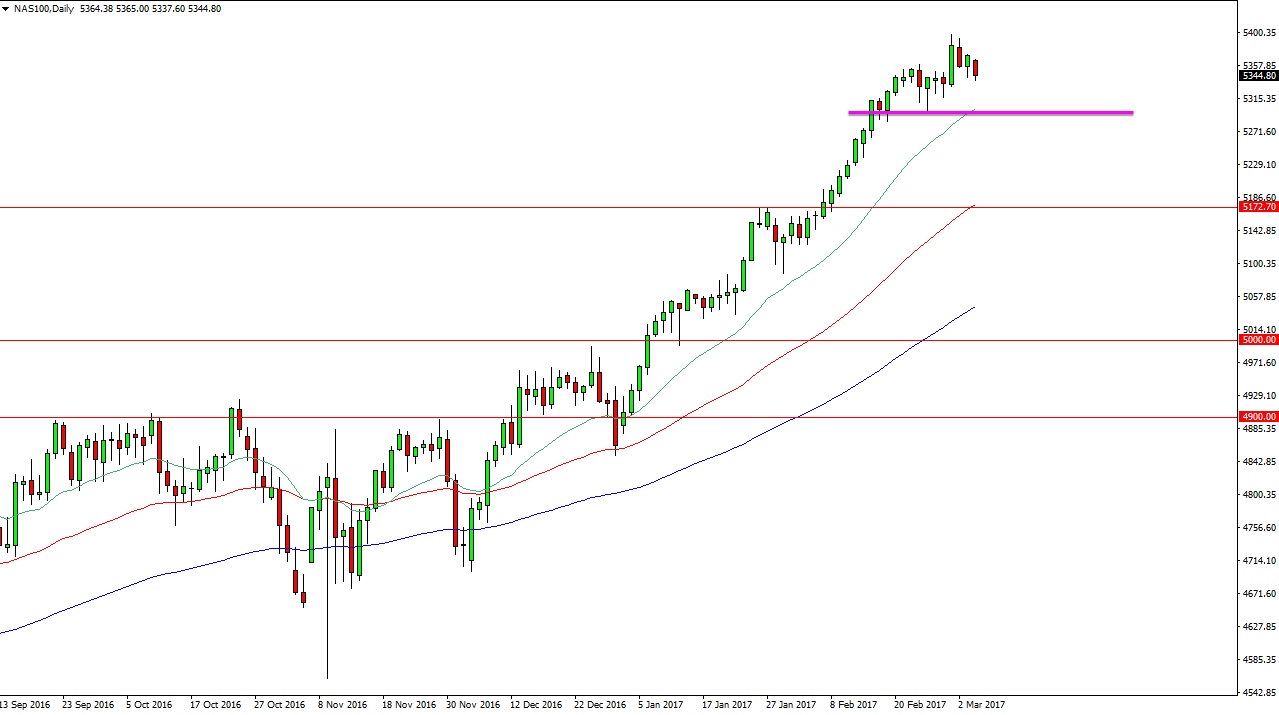

NASDAQ 100

The NASDAQ 100 fell during the day on Monday as well, and much like the S&P 500 is strong, the NASDAQ 100 has been bullish. Ultimately, I believe that the 20-day exponential moving average will offer quite a bit of support, and I think that the 5300 level will also be supportive. I think that in the meantime or to see a lot of sideways action so it might be difficult to place any trades with conviction. I think short-term buying opportunities may present themselves on short-term charts, but that’s probably about as good as it gets.

The 5400 level above should be resistive, and thus I think it would be a little bit of a fight to get above there. But if we can get above there, we should then reach towards the 5500 level. I have no interest in selling, the NASDAQ 100 has been bullish for quite some time and has been a leader as far as indices are concerned worldwide, and as a knock-on effect they have been driving risk appetite higher.