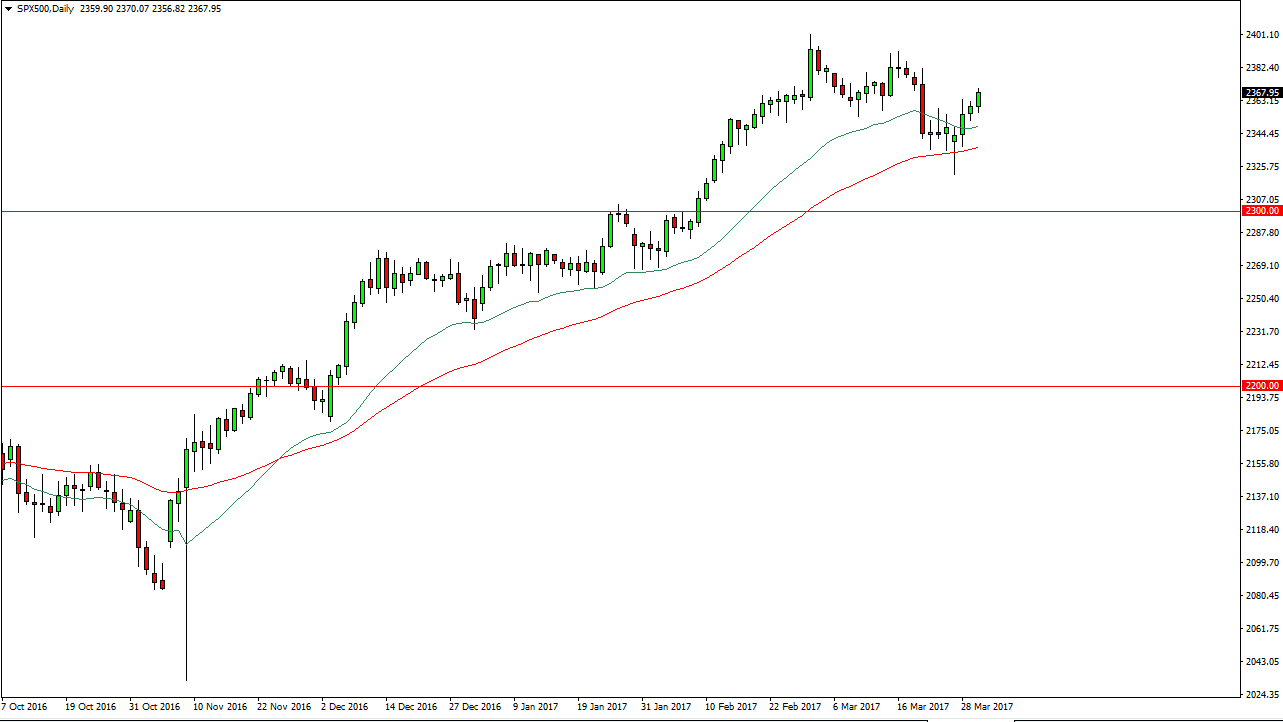

S&P 500

The S&P 500 initially dipped at the open on Thursday, but turned around to form a bullish candle. I believe that pullbacks will continue to be lots, as the 20-day exponential moving average, pictured in green, has offered quite a bit of dynamic support over the longer term. Beyond that, the 50-day exponential moving average, pictured in red, has been even more reliable. Ultimately, the market is going to aim for the 2400 level, but I would like to see a short-term pullback in order to pick up a little bit of value in what I think is a very bullish market in general.

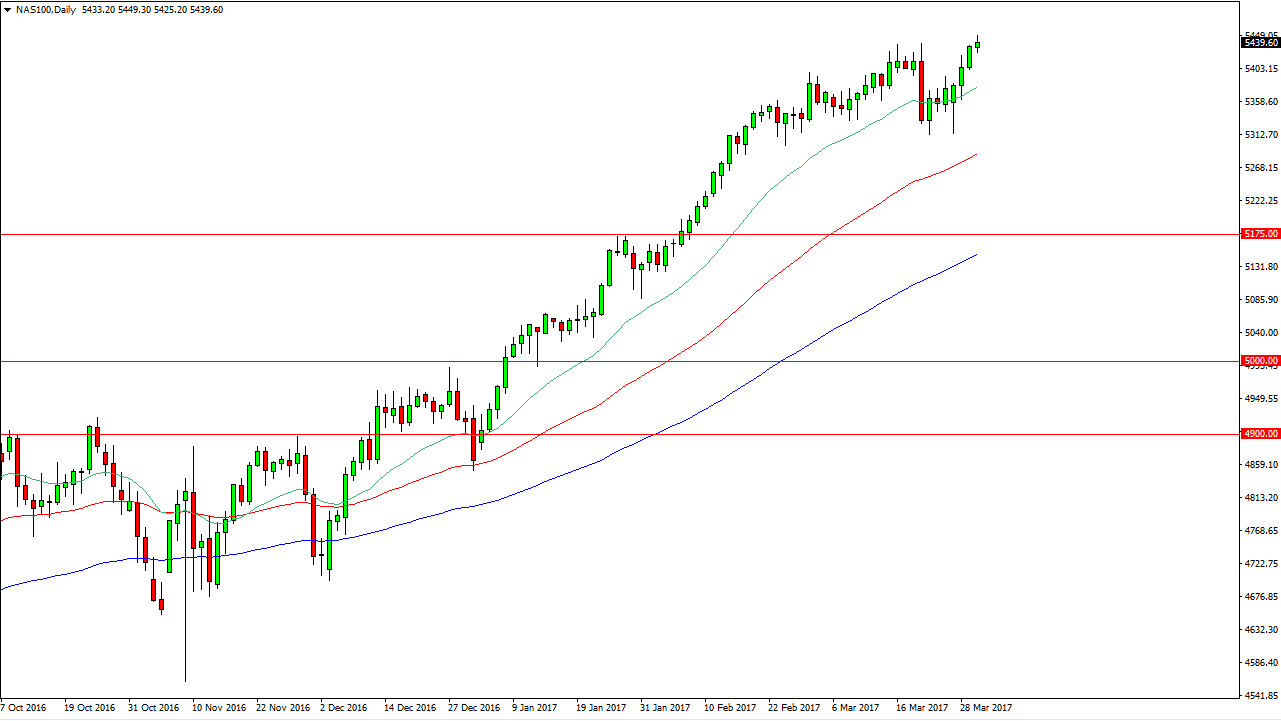

NASDAQ 100

The NASDAQ 100 had a choppy session on Thursday, but we are at a fresh, new high which of course is a very bullish sign. Because of this, I believe that pullbacks should continue to be valuable as the market should continue to favor the NASDAQ 100 over most other markets. The 20-day exponential moving average has been reliable, and I believe that the 5500 level will be targeted. I have no interest in shorting this market, as it has been so bullish and continues to lead the rest of the US higher. In fact, I believe that the rest of the world continues to follow as well.

I believe that the absolute “floor” now is 5300, so until we get below there, the thought of isn’t even remotely there to start shorting. I believe that the NASDAQ 100 is going to continue to lead the way and therefore I am very interested in buying the short-term pullbacks in not only the futures market, but also the CFD market. Once we get to the 5500 level, I would anticipate that we will get a bit of resistance, but that will be psychological more than anything else as it is a large, round, psychologically significant number.