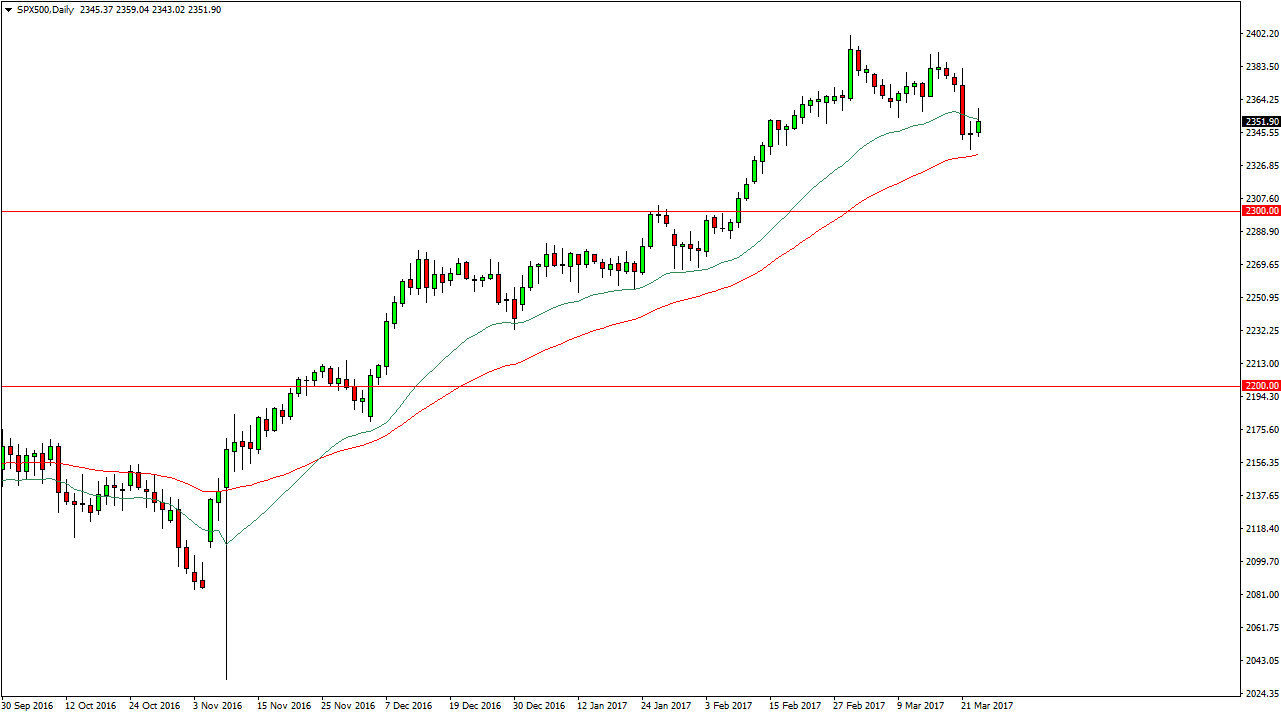

S&P 500

The S&P 500 bounced during the session on Thursday, breaking above the 20-day exponential moving average. We also managed to break above the supportive looking candle from the Wednesday session, which of course is a potential buy signal. Because of this, I believe that the longer-term uptrend will probably continue but it doesn’t necessarily mean that is going to be an easy move. I think a pullback on short-term charts could offer buying opportunities, but you must be able to deal with the volatility that comes with this type of move. The 50-day exponential moving average below has offered support, and I believe that should continue to be the case. I don’t have any interest in selling, I believe that the 2300 level below is massively supportive and will more than likely continue to be. With this, I remain bullish.

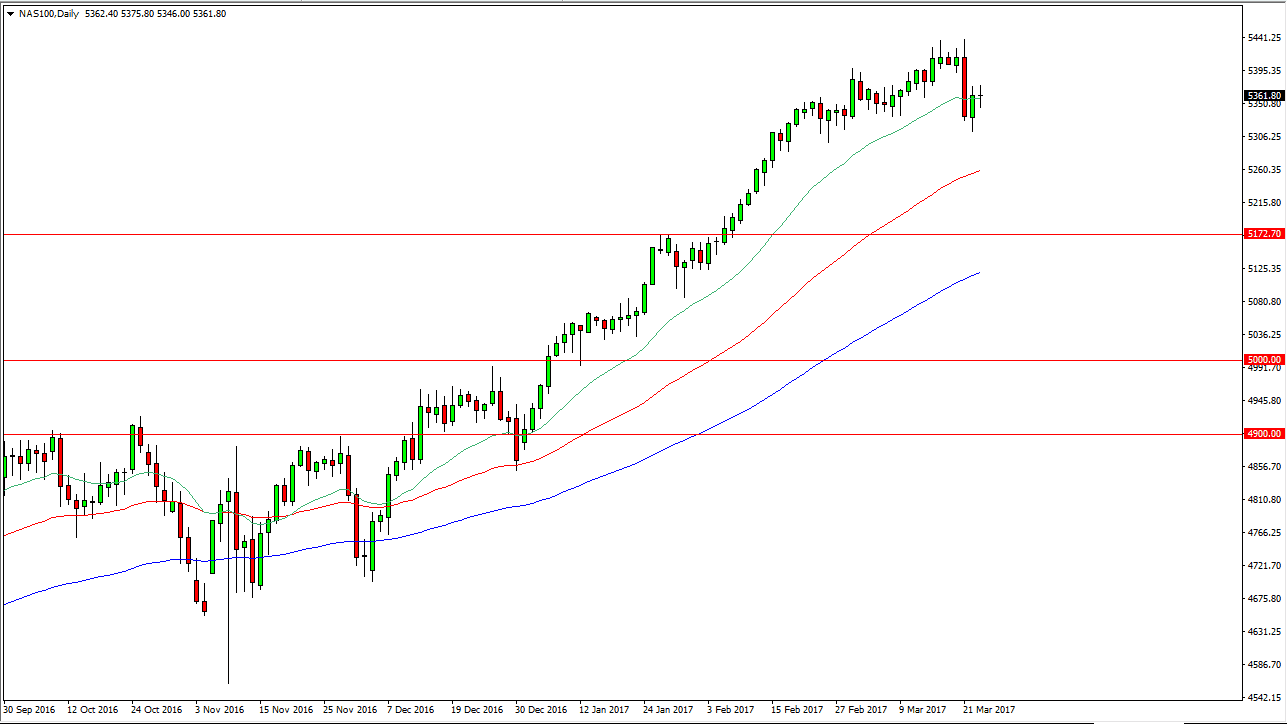

NASDAQ 100

The NASDAQ 100 had a relatively flat day as the choppiness show signs of stabilization, which quite frankly is exactly what I need to see in this market in order to go long. If we can break above the top of the range for the day on Thursday, I don’t see the reason why the market won’t try to reach towards the highs again. Pullbacks offer value, and we more than likely will find value hunters in this market every opportunity get a chance to. I think eventually we will reach towards the 5500 level as well, which is my longer-term target. I recognize that there will be quite a bit of volatility, but quite frankly this point in time we are still very much in an uptrend, even with a significant pullback that happened on Tuesday. When you look at the longer-term daily chart, that massive red candle wasn’t that big when you look at the totality of the entire trend. I remain bullish.