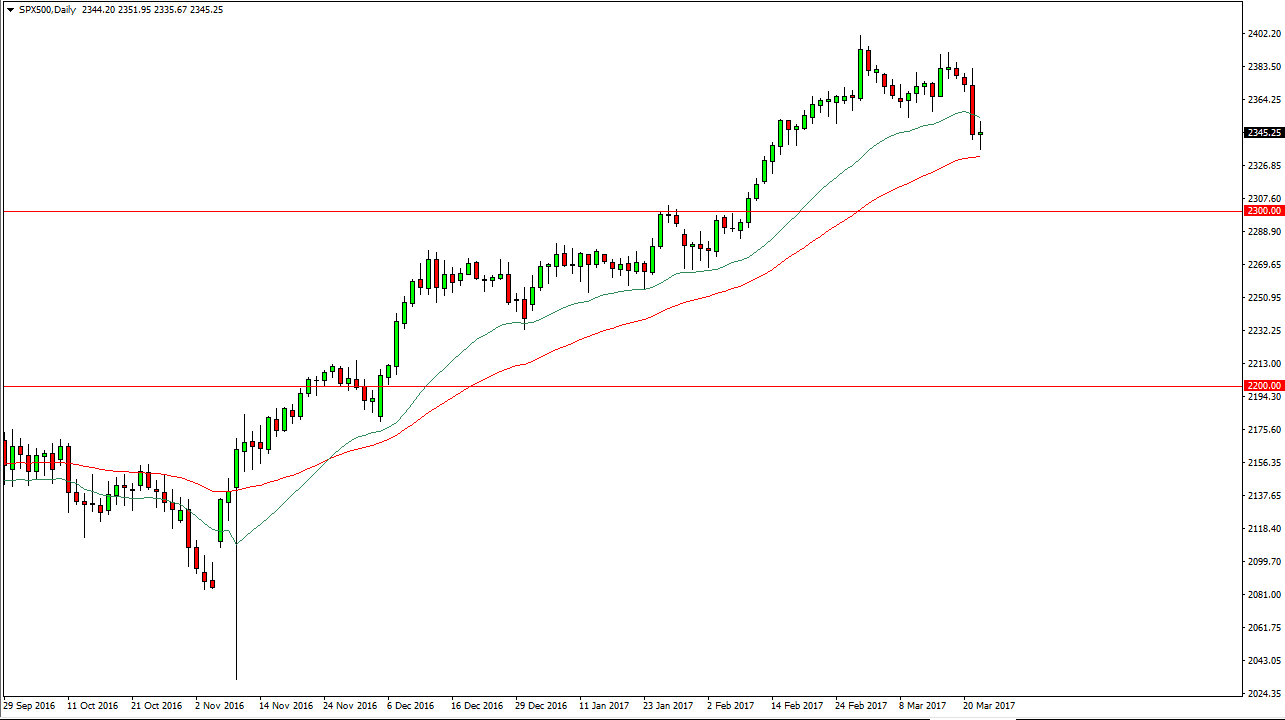

S&P 500

The S&P 500 had a choppy session on Wednesday, as we tested the 50-day exponential moving average. The market seems to be finding a bit of support, and quite frankly this has been a very strong uptrend that we have been involved in, so I believe it’s only a matter of time before the buyers look for value. A break above the top of the candle for the session on Wednesday is reason enough for me to start putting money to work again. I believe there is a massive amount of support at the 2300 level below, so I think that this market will use that as a big floor going forward.

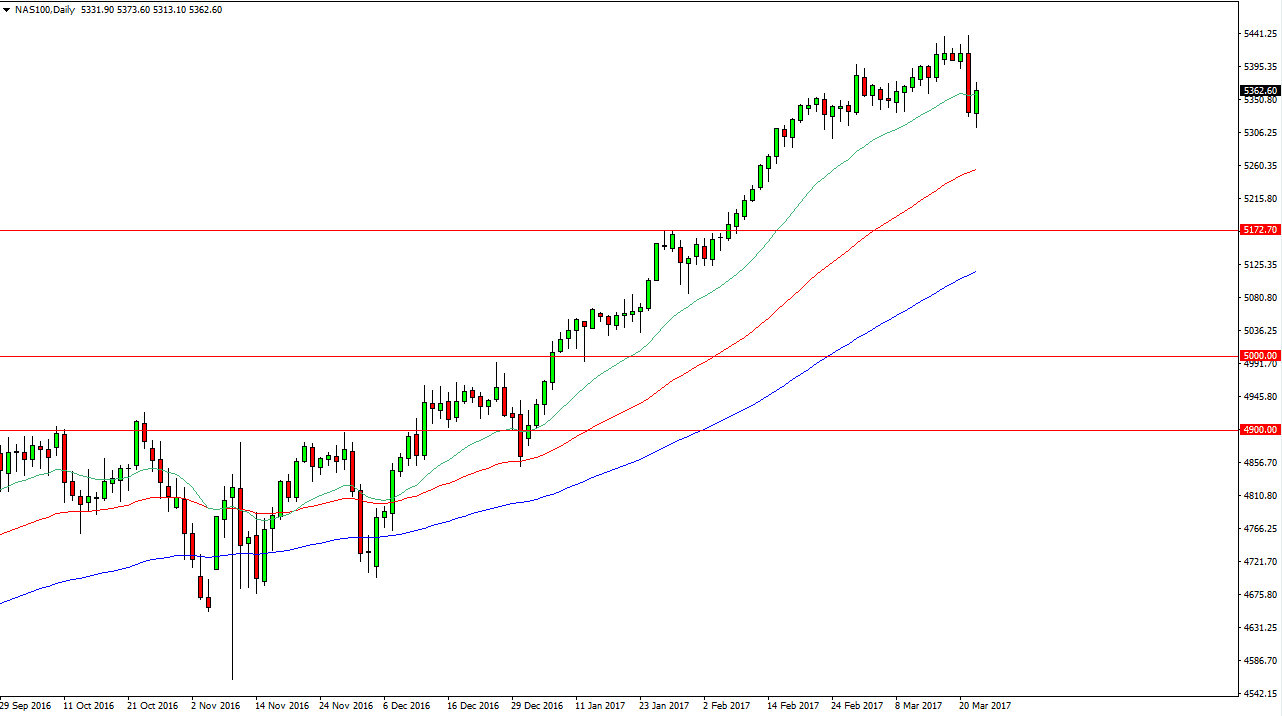

NASDAQ 100

The NASDAQ 100 initially fell during the Wednesday session, but found enough support underneath to turn things around. Alternately, I think that the market reaches towards the 5440 handle. It has obviously been very bullish for some time, and the fact that we found buyers during the Wednesday session after the massive selloff on Tuesday suggests that there is still plenty of bullish pressure in this marketplace. The 20-day exponential moving average pictured in green on the chart has been reliable as of late, and the fact that we closed above there is a very bullish sign again. I think a break above the top of the candle census market looking for the highs, and then eventually the 5500-level given enough time.

Underneath current trading levels we have the 50-day exponential moving average pictured in red near the 5260 handle, so I believe it will continue to work as dynamic support going forward. Given enough time, I think that the markets will not only reach the highs, but continue the longer-term uptrend. I have no interest in selling currently.