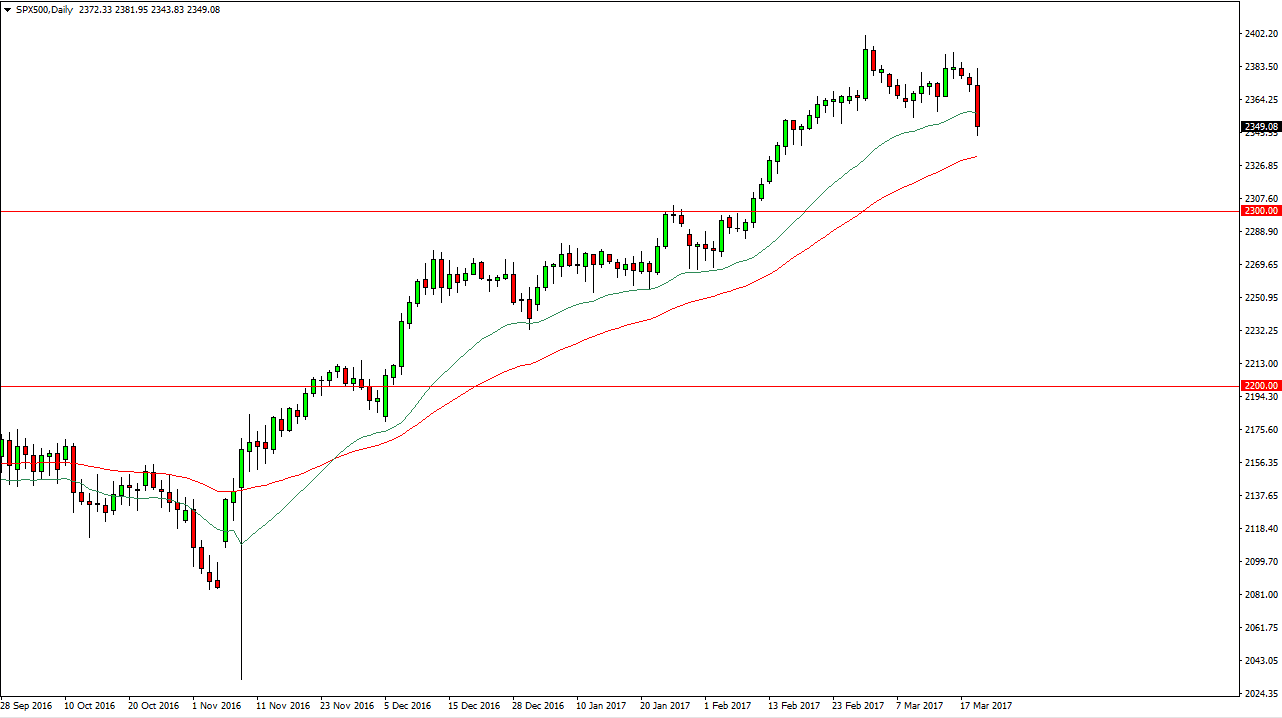

S&P 500

The S&P 500 initially tried to rally during the day on Tuesday, but you can see struggled. We ended up breaking below the 20-day exponential moving average for the first time in 3 months, which of course is a very negative sign. However, this is a market that is still very well in an uptrend, and the 2350 level looks as if it is going to offer a significant amount of support. Even if we break down below here, I believe that the 2300 level is even more supportive. Because of this, I am a buyer on support of candles, but I will wait until a daily close that shows me either support or some type of impulsive moved to the upside. I have no interest whatsoever in selling this market.

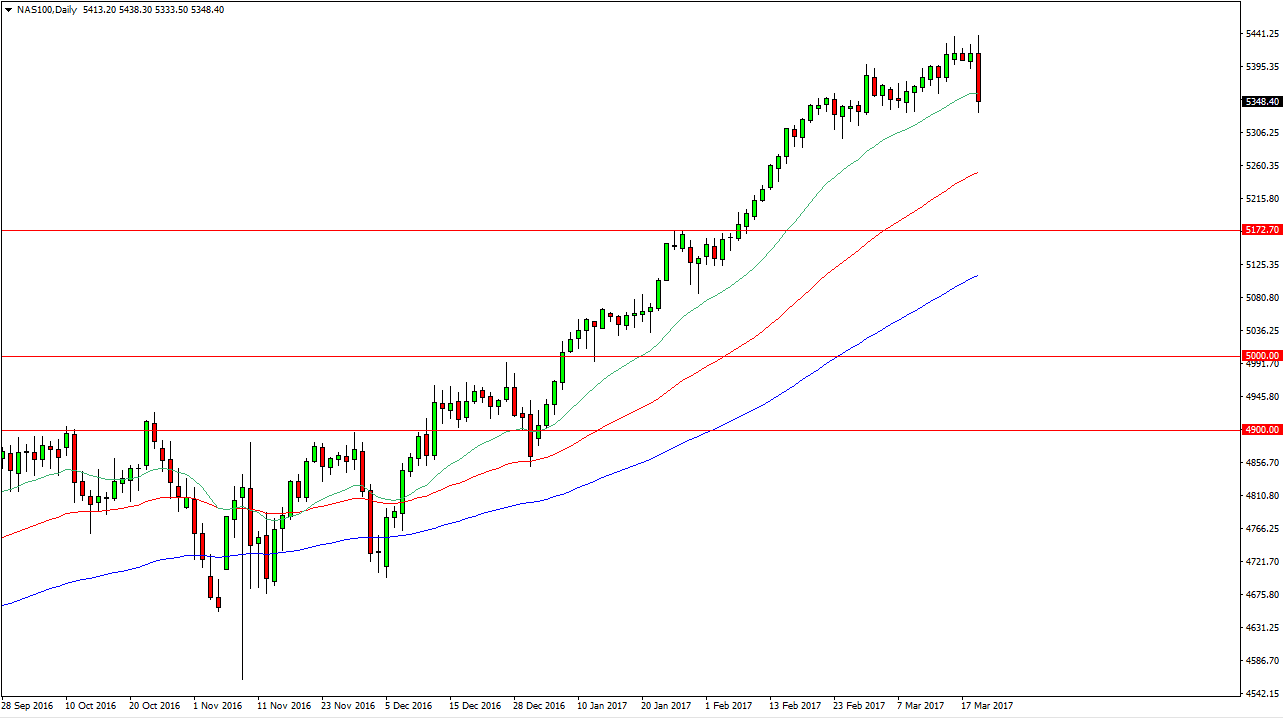

NASDAQ 100

The NASDAQ 100 also tried to rally but fell significantly, slicing through the 20-day exponential moving average as well. However, I believe that there is more than enough support below, especially near the 5300 level. I have no interest in selling, and I believe that it’s only a matter of time before the buyers return. This pullback is probably needed, mainly because we are a bit overbought. Alternately, this is a market that should continue to go much higher, perhaps testing the 5500 level. However, pulling back should only offer value that markets will take advantage of. I believe that the uptrend continues, but we may get a bit of a pullback, as we have needed for quite some time.

The 50-day moving average is closer to the 5250 handle, so we could go as low as there without too much in the way of trouble. Even if we fell that far, we are still very much in an uptrend so I believe that sitting on the sidelines and the short-term might be the best way to go, but eventually we should have a nice longer-term buying opportunity.