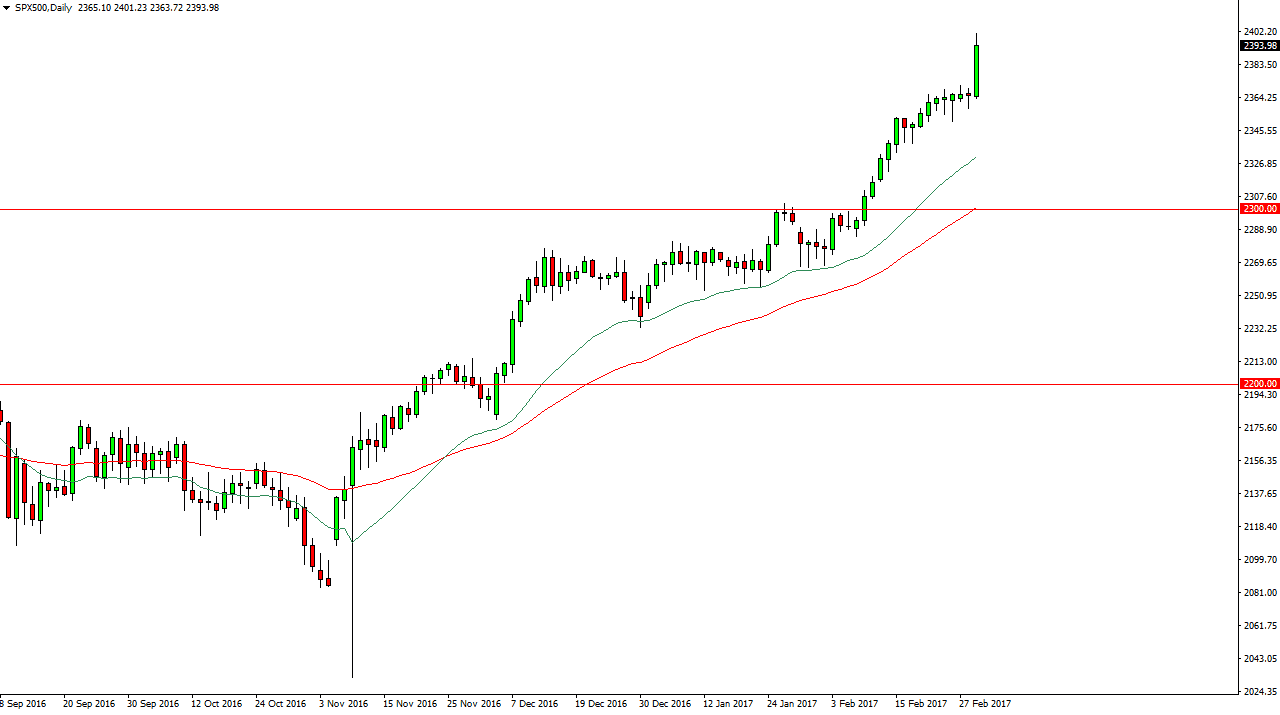

S&P 500

The S&P 500 showed signs of real strength during the day on Wednesday, as we touched the 2400 level. The area has a certain amount of psychological importance to it, so it’s not surprising that we pulled back a little bit. Having said that, I believe that every time we pull back from here it’s a buying opportunity and that the 2350 level is now going to offer a bit of a floor. If we can break above the 2400 level, I think that we will then reach towards the 2500 level above.

This is a market that continues to show extreme strength, and a lot of this reaction would have been due to the presidential speech in front of Congress during the previous day, which of course was very upbeat on the economy and the potential of infrastructure spending.

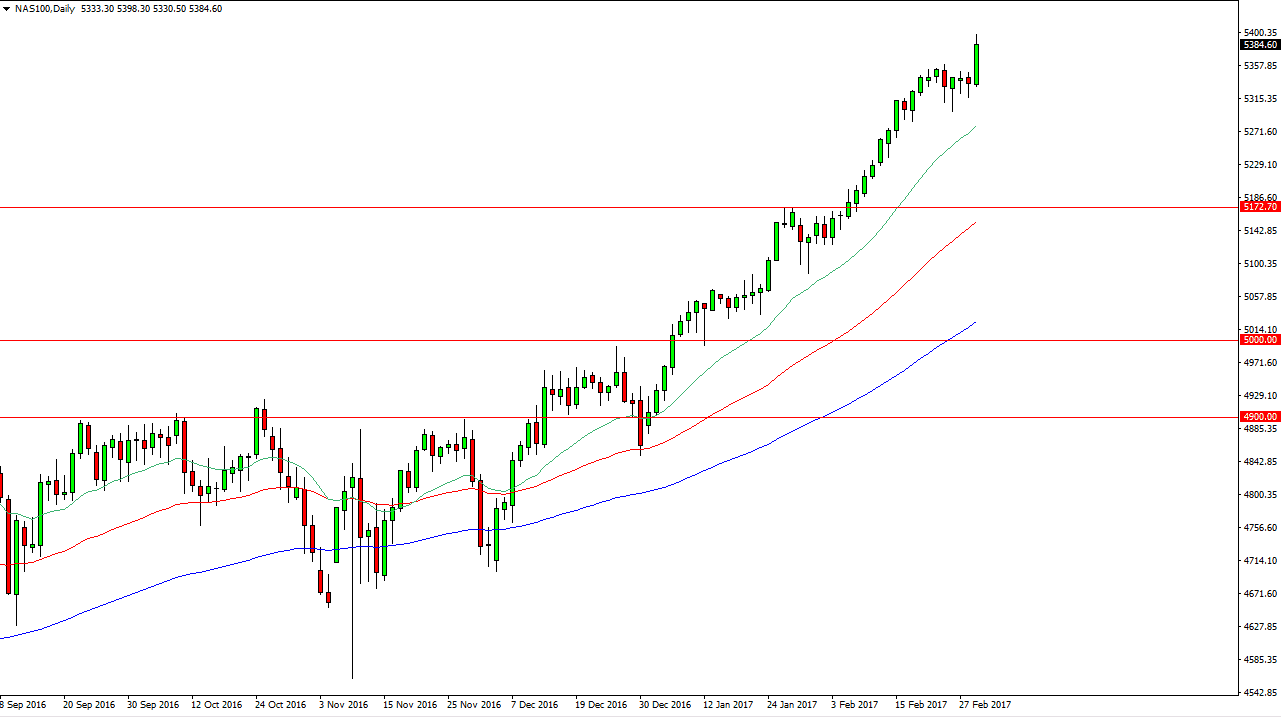

NASDAQ 100

The NASDAQ 100 broke higher as well, reaching towards the 5400 level. I have a longer-term target of 5500, and I do think that we get there eventually. Any pull back in this point in time will more than likely offer support of candles on short-term charts that you can take advantage of. The 5300 level below is massively supportive, and I believe it could indent being a bit of a “floor” at this point in time. I think that the 5500 level will course be targeted as it is a large, round, psychologically significant number, and I have been calling for this number for some time.

Pullbacks will more than likely be looked at as value by people who have missed out on the move higher. Ultimately, I think that the market continues to strengthen just as all stock markets do, and although we are a bit overbought on the longer-term charts, I would have no interest whatsoever in selling this market.