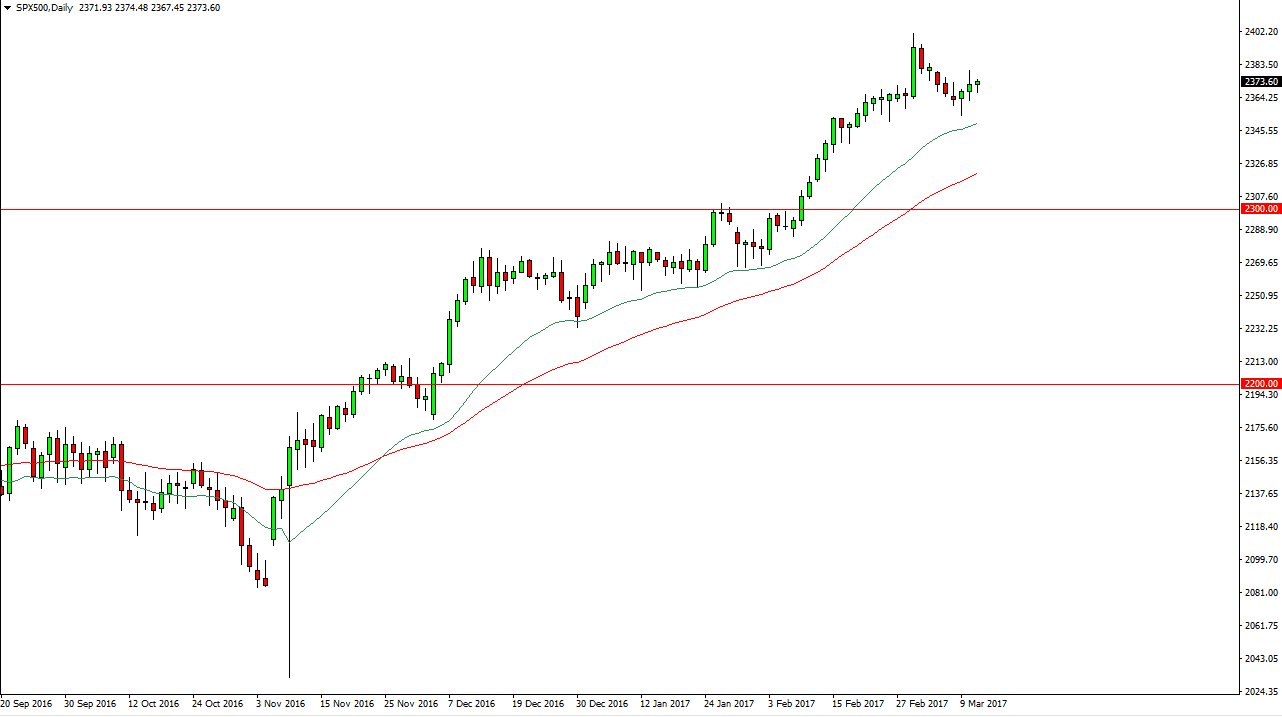

S&P 500

The S&P 500 initially fell during the day on Monday, but turned around to form a hammer. The hammer suggests that we have plenty of buyers underneath, and the green 20-day exponential moving average just below shows a significant amount of bullish pressure in the uptrend that has been so reliable. I believe that the market is going to continue to reach higher, aiming for the 2400 level next. If we can break above there, the market should then go to the 2500 level, which should offer even more resistance due to the large, round, psychological significance. However, given enough time I think that the market will break above there as well, as there are so many fundamental reasons that the US stock markets continue to grind to the upside.

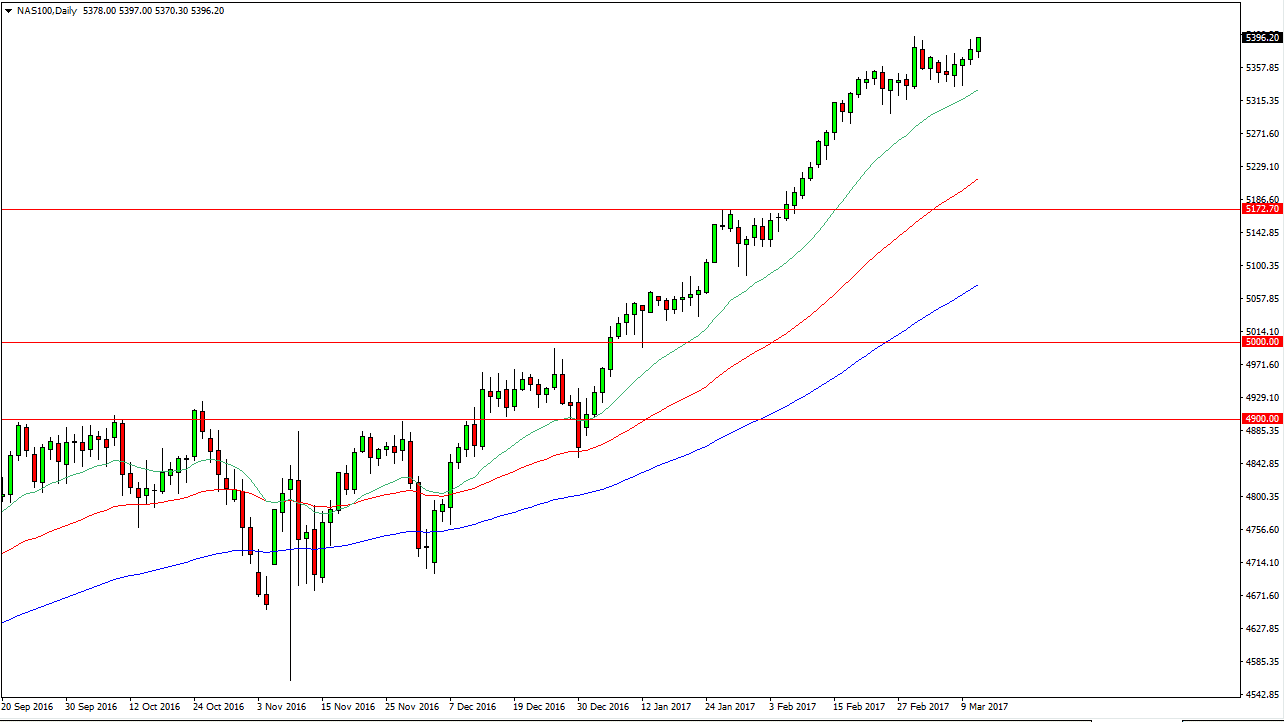

NASDAQ 100

The NASDAQ 100 initially fell during the day on Monday as well, but broke higher, testing the 5400 level. If we can break above there, and I think we will, the market should reach to the 5500 level which has much more significance. I think that every time we pull back, you must be looking for a buying opportunity as the market has shown so much in the way of reliability over the last several months. 5500 of course will offer a significant amount of resistance, but in the end, I don’t see the reason the market should stop there.

Pullbacks will be supported by the 20-day exponential moving average, pictured in green on the chart. Below there, we have the 50-day exponential moving average in red. I believe that the buyers will continue to look to the NASDAQ 100 as the main propellant of US indices to the upside. By extension, the NASDAQ 100 has not only been leading America, but the rest of the indices around the world that I follow. I am extraordinarily bullish in this market.