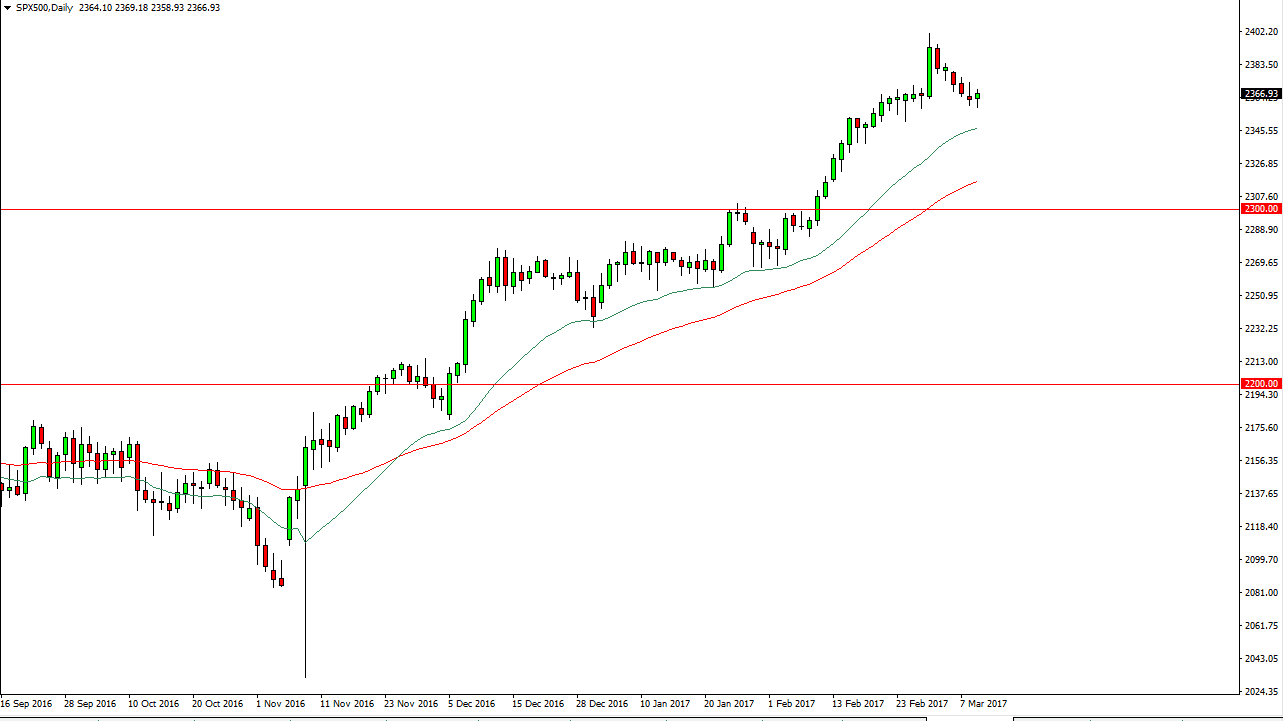

S&P 500

The S&P 500 was quiet during the session on Thursday as one would expect, due to the jobs number coming out today. Simply put, I think that if the jobs number is strong, this market continues to go higher. However, I wouldn’t mind seeing a bit of a pullback as it could offer value at lower levels. I think that the green exponential moving average on the chart, which is the 20-day exponential moving average, continues to provide dynamic support. I have no interest in selling either way, and I believe that the absolute “floor” in the market is down at the 2300 level. This means that I refuse to sell this market until we get below that level, something that doesn’t look very likely.

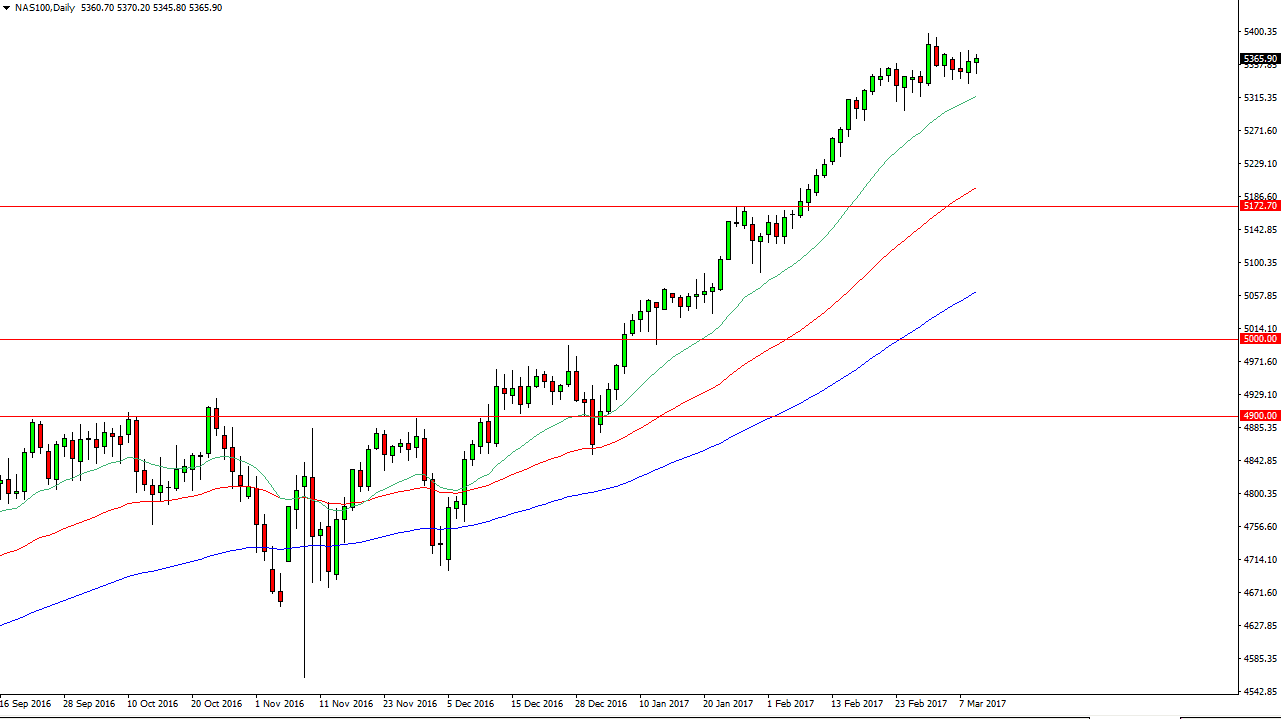

NASDAQ 100

The NASDAQ 100 has led the other indices around the United States and of course the world higher over the longer term. The 20-day exponential moving average is sitting just below and I think that should continue to attract trader’s attention. The 5350 level is a bit of a fulcrum for price right now but I think the real supports probably closer to 5300. I’m looking to buy pullbacks as they offer value in a market that should continue to see quite a bit of strength. I see no interest whatsoever in selling the market, as the major moving averages are spread apart so far, showing significant momentum.

I believe that the 5400 level will offer a little bit of psychological resistance but the real prize is the 5500 level, and that has been my target for some time. We are bit overextended though, so it wouldn’t necessarily be surprising to see a pull back and then move higher. In fact, that’s probably the healthiest move that we could see. Ultimately, buying is the only thing you can do.