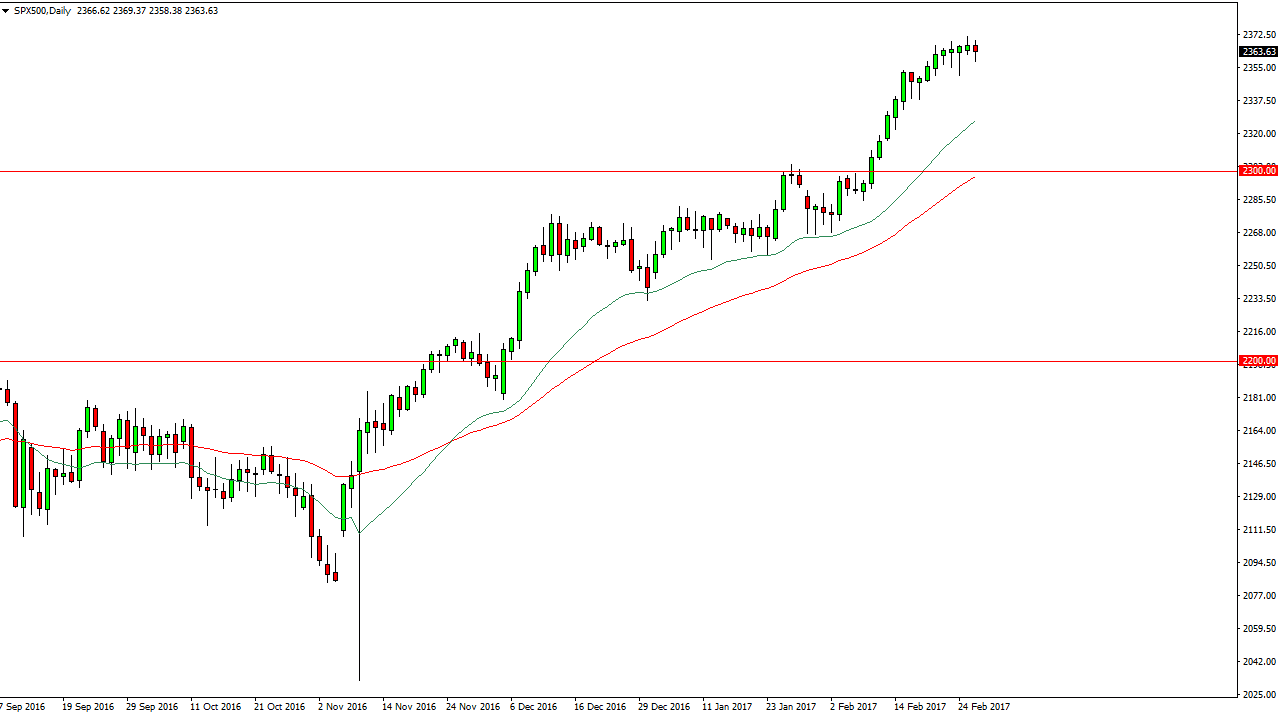

S&P 500

The S&P 500 fell initially on Tuesday but turned around to form a hammer. This of course shows just how stubborn the support is, and I believe it’s only a matter of time before we break higher. However, in the meantime I think we need to build up a little bit of momentum to continue rising. On the chart, you can see that the green 20-day exponential moving average is far below, so we are overbought. It would not surprise me at all if we dropped a little bit to build up momentum, or at the very least went sideways. I have no interest in selling, and I believe that the 2300 level is the floor. Eventually, we should reach towards the 2500 level.

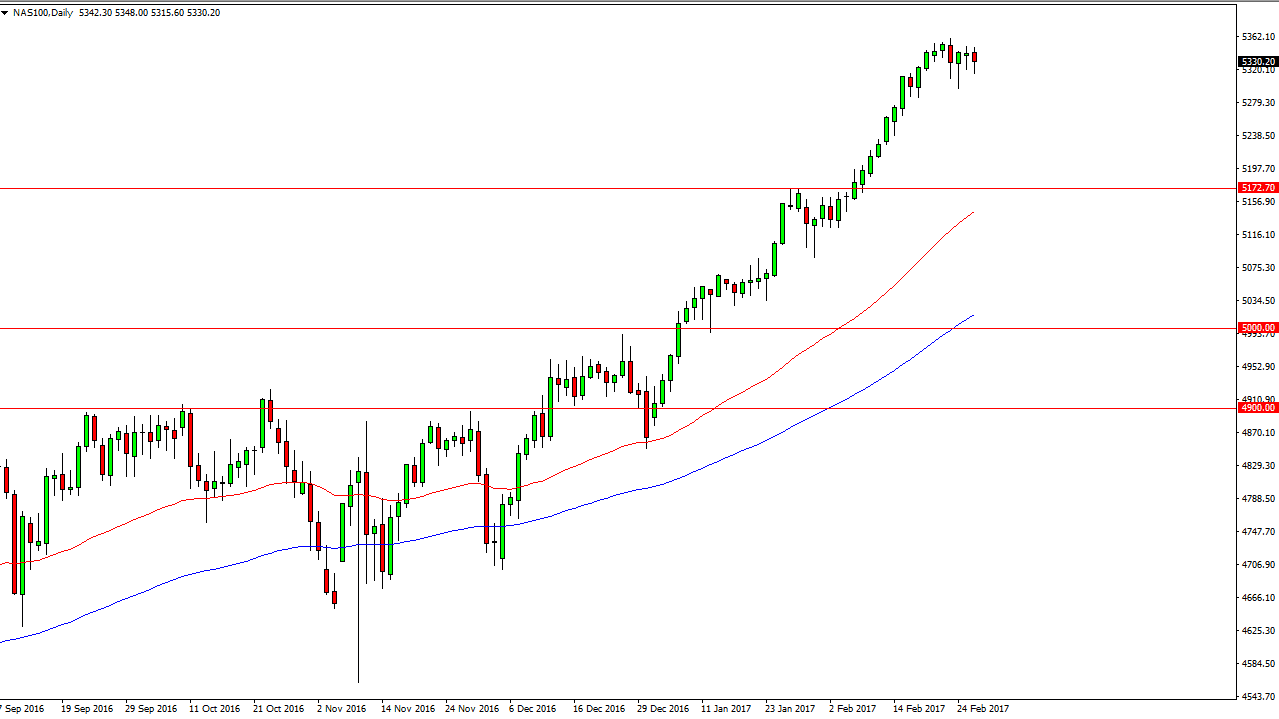

NASDAQ 100

The NASDAQ 100 rallied after initially falling during the day on Tuesday, showing signs of life just above the 5300 level. I think that the US indices need either pullback or find signs of consolidation so that we can build up the momentum to continue to go higher. The 5175 level below should be the floor, but it’s difficult to imagine that we will even go down below. Ultimately, I think that as we pulled back, there will be a lot of value hundreds looking for the opportunity to go long of a market that has obviously been very strong. With that in mind, I have no interest in selling and I believe that the marketplace will continue to lead the rest of US indices higher. By extension, the US indices are leading the rest of the world higher so I still believe that the NASDAQ 100 is probably one of the most important markets that you can follow.

Longer-term, I believe that the market is going to go to the 5500 level, so having said that I think that the drops in price will be looked upon favorably and is actually a healthy reaction to an overextended market.