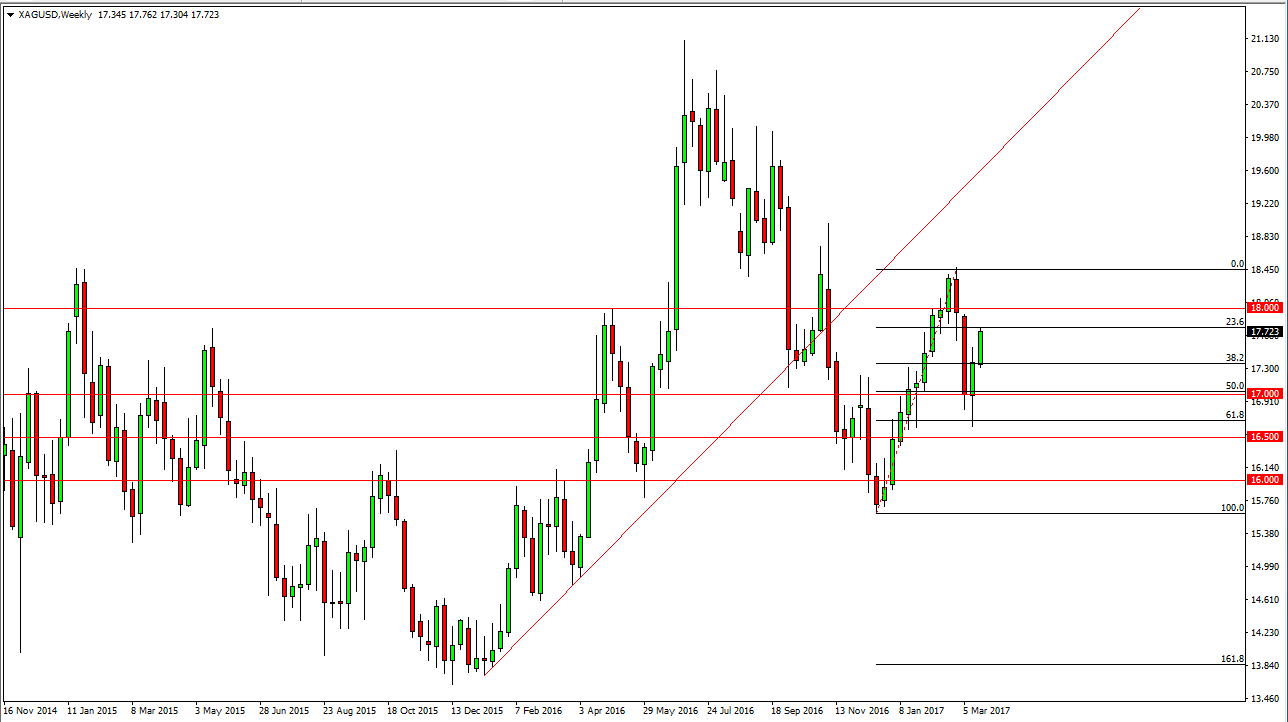

Silver markets have been positive towards the end of March, bouncing off the 61.8% Fibonacci retracement level. We are starting to see quite a bit of bullish pressure in this market, and after the recent rally and then pull back, looks as if the buyers are back into this market and giving us plenty of bullish pressure and momentum to continue trading to the upside.

The $18 level above will offer a bit of resistance, as it is a large, round, psychologically significant number. If we can break above there, then I don’t see any reason we can’t go to the $18.50 level above there, which was the highs from recent trading. If we can break above there, then we continue the longer-term uptrend. I believe that happens, but it may take longer than the month of April to continue that move.

Pullbacks

Value in a market that has found quite a bit of buying pressure. I believe that the $17 level will now offer a bit of a “floor” in this market, so it’s likely that it’s only a matter of time before the buyers get involved based upon value when we drop from here. In fact, it’s not until we break down below the $16.50 level that I would consider selling this market.

This continues to be a longer-term “buy-and-hold” type of situation, and I have recently started to buy physical silver as an addition to my retirement account. I don’t have any interest in selling any time soon as I had said, but I would be careful with leverage as this market tends to be very volatile, and it most certainly will be during the month of April. I believe that longer-term going to reach towards the $20 handle, but is going to take several months to get to that level.