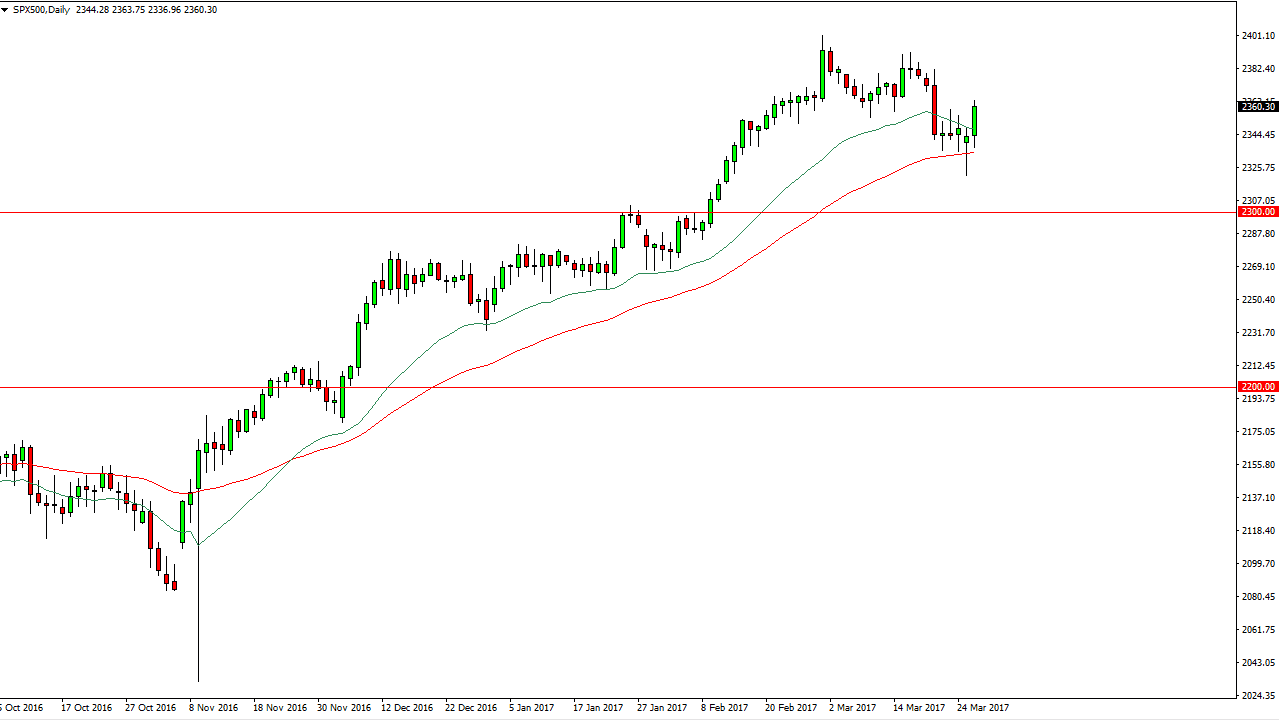

S&P 500

The S&P 500 initially dipped at the open on Tuesday, but ended up breaking above the top of the hammer from Monday and that is a very bullish sign. However, we stopped at the most recent support level in the uptrend, so we may get a little bit of a pullback. Ultimately, I’m still very bullish in this market and I think that we reach towards the 2400 level given enough time. In fact, I believe that we break above there as well, and go reaching towards the 2500 level which is been my longer-term target for quite some time now. With this being the case, I look at pullbacks as buying opportunities as we have seen over the last 24 hours.

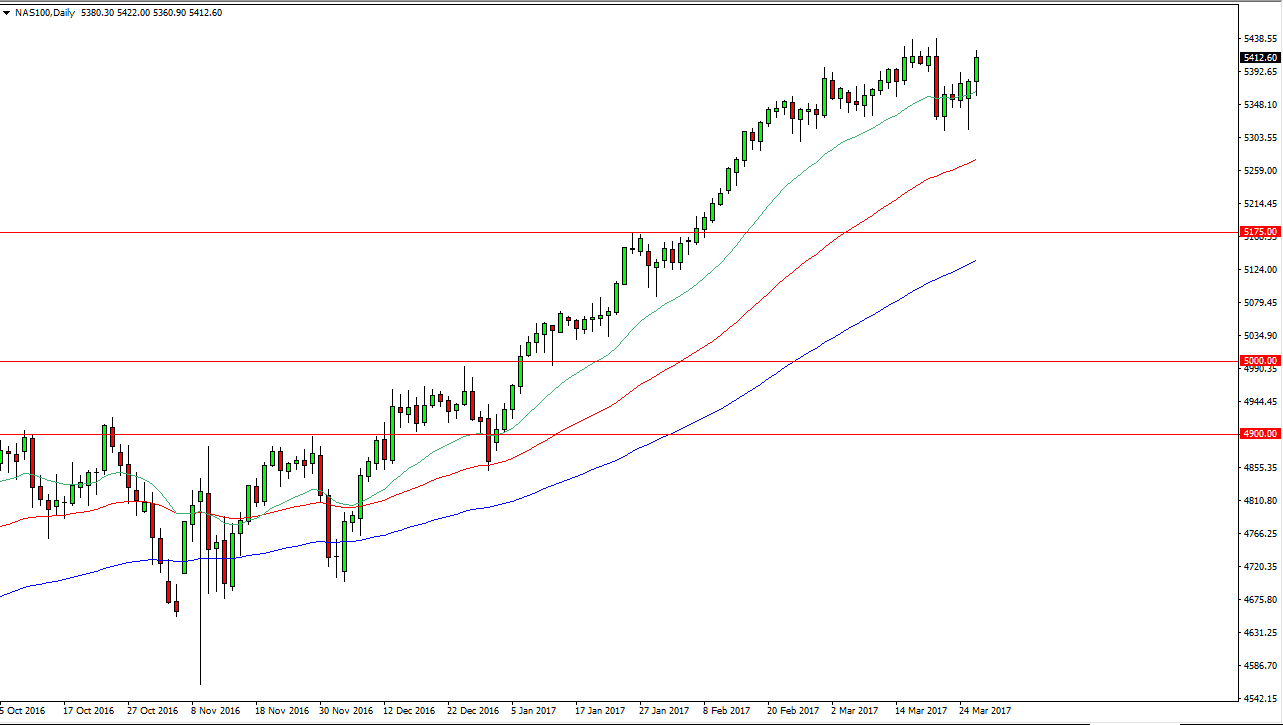

NASDAQ 100

The NASDAQ 100 look very strong during the day as we pulled back just enough to touch the 20 day exponential moving average and continue to go much higher. In fact, we are getting close to the highs again, and I think that it’s only a matter of time before we break out. I expect to see that by the end of the week, and that should continue to favor the buyers over the longer term. Pullbacks continue to be buying opportunities, and I believe that the 5325 level is not going to offer a bit of a floor in this market as we may have finally build up enough momentum to go higher again. I have no interest in shorting, I believe that the 5500 level will be targeted over the medium-term.

The NASDAQ 100 has lead the rest the US indices higher, and it appears now that the US indices will continue to find buyers on dips. With this, I am a firm believer and higher indices across the board when it comes to America, and then by extension Europe as they have been following the Americans lately.