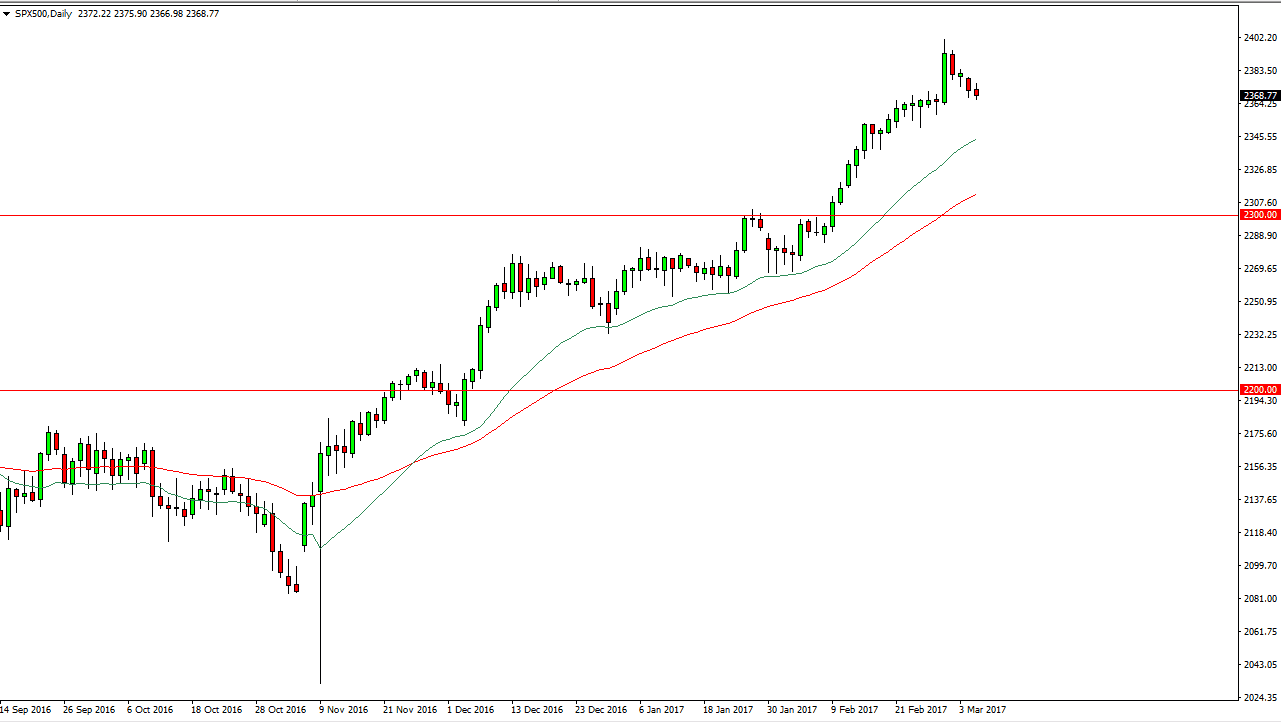

S&P 500

The S&P 500 fell slightly during the day on Tuesday as we continue to see a bit of a malaise when it comes to the indices. However, I believe there is more than enough support just below to keep this market afloat, so I’m looking at this pullback award this grind sideways is an opportunity to pick up value. Given a supportive candle or a touch of the green 20-day exponential moving average, I’m willing to start buying at this point. I have no interest in shorting, and believe that the absolute “floor” in this market is the 2300 level, so I have no interest in selling into we break down below there. Quite frankly, I don’t see that happening. I still have a target of 2500.

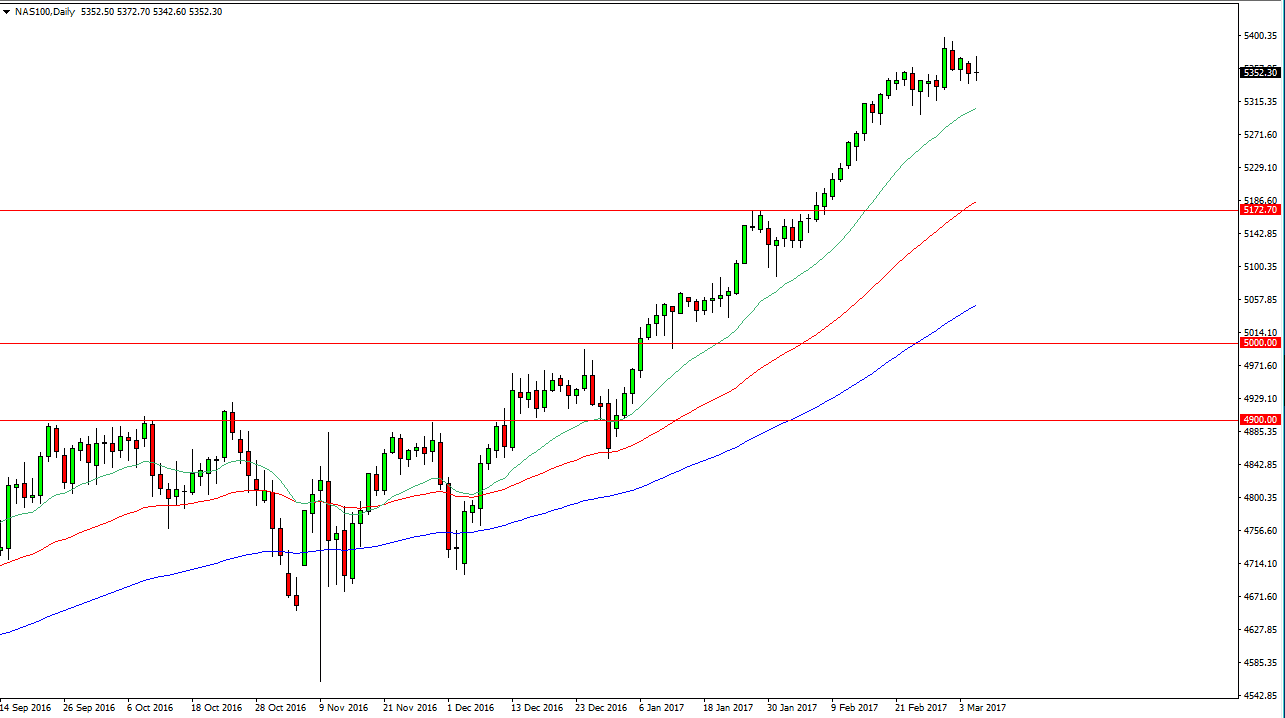

NASDAQ 100

The NASDAQ 100 went back and forth during the day on Tuesday, but I still see a significant amount of support near the 5300 level. That’s an area where I believe the market will eventually find buyers, and the 20-day exponential moving average below continues to offer support. Once we finally pick up the necessary momentum, I believe the market will test the 5400 level, and then eventually the 5500 level. If that’s the case, I believe that short-term pullbacks offer value, as the market has been so strong. Looking at the major moving averages, you can see that the spread is wide, meaning that we’ve had quite a bit of momentum.

The 5175 level below is massively supportive and it’s not until we break down below there that I would consider selling, and even then, it would be a bit difficult. Currently, it appears that the market will continue to find buyers on dips, so I have no interest in selling and believe that the longer-term trend is still to the upside.