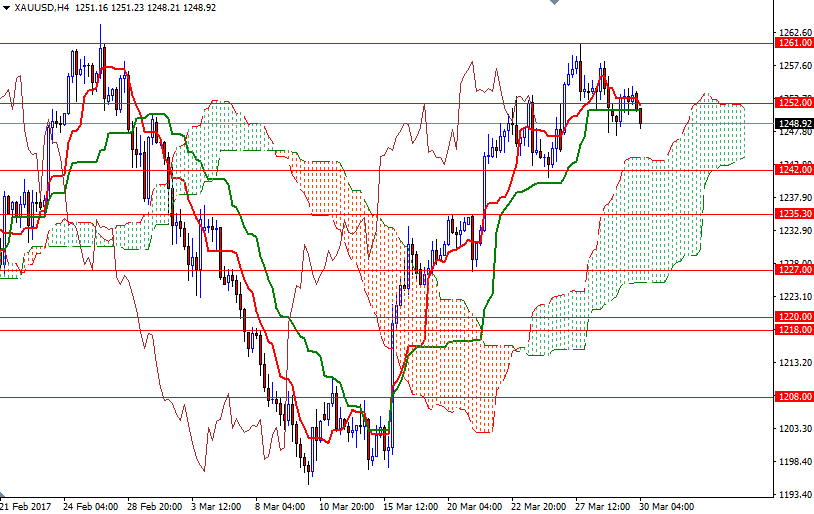

Gold prices settled higher on Wednesday as market players shifted their attention to upcoming speeches by Federal Reserve officials. Gold is still stuck within the trading range of the previous three days in Asian trade today as investors await U.S. GDP data and remarks from FOMC members. The key levels remains unchanged, as the market continues consolidating between the 1261 level on the top and the 1247 level on the bottom.

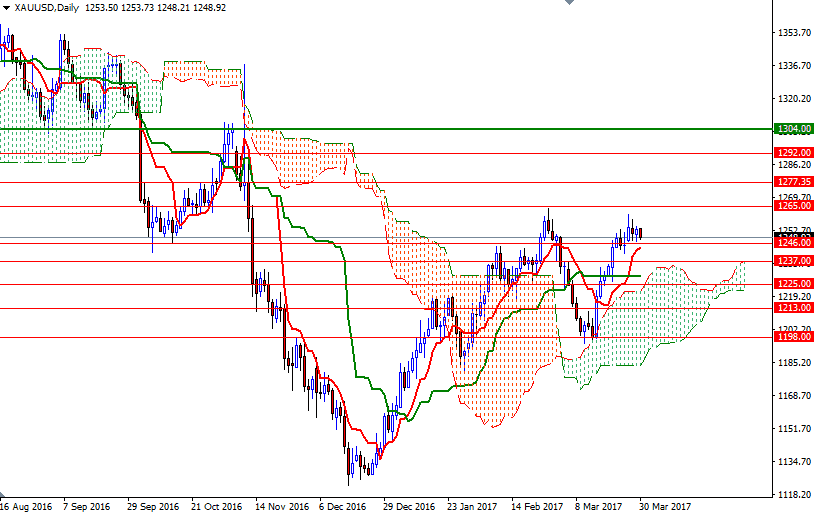

The short-term outlook is bearish with prices residing below the Ichimoku clouds on the H1 and the M30 charts. Technically speaking, the Ichimoku cloud indicates an area of resistance (or support depending on its location) so basically the trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. Despite the negative near-term outlook, the daily chart paints a bullish picture.

The first hurdle gold needs to jump is located at around the 1255 level. Penetrating this initial barrier could provide the bulls the extra power they need to visit 1261. Closing above 1261 would make me think that XAU/USD is on its way to test 1265. The 1265 area is the key resistance for the bulls to capture if they intend to challenge the bears on the 1277.35-1276 battlefield. On the other hand, a break down below 1247/6 would open up the risk of a move towards 1242. Below 1242, the 1237/5 zone stands out and the bears will have to demolish this support so that they can visit 1231.