Gold prices dropped $2.33 yesterday as global stock markets and the dollar rose on stronger-than-expected U.S. economic data. The XAU/USD pair traded as low as $1247.23 an ounce after the Conference Board reported that its consumer confidence index jumped to 125.6 from 116.1 and figures from the Federal Reserve Bank of Richmond revealed that the composite index for manufacturing climbed to 22 following last month's reading of 17. The XAU/USD is currently trading at $1248.62, lower than the opening price of $1250.84.

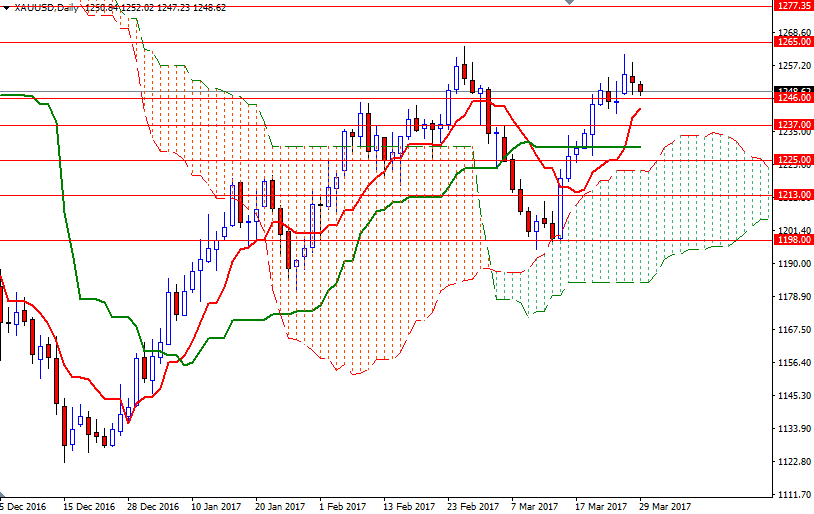

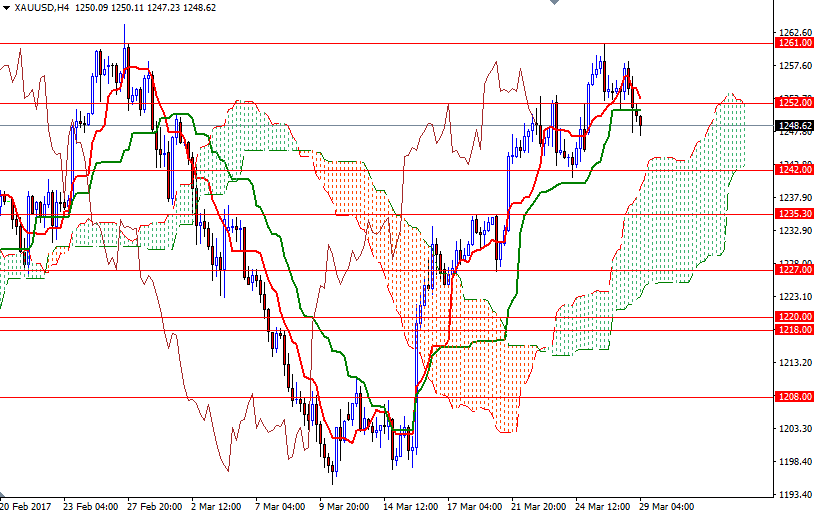

Trading above the daily and the 4-hourly Ichimoku clouds, along with positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines, suggests that the gold bulls will remain in control over the medium-term. The market is trying to hold above the 1247 level, but despite the positive outlook, prices are residing below the clouds on the H1 and the M30 charts. This indicates the short term charts are bearish and there is a risk of a move towards the 1245 level unless prices climb back above the hourly cloud.

If prices dive below 1245, then it is likely that the market will test 1242 afterwards. The bears have to drag prices below 1242 so that they can have a chance to tackle the support in the 1237/5 area. To the upside, the hourly cloud occupies the area between the 1252 and the 1255 levels. Because of that, I think the bulls will need to push the market convincingly beyond the 1255 level so that they can set sail for 1265/1.