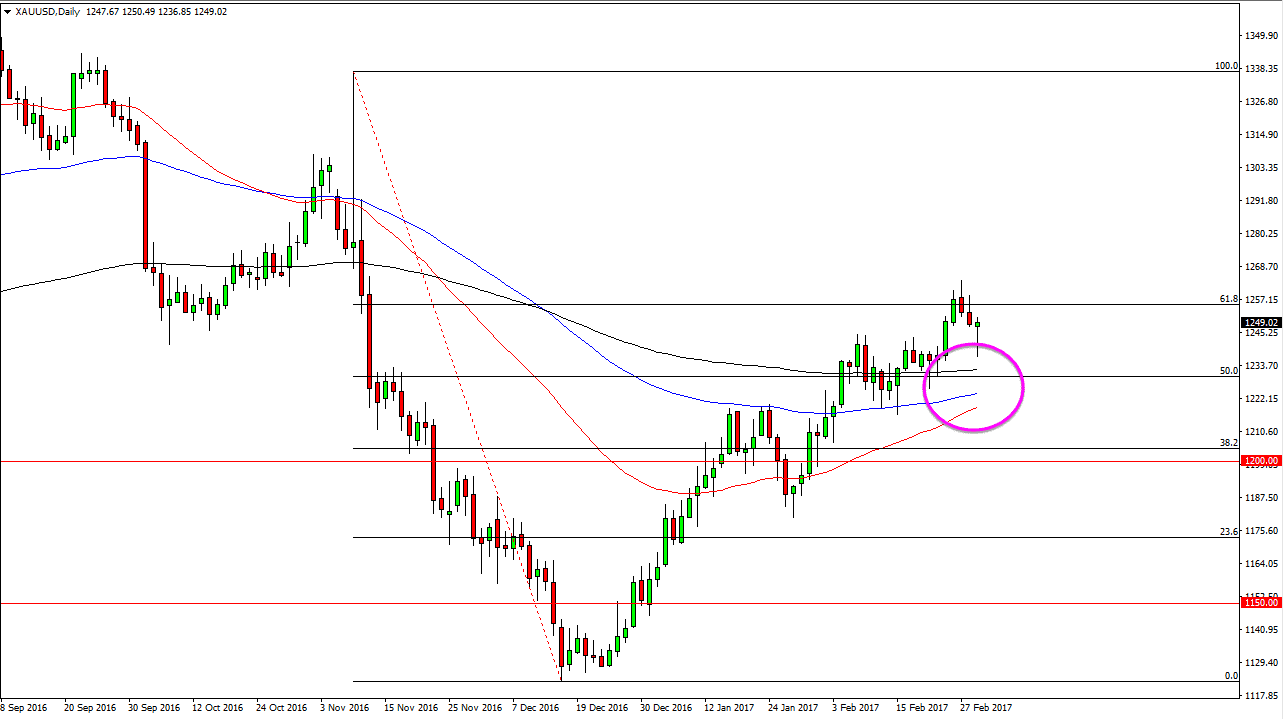

Gold markets fell initially on Wednesday, showing quite a bit of negativity. However, the $1235 level offered enough support to cause the market to bounce. It was previous resistance, so it makes sense that it should now be support. We ended up forming a nice-looking hammer, which is one of my favorite buying signals. But beyond that, we have quite a few other reasons to think about going long of gold.

Moving averages

On this chart, I have a black 200-day exponential moving average, a blue 100 exponential moving average, and a red 50-day exponential moving average. They are starting to reach towards each other just under the 50% Fibonacci retracement level, which has shown the market to be supportive. Given enough time, I think that we will break above the top of a hammer, we will continue to reach towards the 100% Fibonacci retracement level. In other words, I believe that we take out the entire reaction to the Donald Trump election. I believe that longer-term the gold markets are to continue to find quite a bit of bullish pressure. This will be confirmed by longer-term traders if the 3 moving averages cross.

I expect to see quite a bit of volatility in choppiness, but I still believe in the upward bias and have no interest in selling. With enough time, I believe that the buyers will continue to be very aggressive in this market, as the precious metals in general look good. In fact, precious metals markets tend to follow each other, and the Silver markets have already had these 3 major moving average is cross, signaling that it is now a longer-term uptrend. Because of this, I believe that the markets will follow suit, and all precious metals are about to take off to the upside. This isn’t just gold, but it’s also silver and platinum, as well as some base metals like copper. I’m very bullish when it comes to metals.