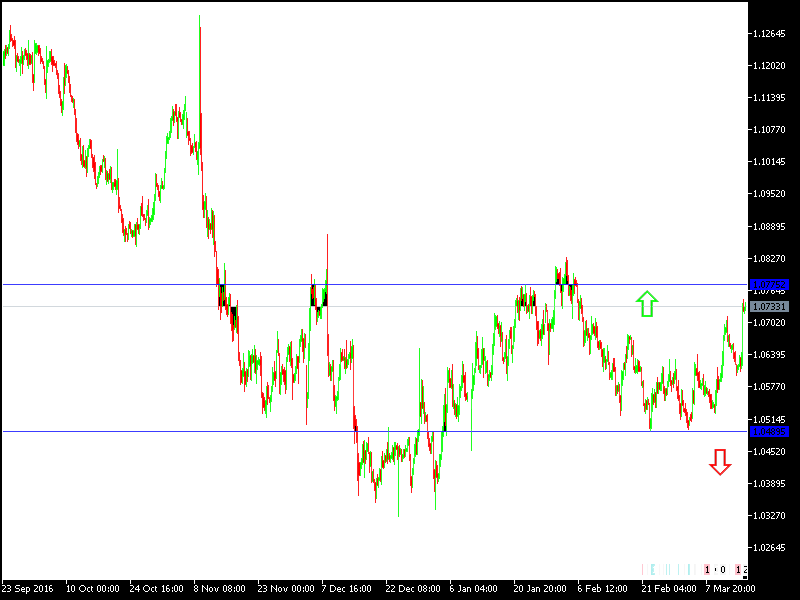

EUR/USD

With the polls results announced showing the near win of the pro- EU party in the Dutch elections, the Euro pounced back to its higher level in 5 weeks and traded at $1.0746, and with a confirmation of this win, the Euro should make more gains, however, these gains will continue to face challenges, as the French elections are due at the beginning of next month, and have more significant effects on the Euro. That is in addition to the near UK-EU negotiations regarding Brexit. The rate hike from the Federal bank didn’t provide the usual support to the US dollar.

Technically: the pair is established around $1.0735 at the time of writing, and the nearest resistance levels are currently at 1.0770 and 1.0830, and the later level is a good selling place at the moment.

On the bearish side: the nearest support levels are 1.0660 and 1.0570, and any move below 1.0570 would threaten the current bullish trend.

On the economic data side: the pair is waiting on an important announcement regarding the inflation levels in the Eurozone, and during the US session, there will be announcement regarding the claimant count, Philly Manufacturing Index and Housing data.

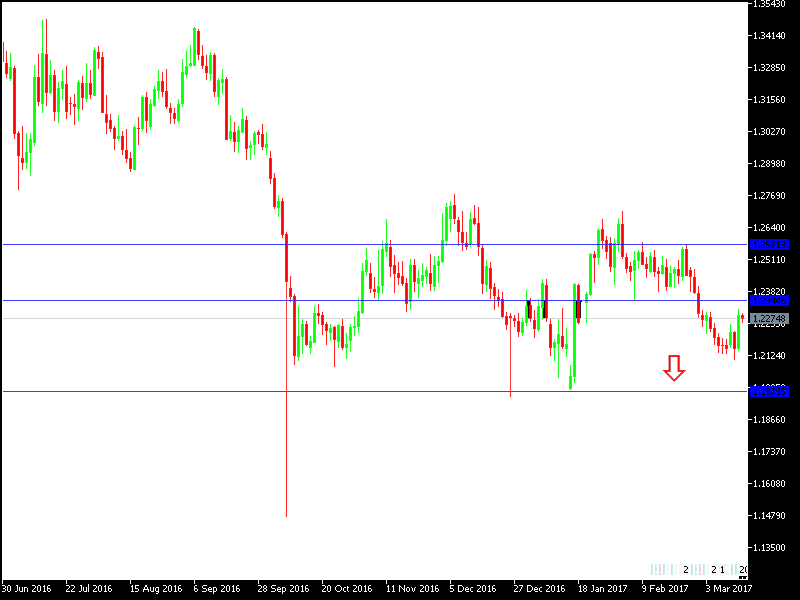

GBP/USD

The GBP/USD gains extended towards 1.2308 during yesterday’s session after the Fed decided to raise the rates to 1.00% and spoke about more hikes during the year. The pair retreated during today’s trading to 1.2260 before settling at 1.2290 at the time of writing, while waiting for the announcement from Bank of England regarding the monetary policy amid expectations that the bank will maintain status-quo. The pair will be dominated by sentiments towards the nearing of official Brexit negotiations.

Technically: if the pair returned and settled at 1.2300, the next tops will be 1.2350 and 1.2420, where it is preferable to sell the pair.

On the bearish side: the nearest support levels are currently at 1.2240 and 1.2170, and move below 1.2170 threatens the current pair’s current bullish trend and opens the path again for a move towards 1.2100.

From the economic data side: the pair is waiting an important announcement from Bank of England regarding the monetary policy, as well as the US claimant count, Philly Manufacturing Index and housing data during the US session.