The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 5th March 2017

Last week, I predicted that the best trade for this week was likely to be short EUR/AUD. The result was very negative with a loss of 1.56%.

The Forex market has been in a very indecisive mood with few clear trends, particularly regarding the U.S. Dollar which is usually the main engine behind major market moves. However, this week we started to get signs of renewed U.S. Dollar bullishness.

The most bearish currencies against the U.S. Dollar and in general against a long-term basket of currencies are the New Zealand and Canadian Dollars, and to a lesser extent the British Pound. Therefore, I suggest that the best trade of the coming week will be long the U.S. Dollar and short of the New Zealand and Canadian Dollars.

Fundamental Analysis & Market Sentiment

The major element affecting the market right now is the perception that a U.S. rate hike is more likely to happen later this month, following comments from two members of the FOMC.

Technical Analysis

USDX

The U.S. Dollar printed a large bullish engulfing candle within the scope of a wider bullish trend that is manifested over the long term. Note how the price found support close to the supportive trend line and the horizontal level at 122186, as shown in the chart below. Also, the price is now above its level from 3 months back, which is a sign the bullish trend has resumed.

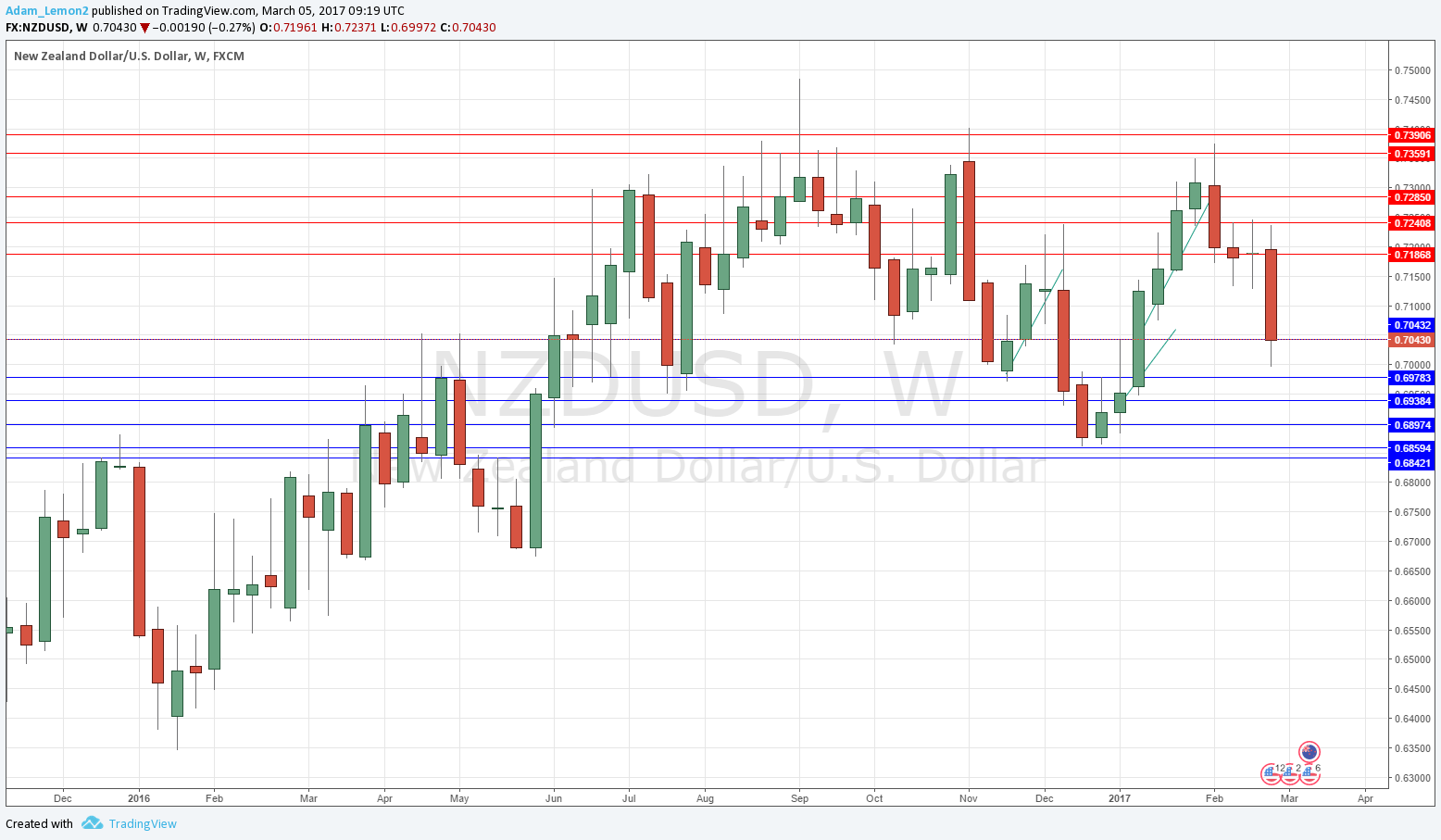

NZD/USD

This week we see a large bearish candle following a doji candle, which is part of a wider pattern of repeated rejections of a resistant area above the current price. This suggests that a major bearish turn will probably continue with some momentum, and it must be noted that the price has reached an area which has proved to be resistant over a lengthy multi-month period. The price is also below its levels from both 3 months and 6 month, indicative of a long-term bearish trend.

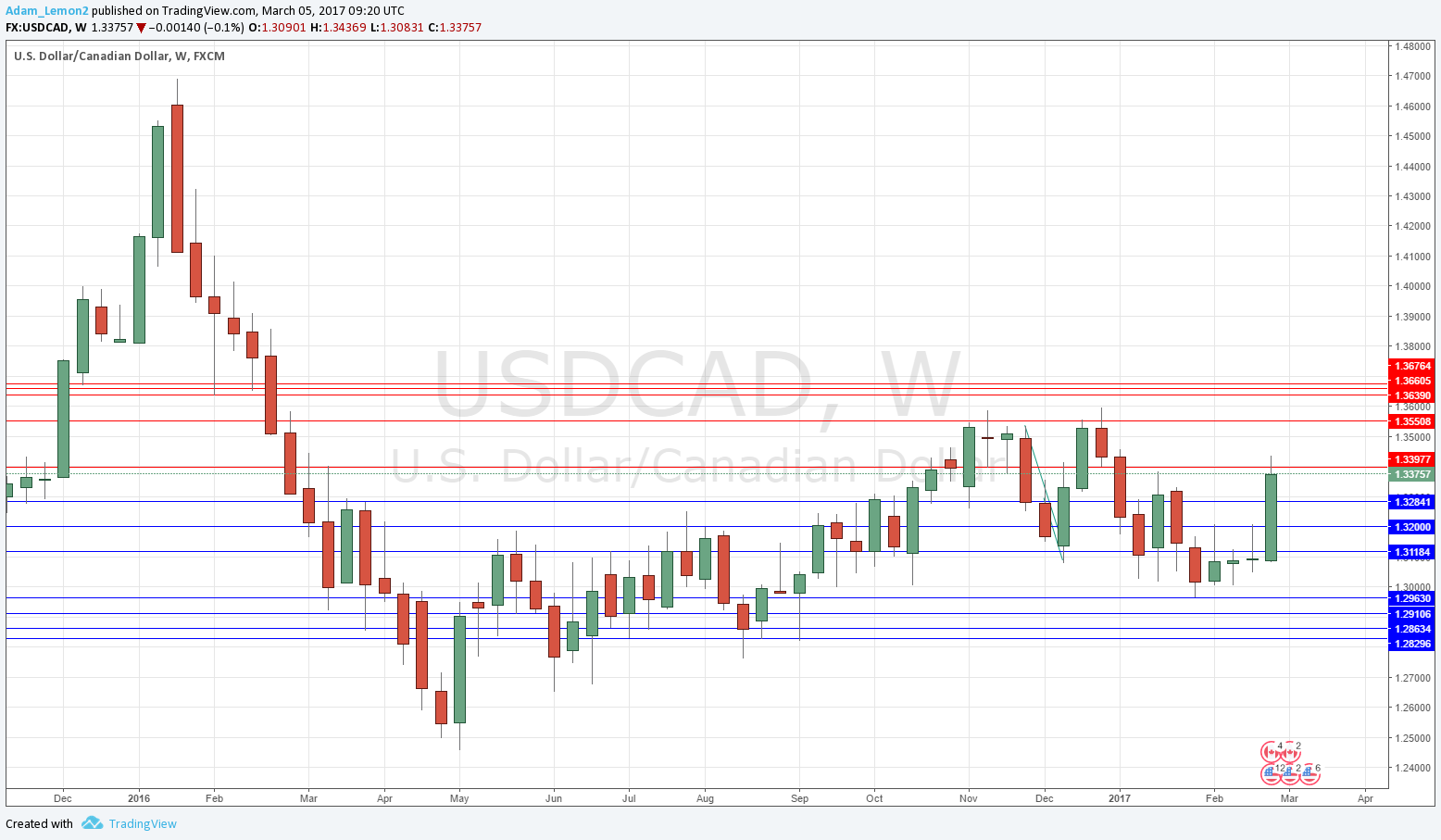

USD/CAD

This week we see a large bullish candle, closing very near its high which is a bullish sign. The strong upwards movement has brought the price to above its levels of both 3 months and 6 months suggesting a new bullish trend is beginning. The price is at resistance, but it looks as if it will continue to at least the 1.3550 which has been major multi-month resistance and as such might be hard to break.

Conclusion

Bullish on the U.S. Dollar; bearish on the New Zealand and Canadian Dollars.