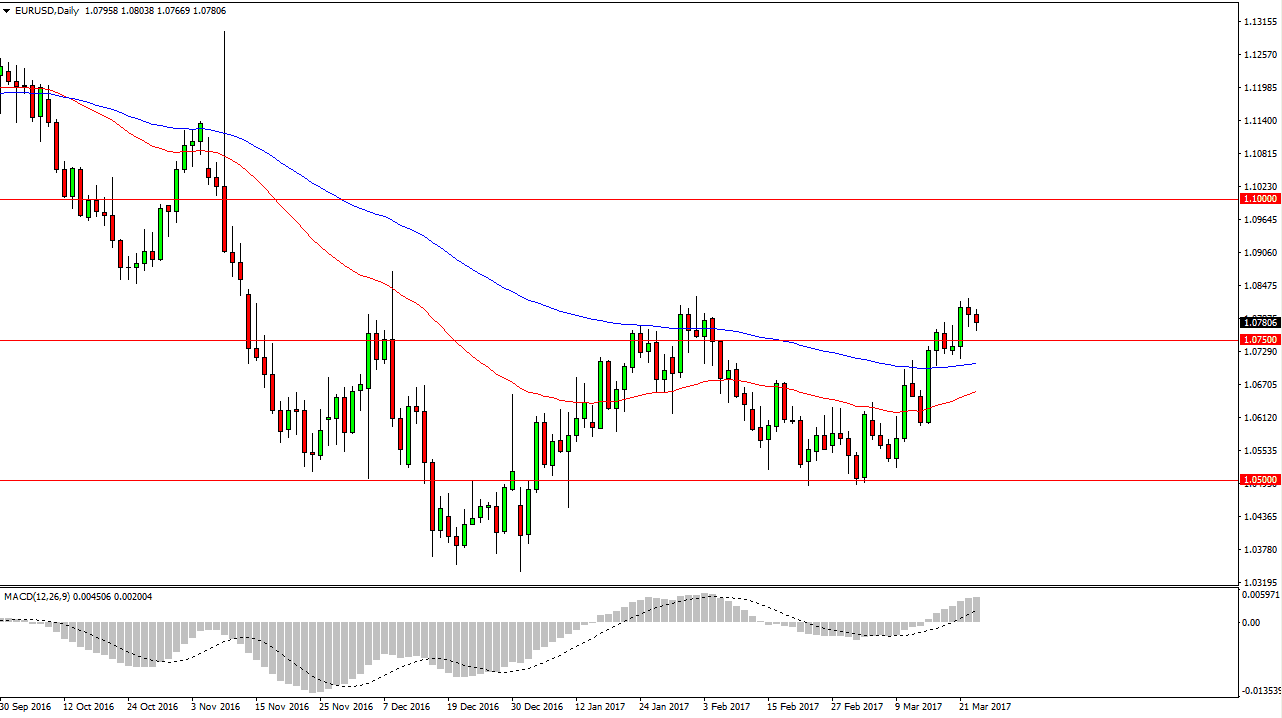

EUR/USD

The EUR/USD pair fell initially during the session on Thursday but continues to find support above the 1.0750 level. I believe that the market is going to try to break above the recent high, and start reaching towards the 1.09 handle. A break above there sums the market to the 1.10 level. Alternately, if we can break down below the 100-exponential moving average below, pictured in blue, then it’s possible that the market may roll over. Currently, it appears that the EUR is favored and I think that a lot of this comes from the idea of the European Central Bank stepping away from quantitative easing a bit. With this, I believe that the pair will find buyers on pullbacks as it will be perceived as value.

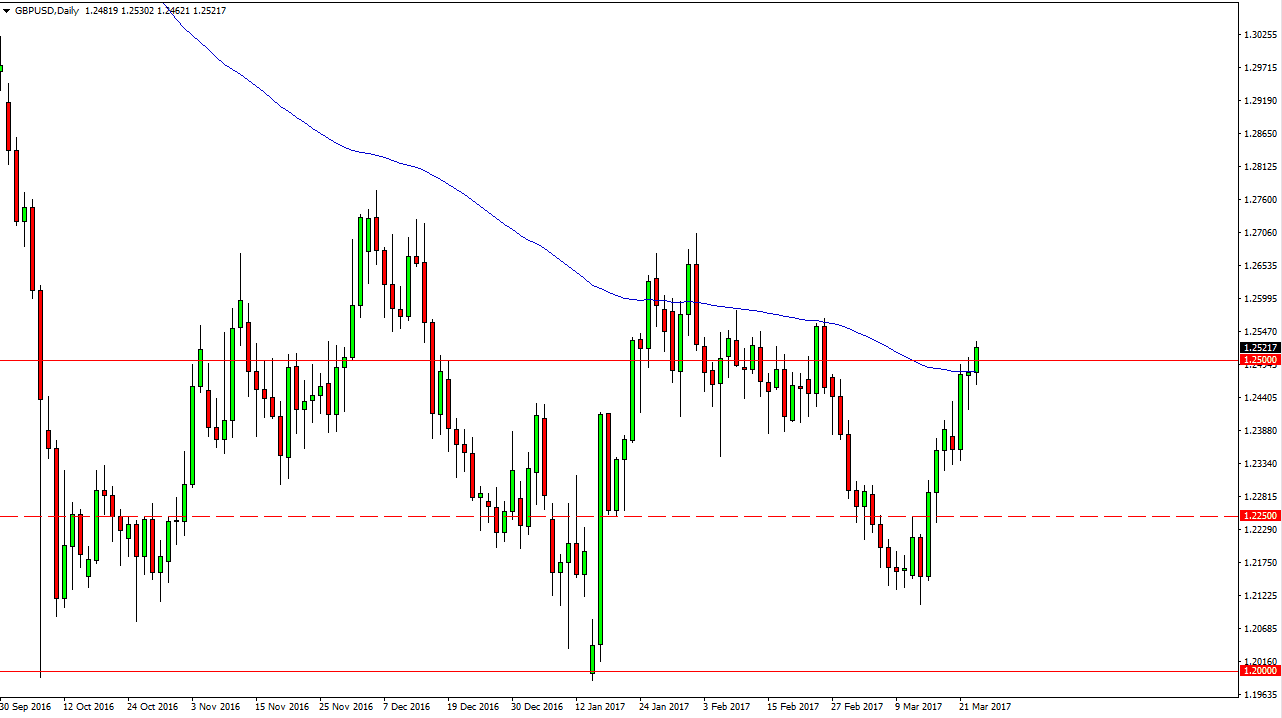

GBP/USD

The British pound broke above the 1.25 handle during the session on Thursday, showing signs of real strength. The 100-exponential moving average has offered a bit of support, but I recognize that there is a lot of noise all the way to the 1.26 handle above. If we can break above there, then the market can go much higher. However, in the meantime I think that short-term pullbacks will probably be the norm. I believe that the hammer from the Wednesday session should be massively supportive as well, so having said that it’s likely that the market will find buyers every time you pull back. This is supposed to be value in the market, and thus I think that perhaps the market is already starting to come to terms with the fact that the Article 50 is about ready to be triggered, and when it does I think that will represent the absolute bottom in this market.

Even if we did breakdown from here, I believe that we have already made the lowest move in this market, barring some type of weird automatic reaction to the Article 50. Nonetheless, I’m looking for buying opportunities and not selling opportunities.