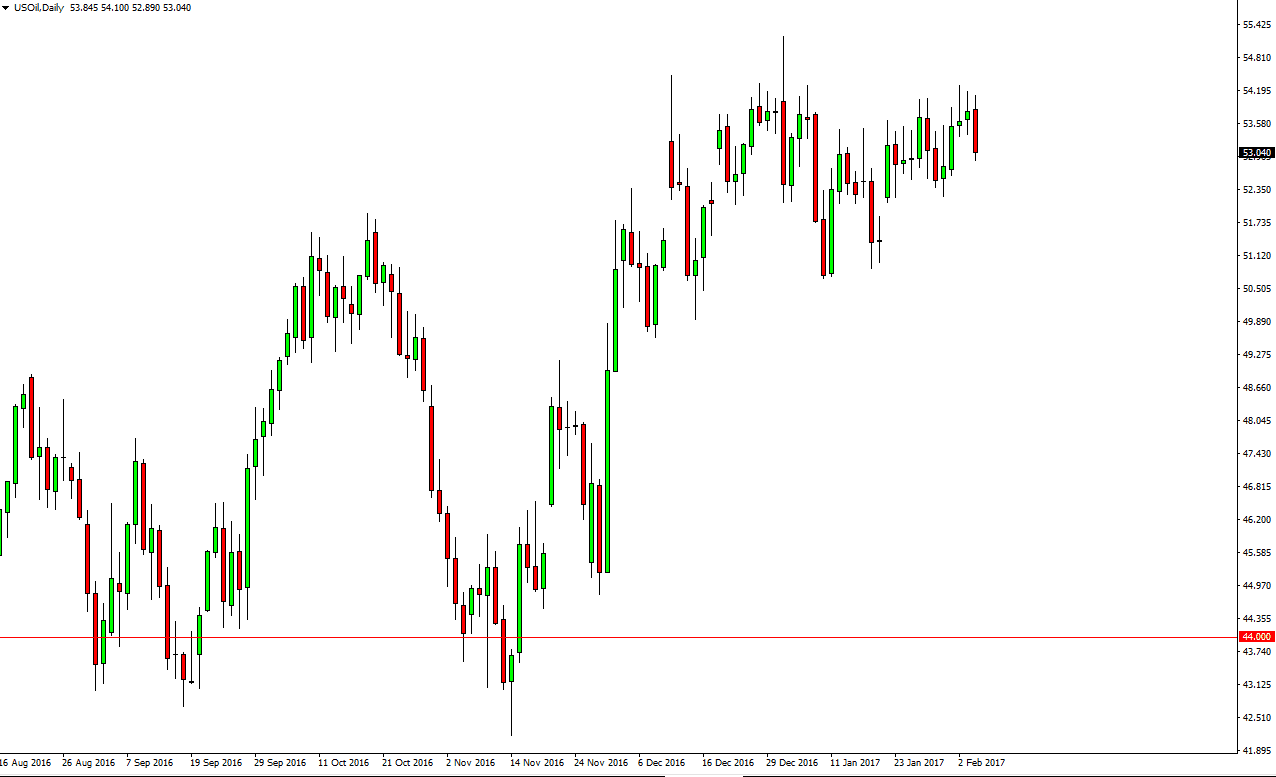

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Monday but turned around and showed quite a bit of bearish pressure. Towards the end of the day, we started to reach towards the $52.50 level, an area where I think we will see buyers come back into play. However, this is a market that should continue to favor volatility in general, because there are a lot of moving pieces at the same time. After all, the OPEC production cuts of course were bearish for the markets, suggesting that perhaps there would be less supply. However, at the same time we have seen a build in inventories when it comes to America, which is a very bearish sign. The OPEC production cuts have no effect on Canadian, Mexican, or American drilling. Quite frankly, OPEC is powerless over the longer term and it will only be a matter of time before the sellers get a bit more aggressive. In the meantime, I believe a lot of back and forth trading is what we’re going to see.

Natural Gas

The natural gas fell initially on Monday, but found support at the $3.00 level. This makes a lot of sense, is a large, round, psychologically significant number, but I believe the longer-term we will finally break down below there. Once we do, the market should then reach towards the $2.60 level. I think that there is a good chance that sellers will return sooner rather than later, and on signs of exhaustion I am more than willing to start selling again. In fact, I believe there is a good chance of sellers getting involved in this market all the way to the $3.75 handle. Waiting for exhaustion is probably the best way to trade this market right now, and I have no interest in buying as warmer than expected temperatures should continue to be a feature of the market.