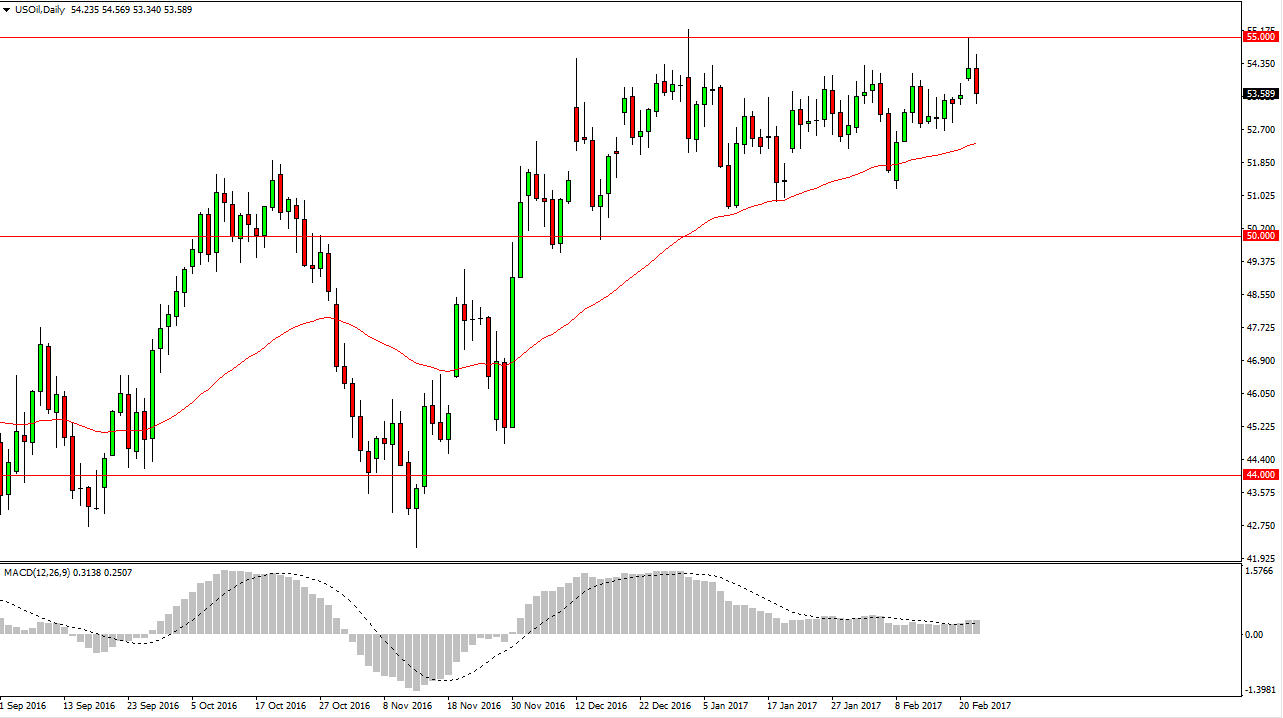

WTI Crude Oil

The WTI Crude Oil market tried to rally on Wednesday, but gave back the gains and ended up falling all the way down to fill the gap from the previous session. I think there’s plenty of support below though, so it’s probably only a matter of time if the buyers get involved. I think will probably drop from here but expect to see bullish pressure underneath near the 50-day exponential moving average. Ultimately, the $55 level above is extraordinarily resistive, so if we can break above there, the market should continue to go much higher. I think that eventually the bearish pressure will take over, but in the short term I think that we still have buyers. However, keep in mind that the Crude Oil Inventories announcement comes out today and that of course can throw a monkey wrench in everything.

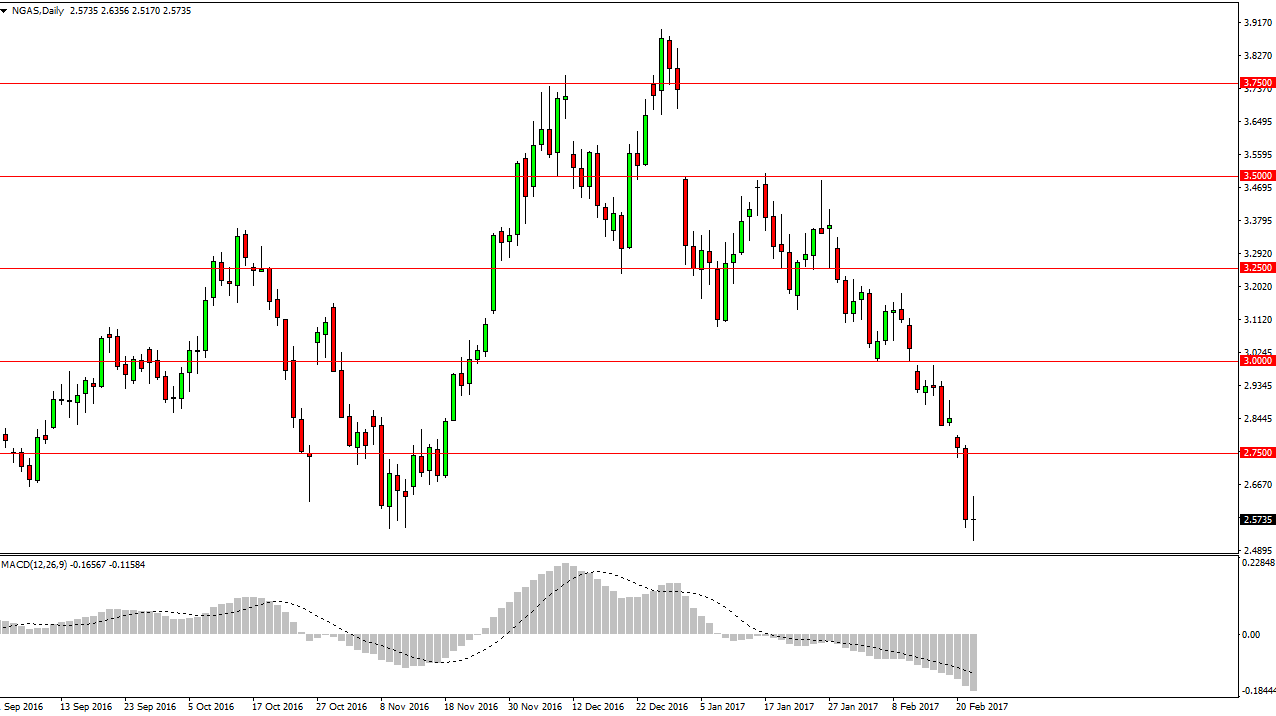

Natural Gas

The natural gas markets went back and forth on Wednesday as well, showing a lot of volatility. It looks as if the $2.50 level will be supportive and that’s not surprising that being the case as the large, round, psychological significance of the number should continue to attract a lot of attention. If we rally from here, I think that there is a selling opportunity near the $2.75 level, and quite frankly I would like to see a rally that I consider selling as we are so oversold. No matter what happens, buying is an even a thought, as I continue to wear shorts and T-shirts and what should be the dead of winter.

Ultimately, I believe that the natural gas markets are very negative longer-term, so I have no interest in buying and not only that, don’t even have a scenario in which I am willing to serve buying at this point. Natural gas will more than likely reach towards the $2.25 level over the next couple of weeks.