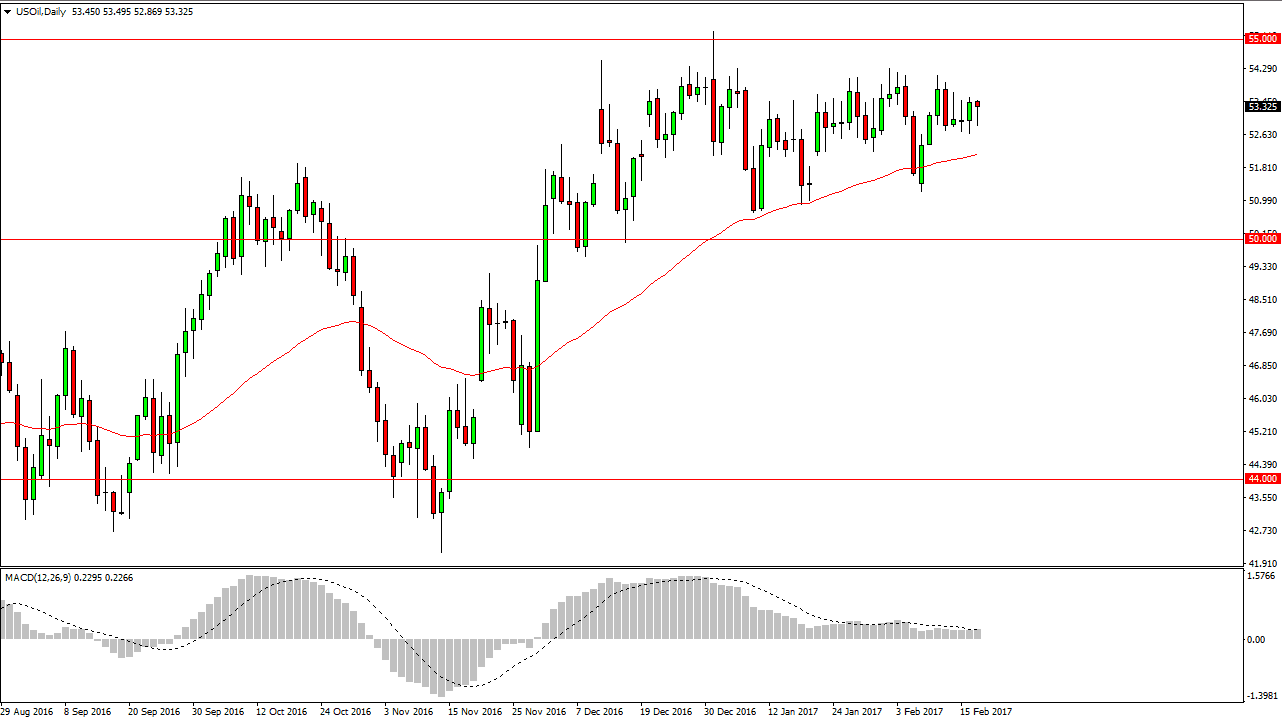

WTI Crude Oil

The WTI Crude Oil market fell initially during the day on Friday, but turned around to form a bit of a hammer. The hammer of course is a bullish sign, so having said that I think that we are going to attempt the $54 level again. If we can break above there, we need to deal with the $55 level above which is massive resistance. If we did manage to break above there, it’s likely that we would go much higher, perhaps all the way to the $60 level. Ultimately, we are going to get a lot of volatility so we can break down below the bottom of the hammer, the market could reach down to the $51 level. Either way, the oil markets will continue to be very volatile and difficult to deal with.

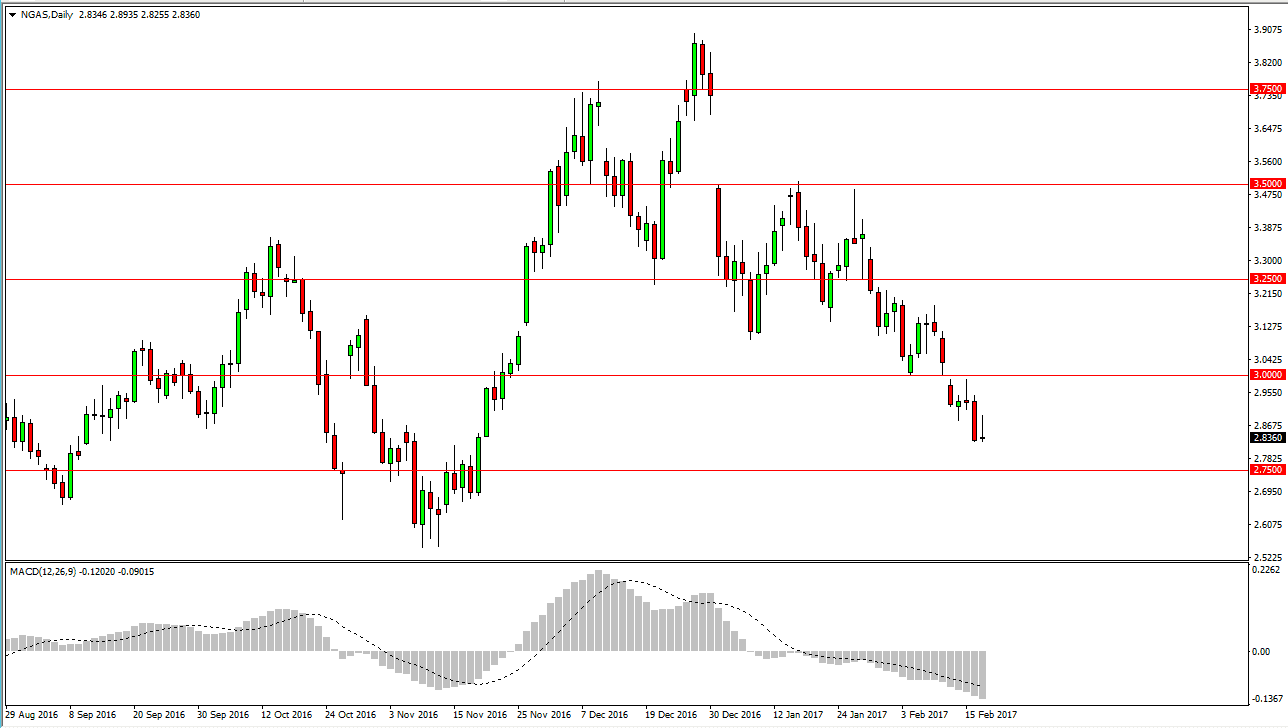

Natural Gas

The natural gas markets rallied on Friday, but gave back all the gains to form a shooting star. The shooting star sits at the bottom of the downtrend, and that suggests that we are going to go much lower. The $2.75 level underneath will be the target, and perhaps just a stop on the way down to the $2.60 level. I believe that anytime this market rallies you have to be looking for selling opportunities, on signs of exhaustion on short-term charts. The natural gas markets continue to suffer at the hands of warmer temperatures in the United States, and of course a massive amount of oversupply when it comes to the natural gas markets. Demand simply isn’t there, and there is far too much in the way of supplying to drive prices higher, so I believe that natural gas markets will continue to look very negative.

Any rally at this point in time will have to deal with the $3 level, which I believe is a bit of a “ceiling” in the market. In fact, I would be quite surprised if we broke above there anytime soon.