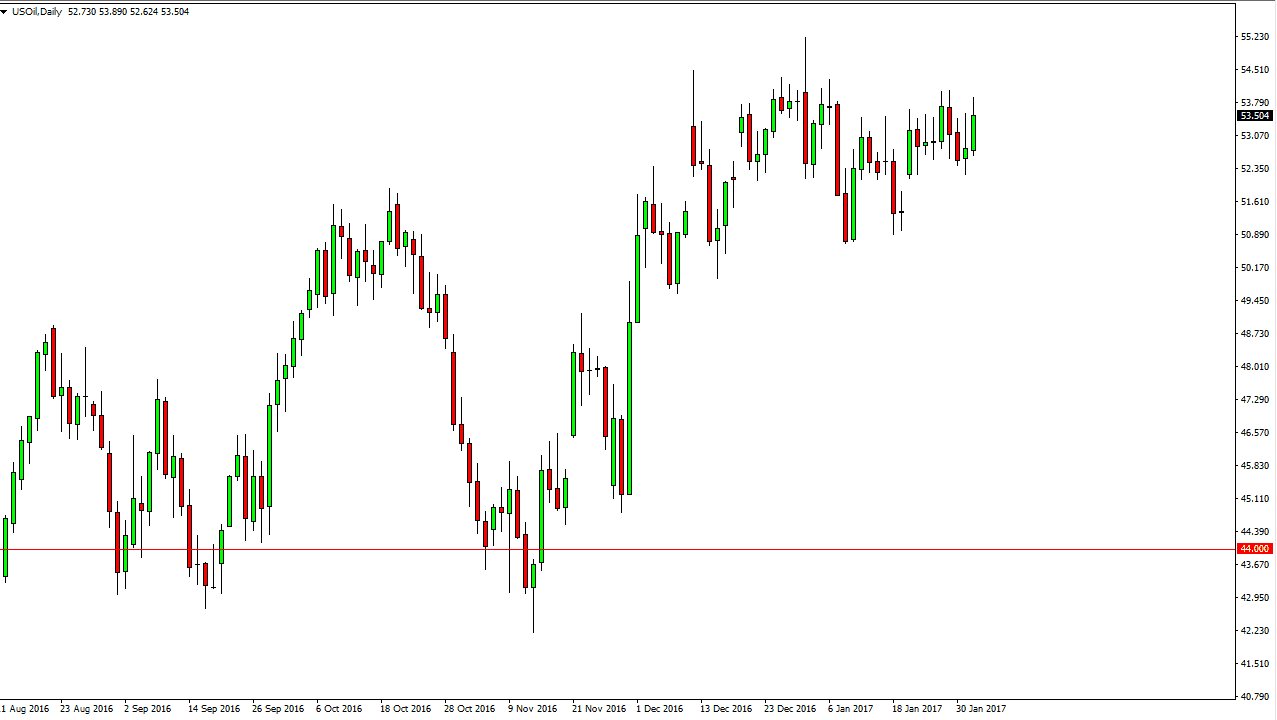

WTI Crude Oil

The WTI Crude Oil market had a positive session, but remains within the consolidation area that we have been in for a couple of weeks. I believe that the market is shrinking, as volatility remains quiet. I think that the overall consolidation between the $50 level on the bottom in the $55 level on the top remains though, so it’s not until we break out of that range that I think a longer-term trade can be placed. In the meantime, it’s probably going to be a simple matter of going back and forth, if you feel like scalping. Otherwise, this is probably a market that’s best left alone into it makes his intentions clear. There are a lot of moving pieces now, all of which are pointing in opposite directions. Because of this, expect difficulties.

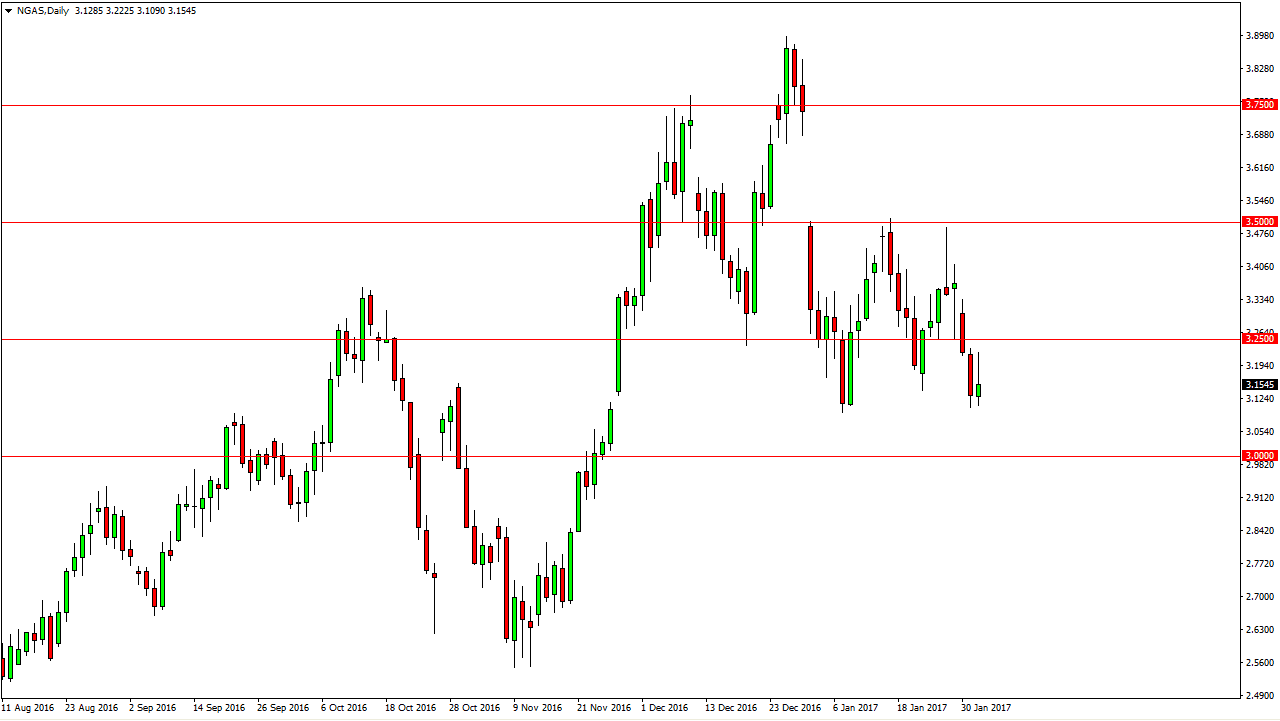

Natural Gas

Natural gas markets initially tried to rally during the session on Wednesday, but found the $3.25 level to be far too resistive to continue. By finding this trouble, we turned around and formed a shooting star which course is a very negative candle stick. This is especially true at the bottom of the downtrend, because it shows that the market hasn’t even bothered to put up a serious fight. On a breakdown below the bottom of the candle I fully anticipate that the natural gas markets will reach towards the $3.00 level, and possibly even lower. I cannot possibly give you a positive scenario in the natural gas markets right now, and even if we do get a pop and price, I believe that the longer-term sellers will jump right back in and squash that attempt.

I think the real question now is going to be whether we can break down below the $3 handle. I think we do, but it may take several attempts. I continue to sell on signs of failure on short-term rallies and of course breakdowns.