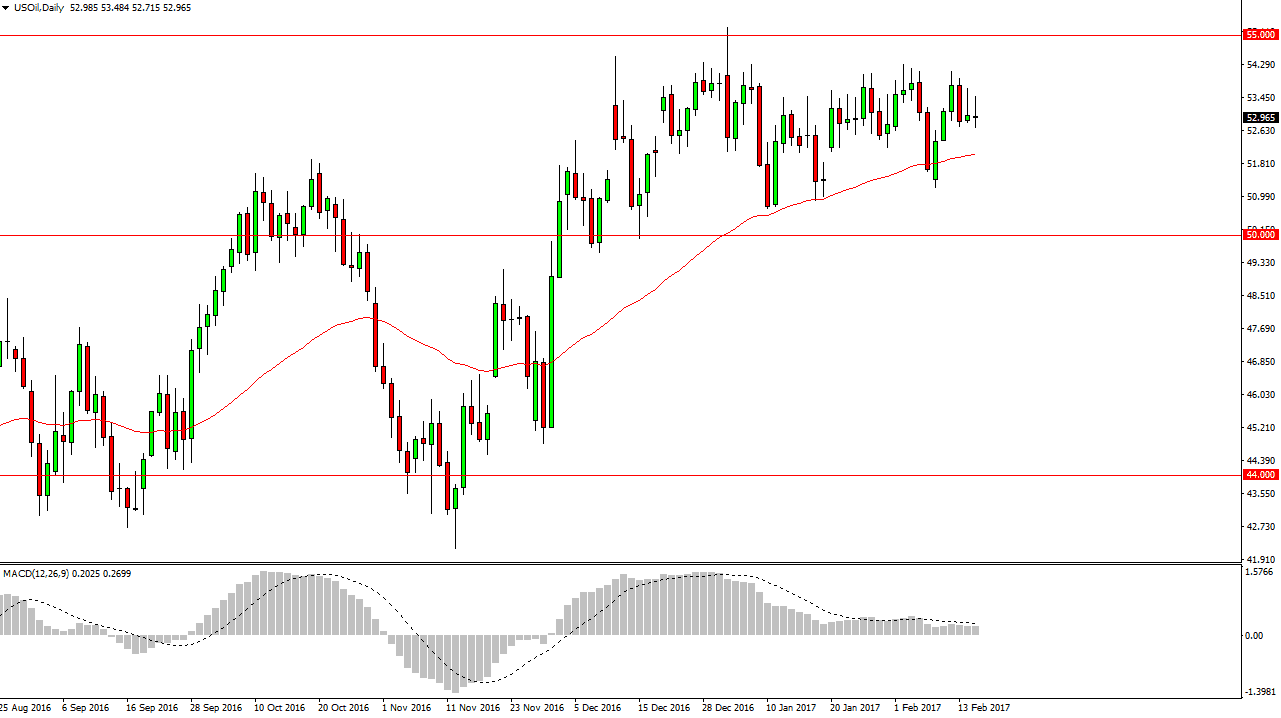

WTI Crude Oil

The WTI Crude Oil market initially rally during the day on Wednesday, but continues to show quite a bit of volatility. The resulting a shooting star matches the one that we formed on Tuesday, so I think that it’s only a matter of time before the sellers get involved and push much lower. The 50-day exponential moving average just below offers dynamic support, but I think that it’s only a matter of time before we reach towards the $51 level. I think that the market continues to chop around over all, as we have some traders focusing on OPEC production cuts, while the others are focusing on the oversupply and massive amount of inventory that the United States and other countries have.

Natural Gas

The natural gas markets rally during the day on Wednesday but turned around to form a shooting star as the $3 level offered far too much in the way of resistance. The shooting star course is a very negative candle, and I think it shows a we are going to continue the overall downtrend. The $2.75 level below should be the target, and I think that every time we rally you should start shorting. Given enough time, I think that we will not only reach the $2.75 level, but go well below there. The momentum is strong to the downside and I believe that will continue to be the case. The lows from 2016 were near $2.60, and with that being the case I think that will be the target. Even if we did rally from here, I have a hard time believing that the market will reach above the $3.25 level unless something massively changes. There’s far too much in the way of supply, and we are getting warmer than usual temperatures during winter months in the northeastern part of the United States, a perfect recipe for bearish momentum.