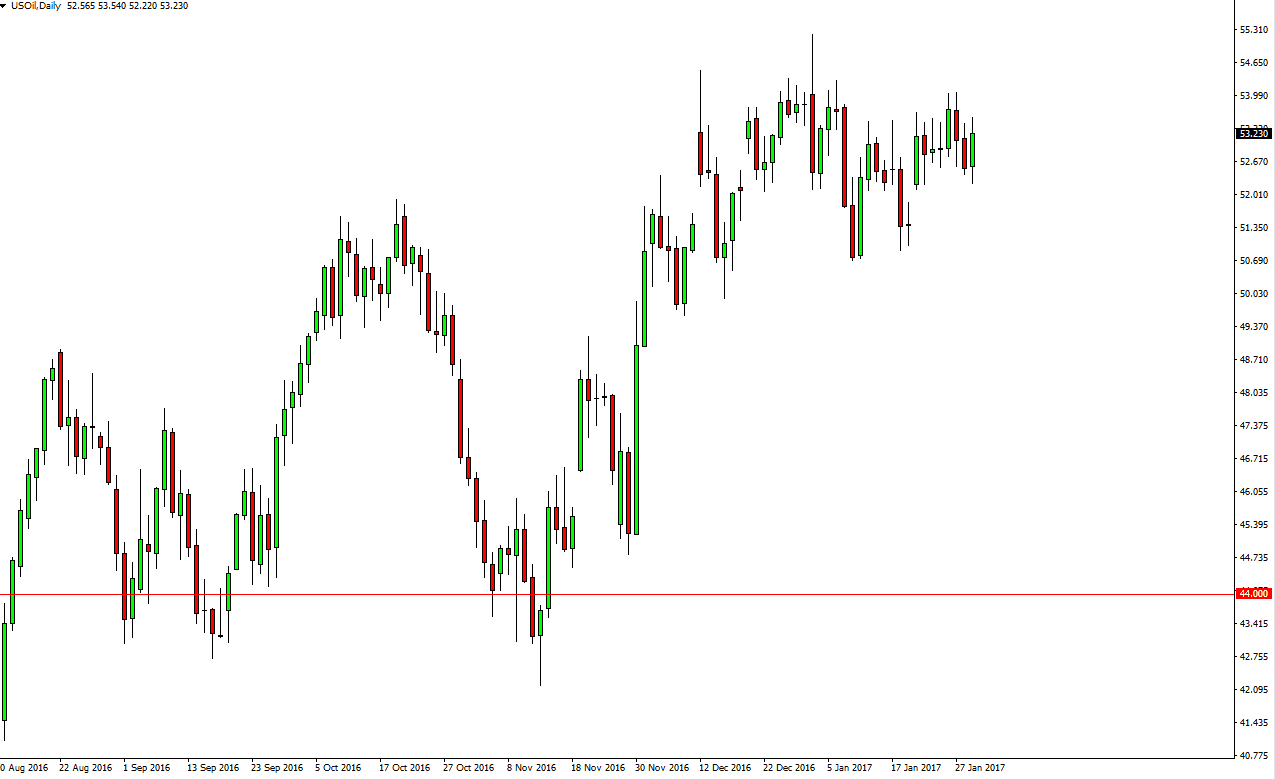

WTI Crude Oil

The WTI Crude Oil market initially fell during the session on Tuesday, and then broke higher and reached towards the $53.50 level which of course was resistant. Because of this, I believe that the back and forth type of choppiness will continue going forward. The market continues to see buying and selling, as the market overall is trying to figure out whether the oversupply issue is going to take over the production cuts. The $55 level above continues to be resistive, while the $50 level below continues to be support as soon as we breakout of the range, then we can start placing longer-term trades. Currently, this is short-term scalping going forward and I don’t think there is much else you can do.

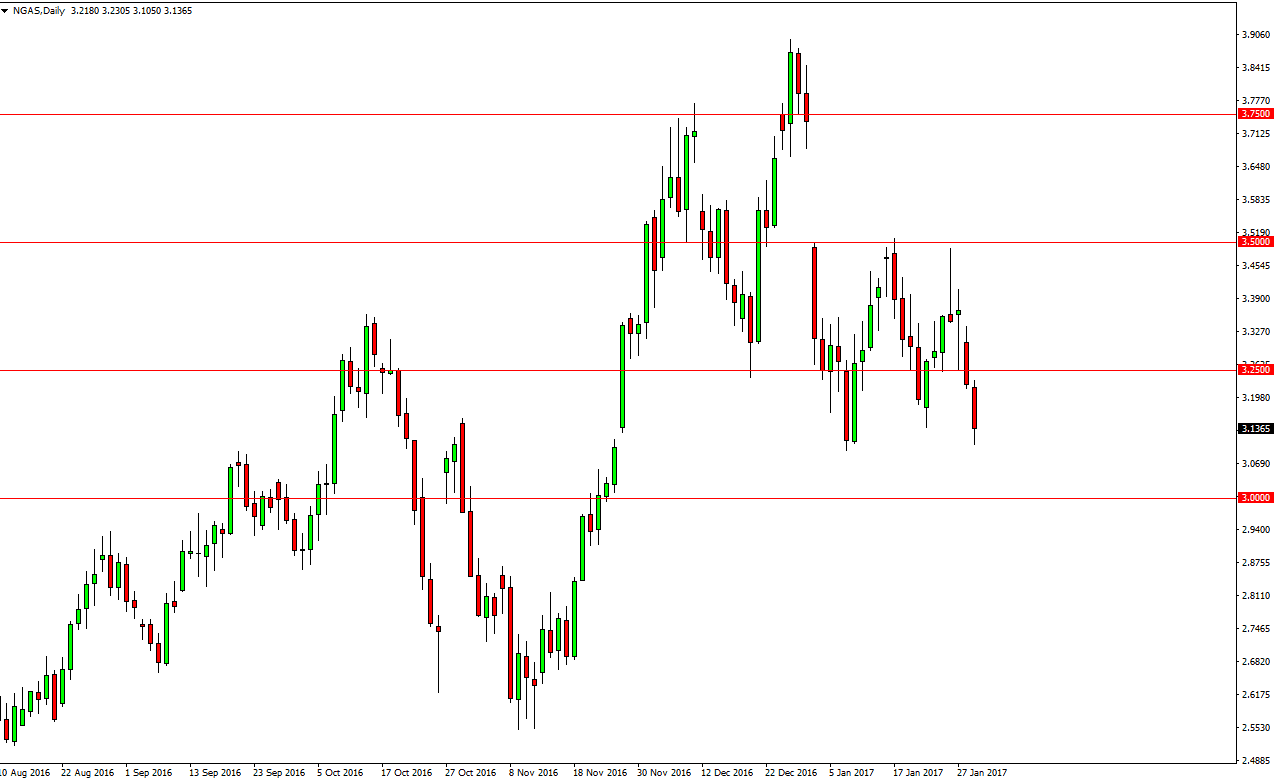

Natural Gas

The natural gas markets broke down on Tuesday, reaching towards the $3.10 level. That’s an area where there is a significant amount of support, but I think that we are going to break down below the bottom of the range for the session on Tuesday, reaching towards the $3 level. A rally from here will face quite a significant amount of resistance near the $3.25 level. That’s an area where expect sellers a step back in, and give us an opportunity to start shorting on exhaustive candles.

Ultimately, I believe that the $3 level underneath will be broken as well, as the warmer temperatures in the northeastern part of the US continue to weigh upon natural gas, as well as the oversupply that we have in both the United States and Canada. I believe longer-term we may be able to reach all the way down to the $2.55 level again, and that every time we rally it’s likely that sellers will return on signs of exhaustion, as the market looks a very heavy now, and the sellers will be interested in jumping in every time to get an opportunity.