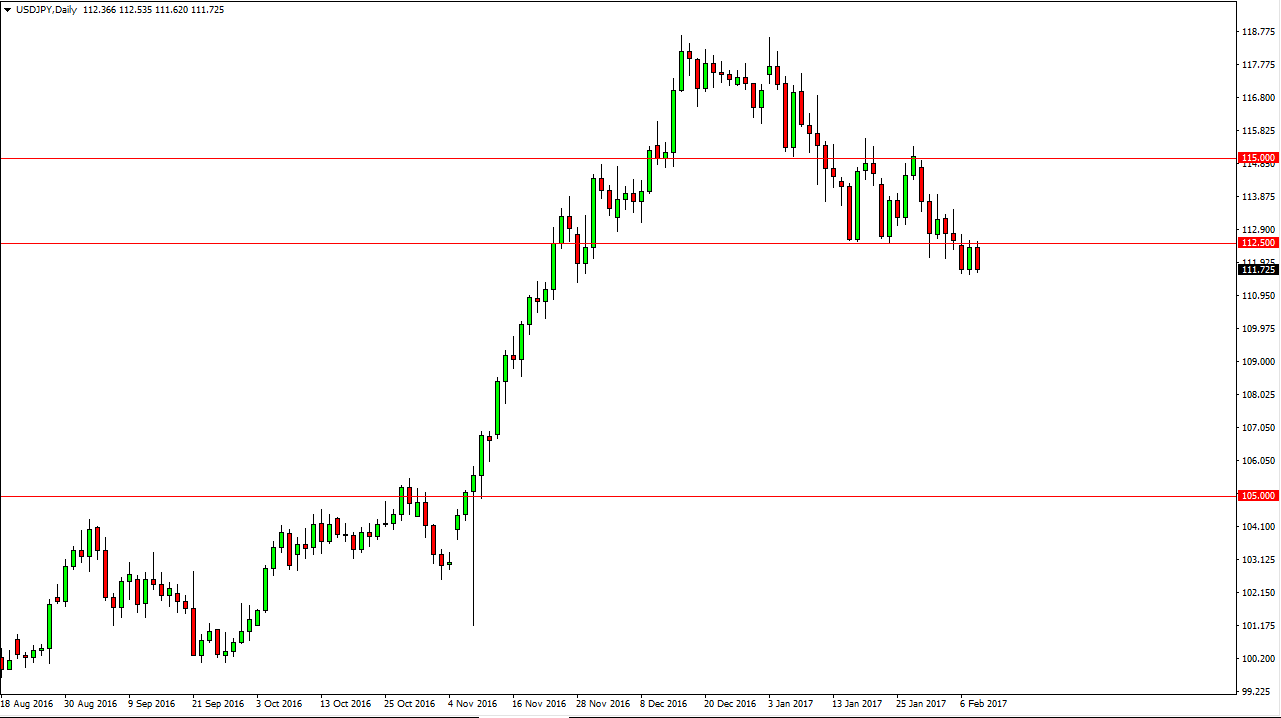

USD/JPY

The USD/JPY pair found resistance at the 112.50 level, yet again. This is an area that previously was support but now should act as resistance. Further weighing upon the market is the shooting star from a few sessions ago that’s is just above there as well. Because of this, the market will continue to struggle to get above there. However, I do believe that the longer-term uptrend is still intact, and because of that if we can break above the top of the shooting star from the Friday session, the market will more than likely reach towards the 115 level above. I still believe that the 111.50 level underneath continues to offer support, and if we can break down below there the market should then reach to the 110 handle. Either way, it’s going to be volatile but I am currently waiting for an opportunity to take advantage of the longer-term uptrend.

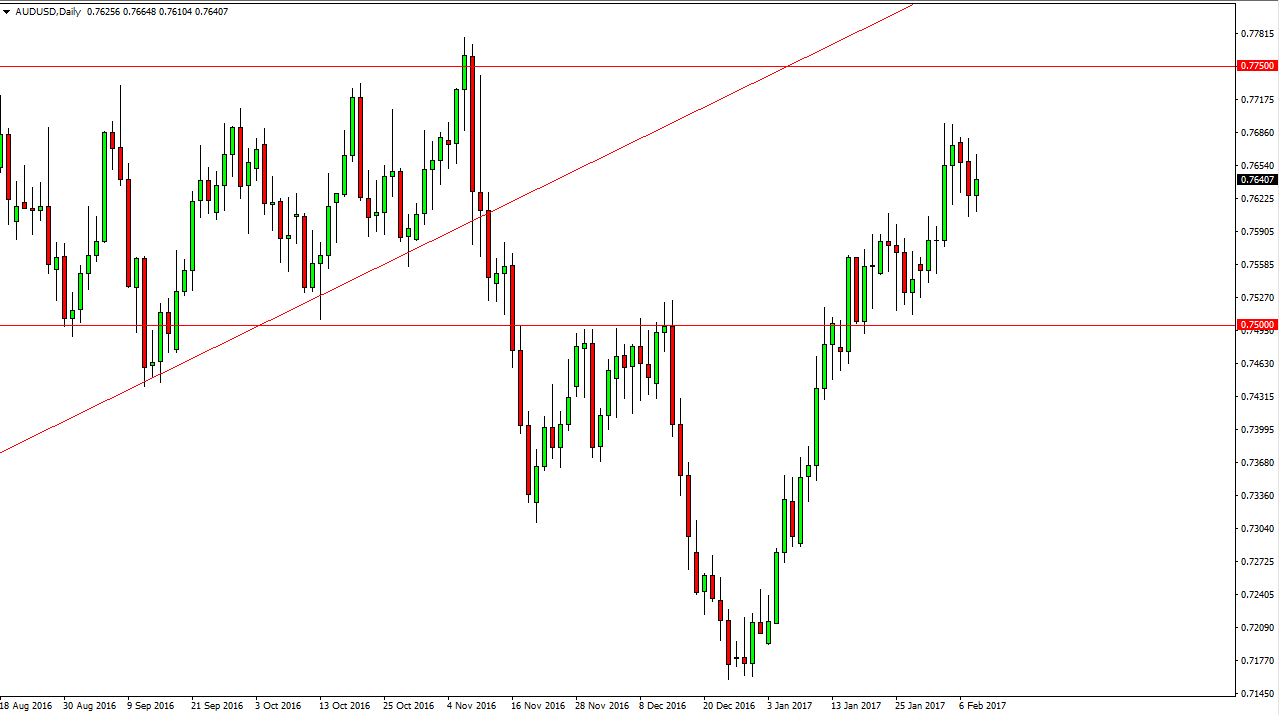

AUD/USD

The Australian dollar had a choppy session on Wednesday, forming a relatively neutral candle. The Australian dollar has been rallying for some time, and the 0.76 level has offered quite a bit of support. Any type of supportive candle in this area should be a buying opportunity, just as a break above the top of the candle for the day on Wednesday would be as well.

I also believe that there is a massive amount of support near the 0.75 handle underneath, and with this being the case the bounce would more than likely be a bit more significant from there. The 0.7750 level above continues to be resistance, and I think that is the longer-term target. The Australian dollar has been highly influenced by the gold markets as of late, as the longer-term correlation dictates. It looks as gold markets are going to go higher over the longer term anyway, so I’m bullish.