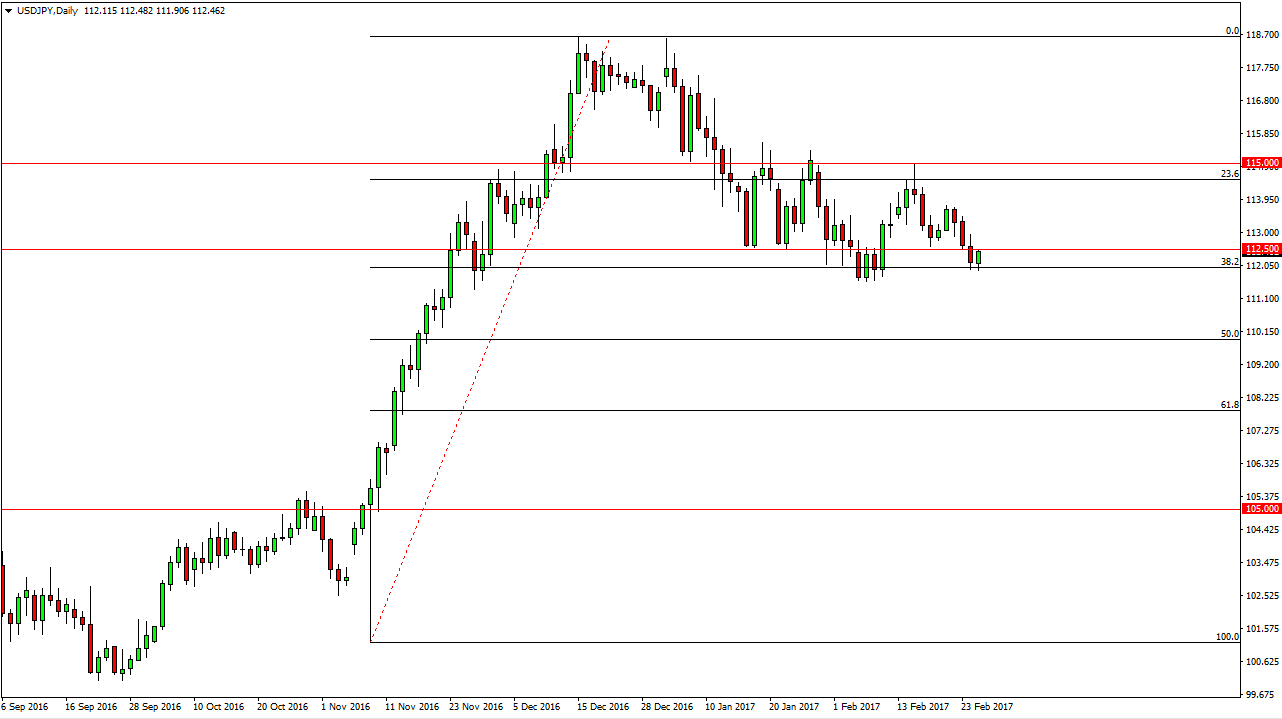

USD/JPY

The USD/JPY pair rallied during the day on Monday, bouncing off the 112 level. The fact that we have broken above the 112.50 level suggests that the market should continue to go higher. A break above the top of the range for the day should send this market looking for the 115-handle given enough time, and I believe that’s what’s about to happen. I recognize that the 38.2% Fibonacci retracement below is offering support, and I believe that the 111.50 level underneath is massively supportive. Although it might be choppy, the move higher should be what we see next. Pullbacks continue to offer value as far as I can tell, as I believe the Bank of Japan will continue to pressure the value of the Yen in general.

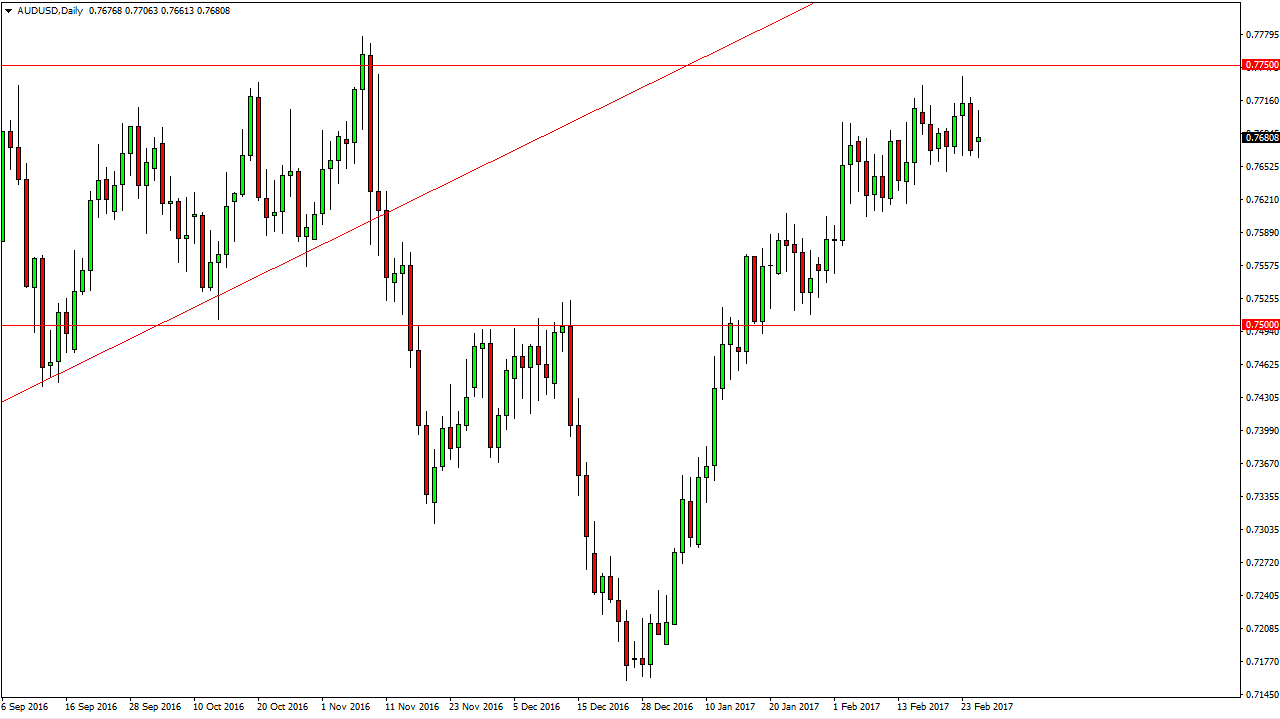

AUD/USD

The AUD/USD pair went back and forth during the session on Monday as volatility returned to the market. The 0.7650 level underneath continues to be supportive, and I believe it’s only a matter of time before we bounce from there. If we reach towards the 0.7750 level, I believe that it will be a fight to continue going higher. However, if we break above that vital level I don’t see any reason why we can’t continue to go much higher. A pullback should continue to offer value quite a bit of value as the move higher has been relentless. I believe that the gold markets continue to offer quite a bit of bullish pressure as well, and I believe that a break above the 0.7750 level will then send this market looking for the vital 0.80 handle, an area that has been an important over the longer-term for several years.

I have no interest in shorting this market until we breakdown below the 0.75 handle, something that looks very unlikely right now.