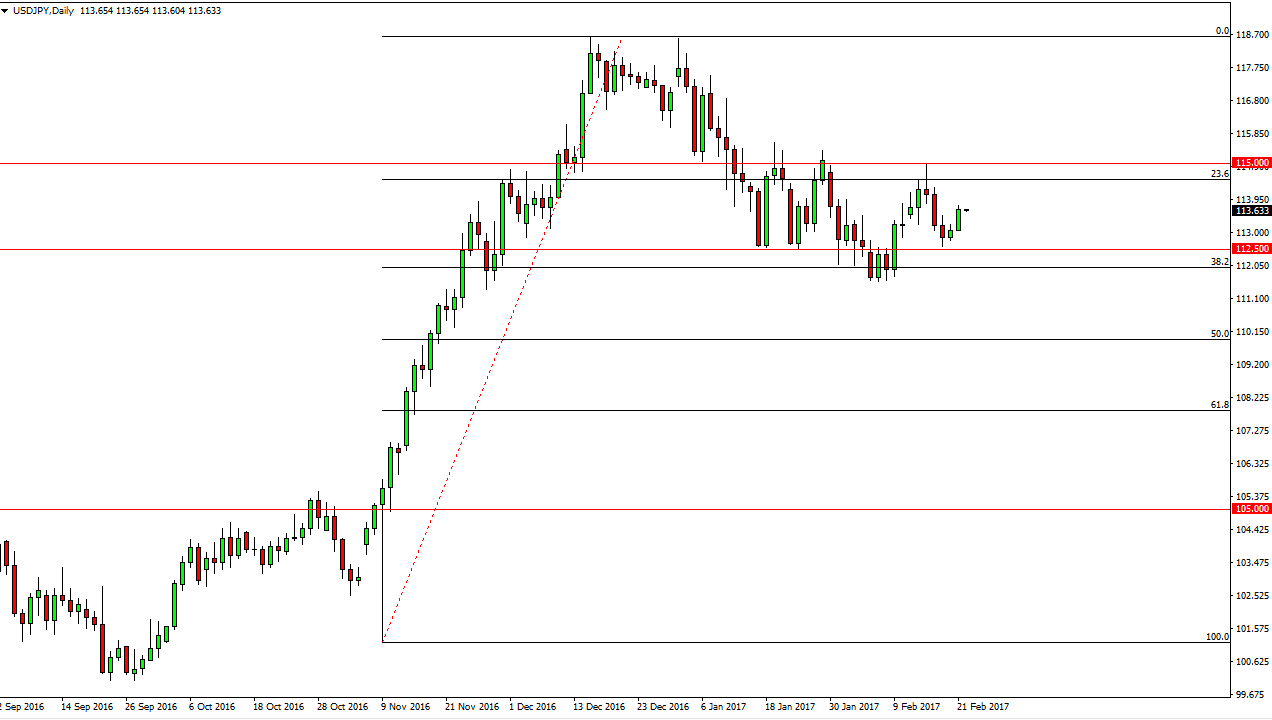

USD/JPY

The USD/JPY pair had a bullish session on Tuesday as we continue to see bullish pressure underneath. The Bank of Japan will continue to have a very loose monetary policy, so I believe that ultimately we will go higher. The 115 level above will be resistive, so I think were going to see is another attempt to break above there. Short-term traders will be buyers, short-term pullbacks could offer value. We have bounced directly from the 38.2% Fibonacci retracement level, a common occurrence in a strong uptrend. If you can keep your eye on the longer-term move, it can give you quite a bit of confidence as this pair does tend to be volatile.

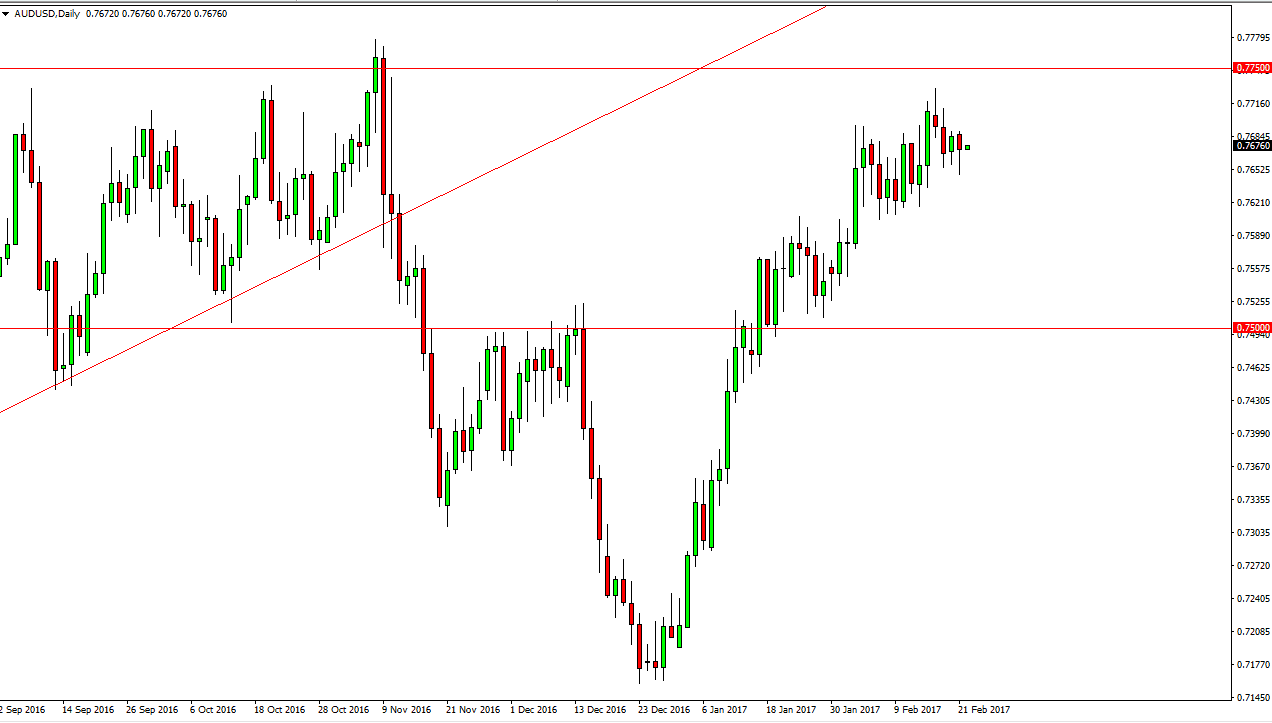

AUD/USD

The Australian dollar initially fell during the day but turned around to form a hammer. The hammer of course is a very bullish sign, and because of that I think if we can break above the top of the hammer, we will more than likely reach towards the 0.7750 resistance barrier. Gold markets have a massive influence on this pair, and they look like they are starting to find buyers below. I think it’s only a matter of time before we break out, and when we do break above the vital 0.7750 level, the market should then reach towards the 0.80 handle after that. I have no interest in shorting this market, I see significant signs of support below at several different levels.

The 0.76 level underneath is supportive, just as the 0.7650 level as. I think it is going to be a volatile and choppy, but given enough time I don’t see the reason why the buyers don’t come out on top, as we have seen quite a bit of strength in the Aussie. In fact, I don’t even have a scenario in which I am willing to sell anytime soon.