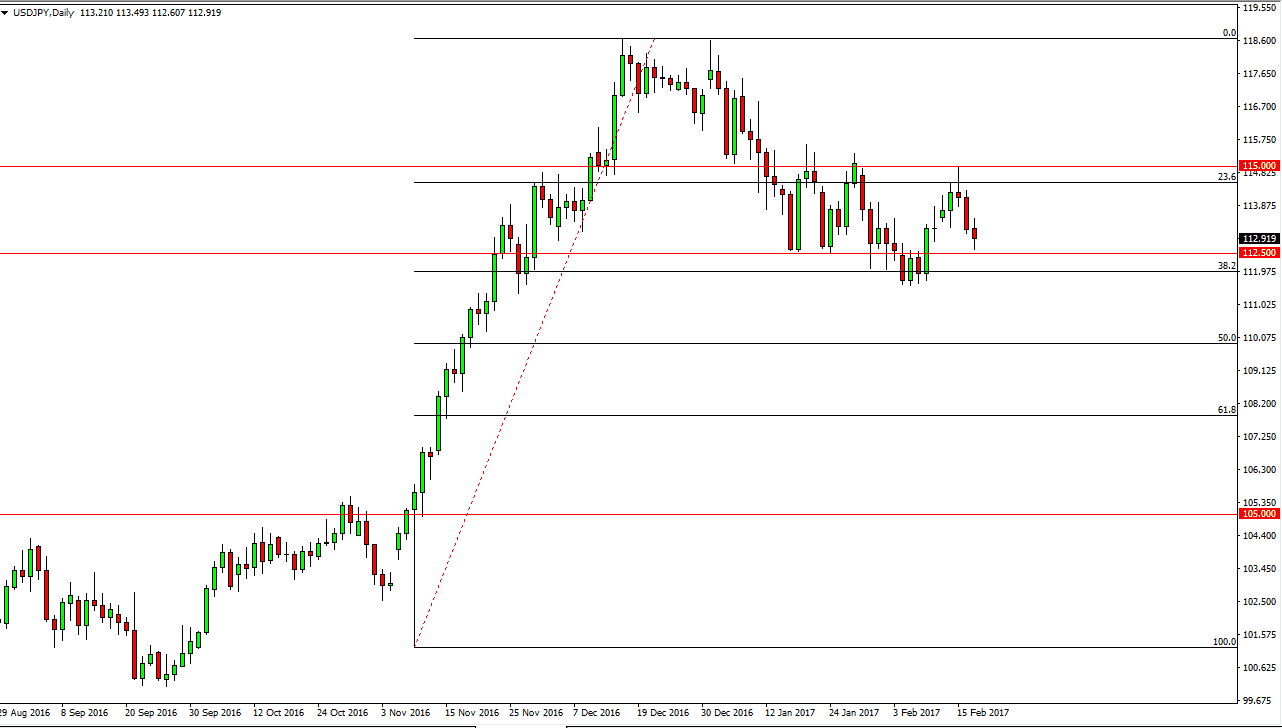

USD/JPY

The USD/JPY pair initially fell during the day on Friday, but found enough support at the 112.50 level to turn things around to form a hammer. The hammer of course is a bullish sign and I think that we are going to bounce and reach towards the 115-level given enough time. I think there support extending all the way down to the 111.50 level underneath, so I’m a buyer. I believe the longer-term uptrend still is very much intact, and we will eventually break above the 115 handle. As soon as we do, the market should then reach towards the 118.50 level and possibly beyond over the longer term. It might be choppy, but given enough time I think the buyers will assert their strength.

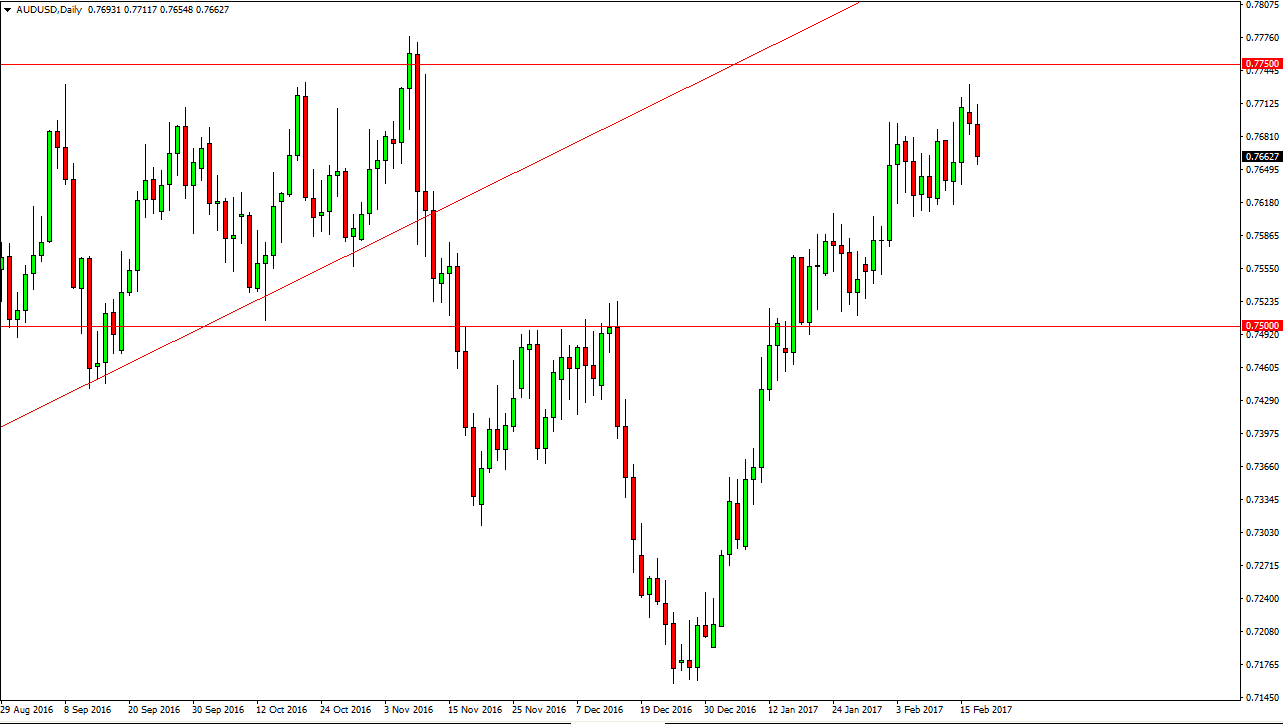

AUD/USD

The Australian dollar initially tried to rally on Friday but turned around to form a very negative candle. However, I think there’s a lot of support underneath, specially near the 0.76 level, so I have no interest in selling. We’ve been in a very strong uptrend over the last several weeks, and I think that we will continue to go to the upside. It might be a bit difficult to rise, but I think eventually we will reach towards the 0.7750 level. Pullbacks continue to be buying opportunities as there is so much in the way of bullish pressure underneath, and of course gold markets have looked very healthy. Because of this, I think the gold will push the Australian dollar higher over the longer term. The 0.76 level offer support, and even if we broke down below there I think there’s even more support at the 0.75 handle.

If we do break above the 0.7750 level, I think we will reach towards the 0.80 level, which has been a magnet for price on the longer-term charts.