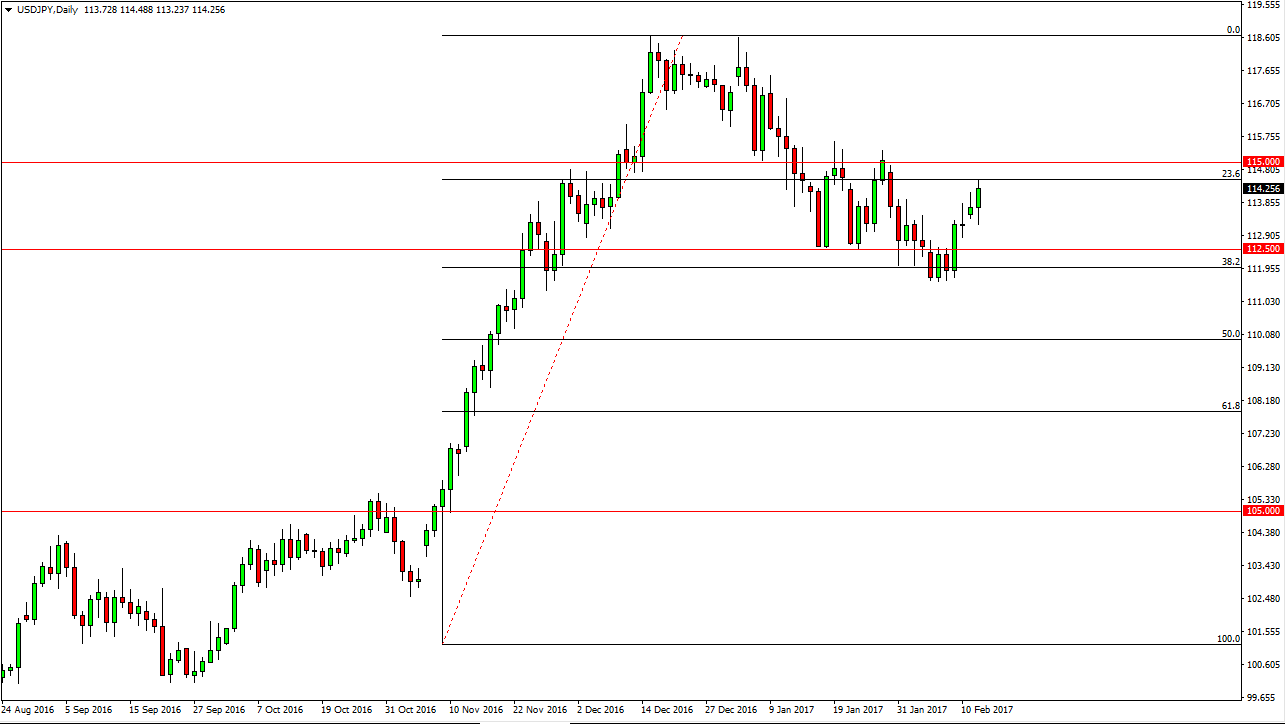

USD/JPY

The USD/JPY pair initially fell on Tuesday but found enough support during the Janet Yellen speech in front of Congress to continue to go higher. I believe that the market will then reach towards the 115 handle, which should be massively resistive. If we can break above there, the market then reach us towards the 118-handle next. I think that will be quite a bit of volatility in the way, so given enough time it’s likely that the market will continue to chop around with an upward bias. I don’t have any interest in selling, I believe that eventually this pair will go much higher. Also, Janet Yellen suggested that perhaps there is the possibility of interest rate hikes if the economy keeps going the way it has, so that of course gives us some bullish pressure in the US dollar.

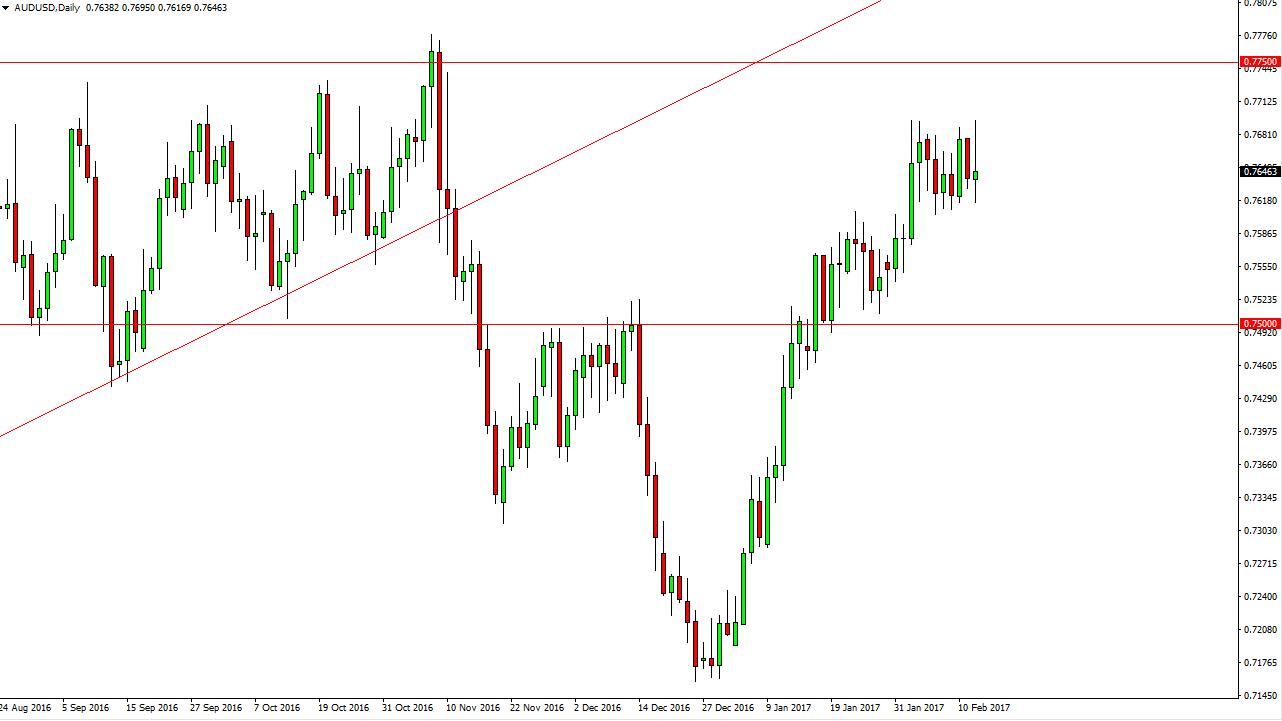

AUD/USD

The Aussie went back and forth during the day, showing volatility yet again. The gold markets were a bit of a mess, so that of course translated into a messy Australian dollar. I think that there is a significant amount of support at the 0.76 level, and that the support extends all the way down to the 0.75 level. If we break above the top of the shooting star, the market then could go to the 0.7750 level, which I think is the longer-term target. However, I believe that this is a very difficult market to deal with at the moment, so I will more than likely trade the Australian dollar against other currencies. If we can break above the 0.7750 level, the market can continue the uptrend. However, I’m not completely opposed to looking for a supportive candle at lower levels, such as the 0.75 level to take advantage of value and get long of the Aussie.