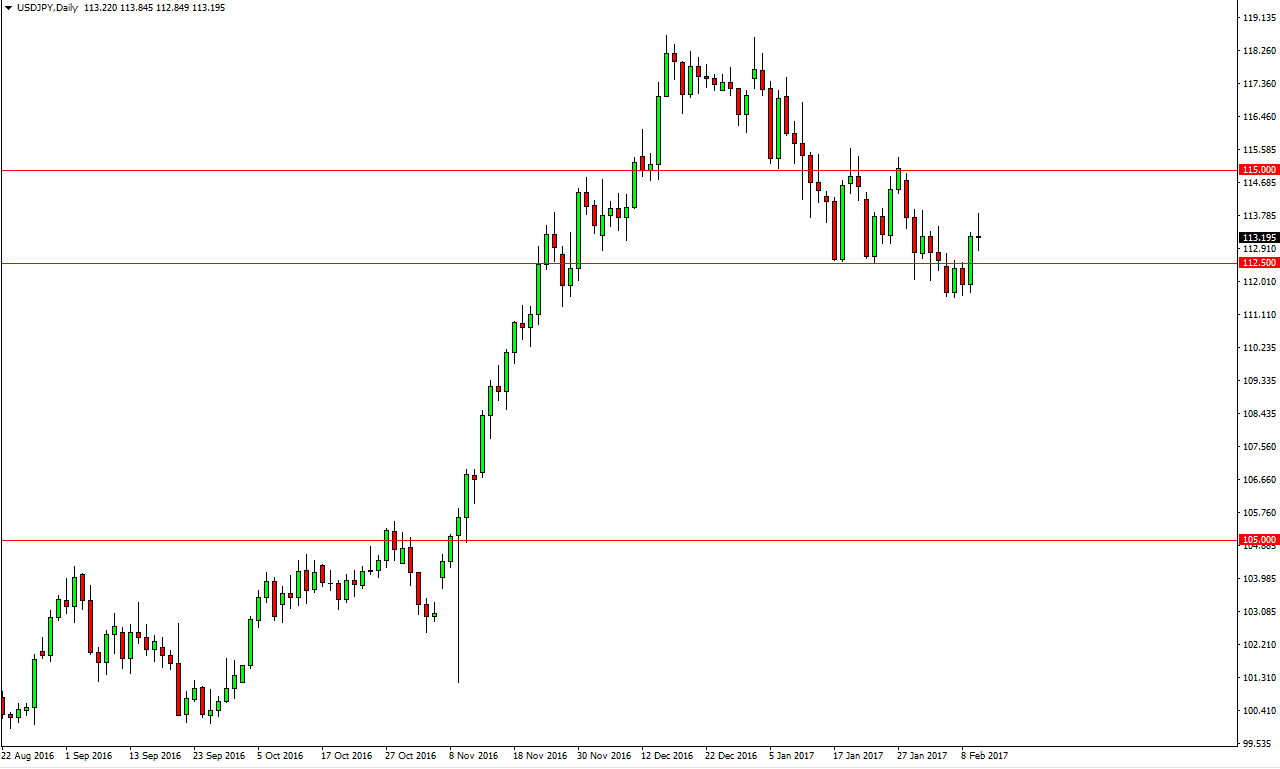

USD/JPY

The US dollar initially rallied against the Japanese yen on Friday but found enough resistance near the 114 level to turn around and form a shooting star. This is obviously a very bearish candle, and we have recently seen a significant amount of downward pressure. However, when I look at the totality of the move over the last couple of months, I recognize that this pullback could end up being a nice buying opportunity. If we break above the top of the shooting star, I would be a buyer and aiming for the 115 handle. Alternately, I believe that some type of supportive action near the 112 level could also be a nice buying opportunity. Currently, I’m not interested in shorting this market.

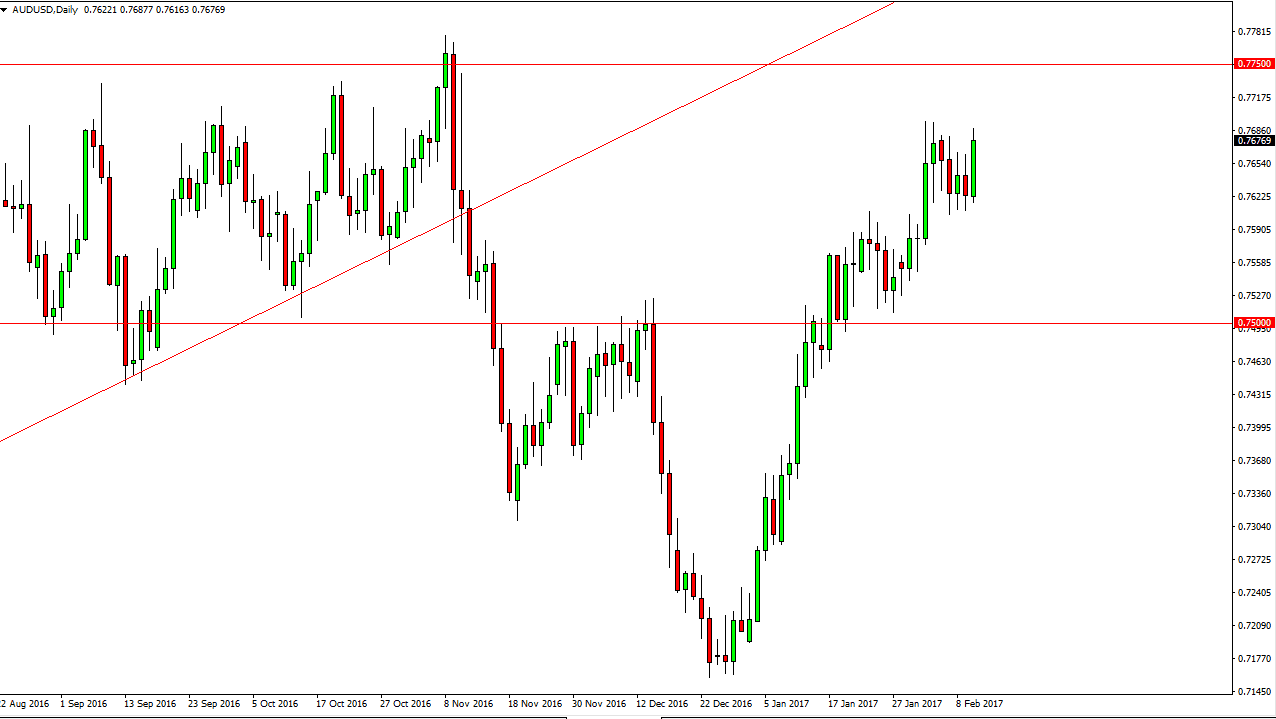

AUD/USD

The Australian dollar has seen significant strength during the Friday session, as we continue to reach towards the top of the recent consolidation area. I believe that we will break above it, and then reach towards the 0.7750 resistance barrier. I think it will take a significant amount of momentum to break above there, but given enough time I don’t see any reason why we won’t. This of course could be helped by gold markets if they rally, as they tend to be major drivers of the Australian dollar.

Even if we fall from here, I would anticipate that the 0.76 level should offer support, so I have no interest in selling this market currently. In fact, I believe there is a massive amount of support below the 0.76 level and extending all the way down to at least the 0.75 level, and I could even make an argument for the 0.74 level below there. In other words, I’m either going to get a buying opportunity or stay on the sidelines of this market. I currently have no interest in selling the Australian dollar, and I believe that will be the way going forward, simply waiting for buying opportunities.