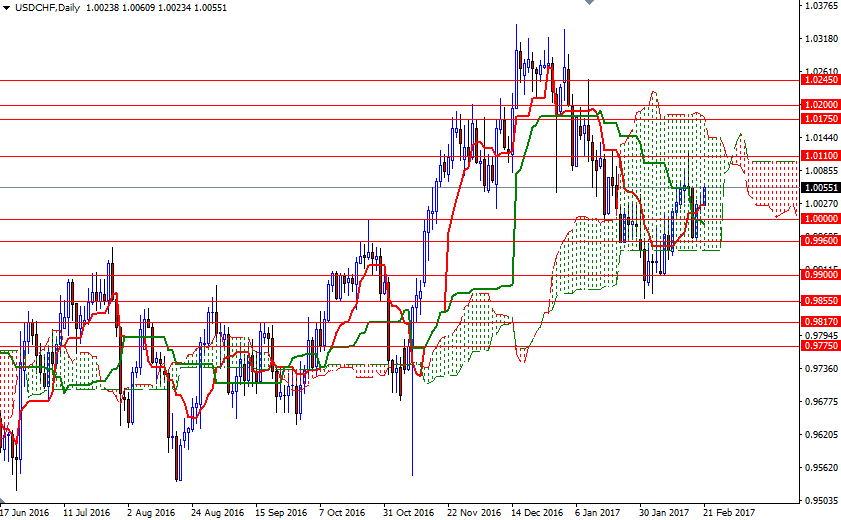

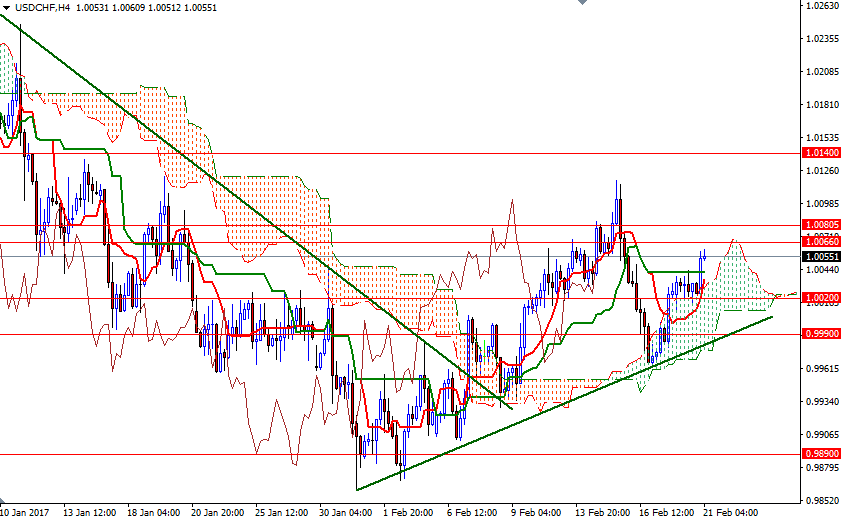

The USD/CHF pair tested the resistance zone at around the 1.0110 level last week as the dollar strengthened on the back of better-than-expected economic data. Although the failure to breakthrough this barrier dragged prices back to the 0.9960/45 area, the market found enough support to reverse. The area where the 4-hourly and the daily Ichimoku cloud overlaps continues to be supportive. The Federal Reserve Chair Janet Yellen, along with several Fed officials spoke in favor of early rate hikes. Therefore, market players will be paying extra attention to minutes of the Fed's latest policy meeting, due on Wednesday, for clues on whether or not the Fed is on course to hike rates as early as March.

While the majority anticipates that the central bank could wait until June unless the Trump administration comes up with a solid fiscal plan, others believe the March meeting is a done deal based on the latest batch of strong U.S. data. From a technical perspective, there are two things catch my attention at first glance. First of all, the USD/CHF pair is trading above the Ichimoku clouds on the weekly and the 4-hourly charts. Secondly, we have bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses on both weekly and daily time frames. That said, I think support formations after pull-backs will attract buyers, as long as the market remains above the 4-hourly cloud (and the short-term ascending trend-line drawn on the chart).

If the 1.0020 support remains intact, it is likely that the USD/CHF pair will test the 1.0066 and 1.0080 levels. The bulls will have to break through so that they can tackle the next strategic resistance at 1.0110. Eliminating this barrier implies that the 1.0140 level will be the next stop. Once above 1.0140, we could possibly see the bulls make a run for 1.0200/1.0175. A break down below 1.0020, on the other hand, suggests that we are heading back to 0.9990. If the bears penetrate this support, then the 0.9960/45 region could be the next port of call. Closing below 0.9945 on a daily basis would make me think that the market is about to challenge 0.9900.