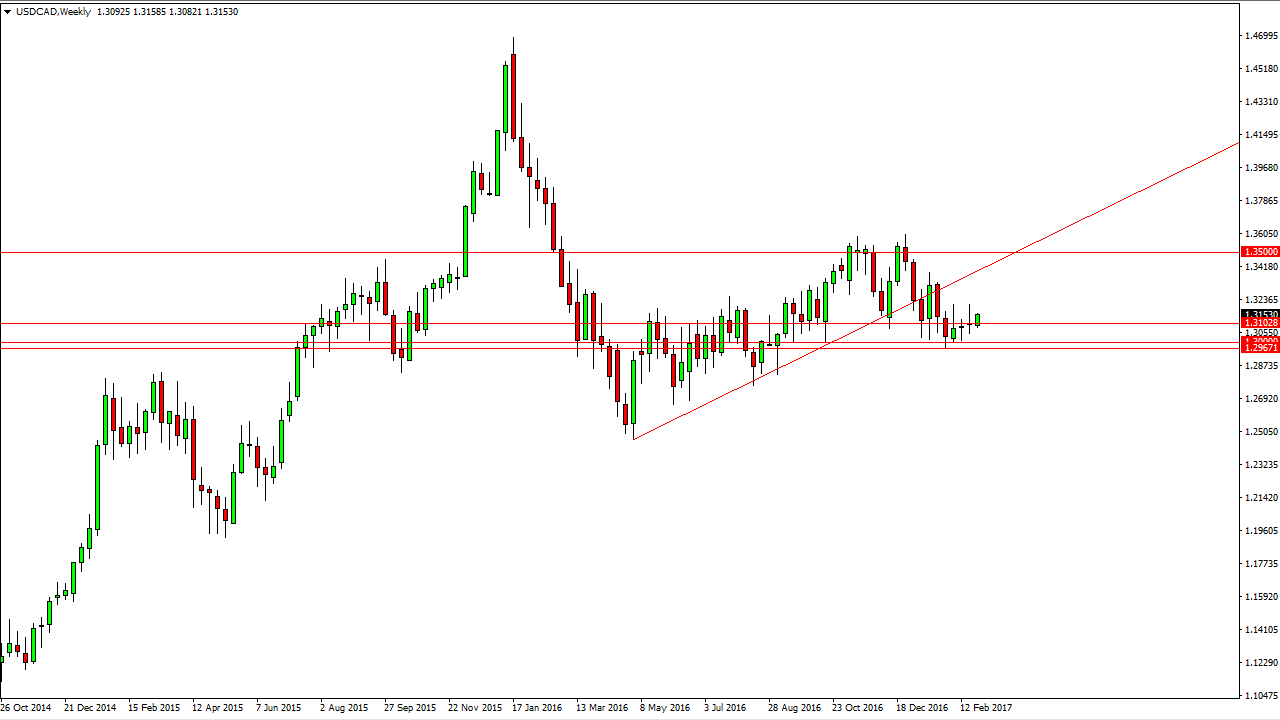

The USD/CAD pair ended up rather tight during most of the month of February, as the markets have been stuck in a very short range. A lot of this is due to the oil markets though, as they are so highly influential to the Canadian dollar. It’s likely that we won’t see any significant move here until oil can either break to the upside, or breakdown. As far as this chart is concerned, it looks as if the 1.32 level above continues to be resistive, but there is a significant amount of support at the 1.30 level, extending down to the 1.2950 handle.

I believe that the move must coincide with the WTI Crude Oil markets making their move. If we can break above the $55 level, I believe that it will send this pair much lower. On the other hand, if the WTI market breaks down below the $53 level, this pair will more than likely reach above the 1.32 handle and perhaps reach towards the 1.34 level after that.

It’s likely that the markets will be choppy in the meantime, and it is going to take a lot of wherewithal to hang on to any trades. I think this will be a short-term traders market for most of the month, and because of that it’s going to be difficult to hang on to a position for any real length of time. However, once we do finally make the move it’s going to be a big one, and I believe that we will get the typical explosion to one direction or the other like we get in this pair. You’re going to have to be patient, so you must pay attention to both market simultaneously.

I believe that a longer-term move to the upside happens as soon as we break above the 1.35 handle, which of course is a significant psychological round number. Of course, the same can be said if we breakdown below the 1.30 handle with any real sense of gusto.