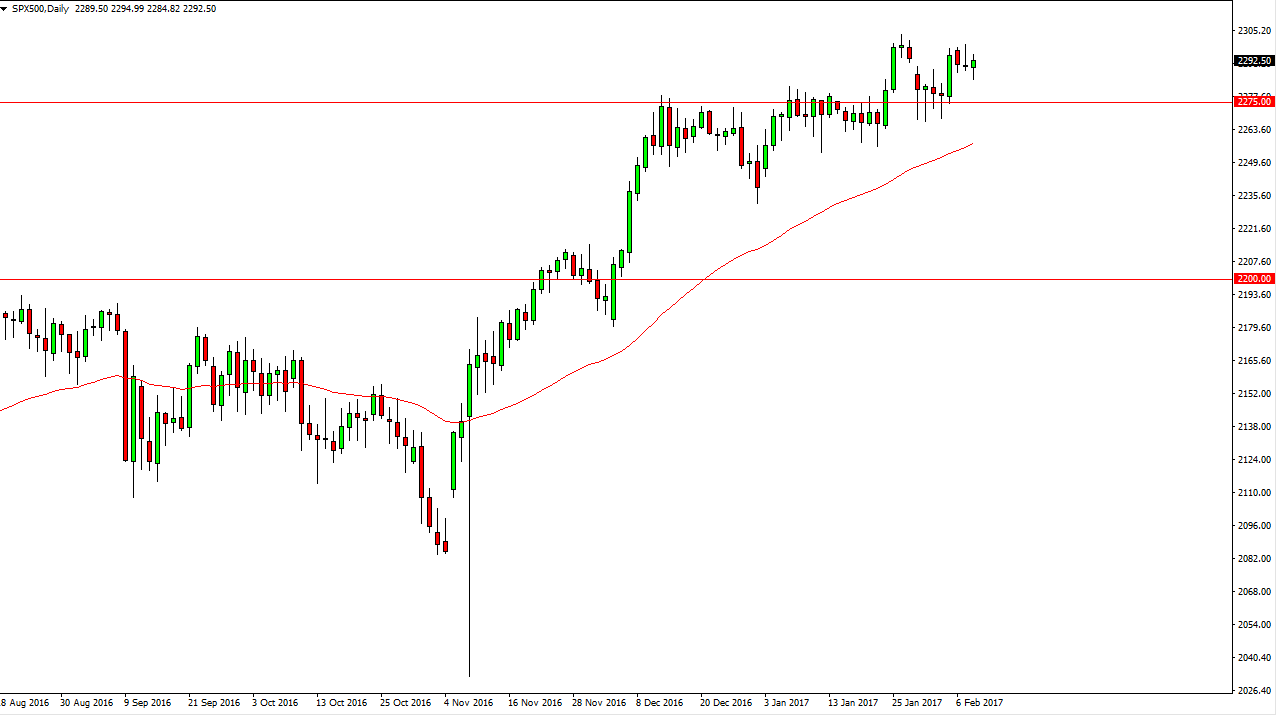

S&P 500

The S&P 500 tried to rally initially during the day on Tuesday, but struggled a bit at the 2300 level. It looks as if the market has plenty of noise between here and the 2275 level again, so given enough time I do believe that the buyers come back. If we can break out above the 2300 level for any real length of time, the S&P 500 should then go to the 2500 handle. Either way, longer-term I am bullish of this market and I believe that the US indices will continue to drive worldwide indices higher. Having said that, the S&P 500 is a little bit less bullish than some of the other indices but still show strength over all.

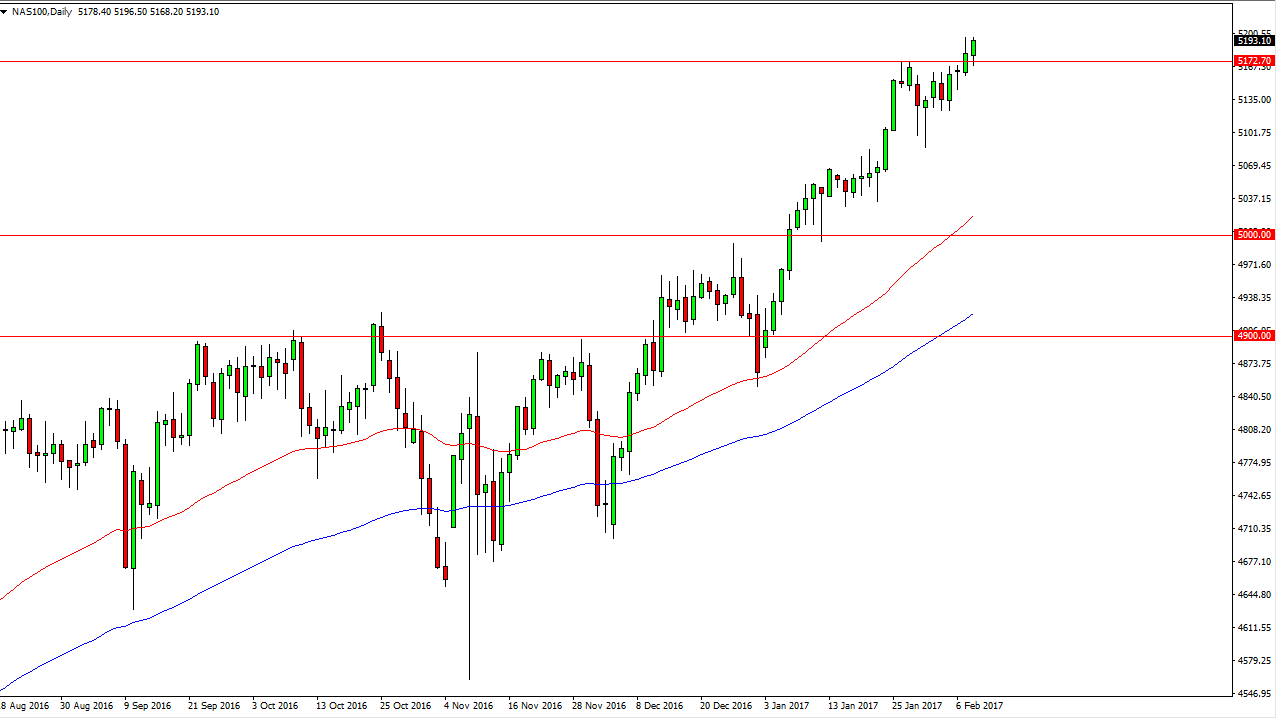

NASDAQ 100

The NASDAQ 100 broke higher on Tuesday, clearing the 5272 handle easily. This market has been banging up against this level for a while, and this suggests that it is going to continue to go higher over the longer term. The market should continue to find buyers when it pulls back, but it is a little bit long in the tooth. Because of this, I do not expect to see some type of explosion to the upside, rather a general grind and attempt to reach towards the 5250 handle.

I believe that the 5100-level underneath continues to be supportive, and it’s only a matter of time before the buyers return on a breakdown. Pay attention to the other US indices, they are starting to move in tandem again, but the NASDAQ 100 has been a bit of a market leader when it comes to US markets. I have no interest in selling, and I believe that longer-term, we will probably see the 5500 handle, but obviously, that’s going to take quite some time to get there. If you can handle the longer-term “buy-and-hold” mentality, this might be the market for you.