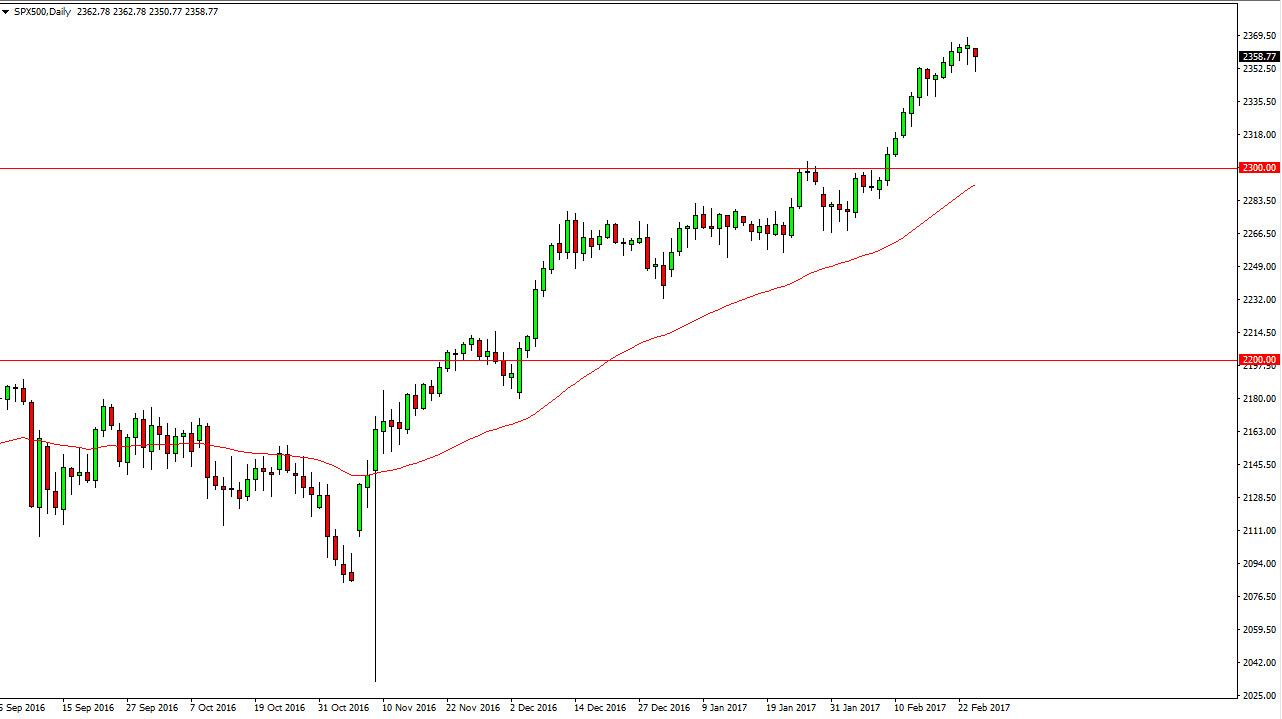

S&P 500

The S&P 500 initially fell on Friday but as we have continued to see, buyers are willing to buy dips as the market seems to be well supported. The 2350 level offer support that I think runs down to the 2340 handle. If we can break down below there, then we go to the 2300 level. Nonetheless, I’m not willing to sell and every time we pull back I look at it is an opportunity to pick of value in a market that’s extraordinarily bullish. The 50-day exponential moving average has been offering dynamic support recently, so a pull back to that moving average could happen over the next several sessions. Nonetheless, I still think that would be a buying opportunity and I have no scenario in which I am willing to sell.

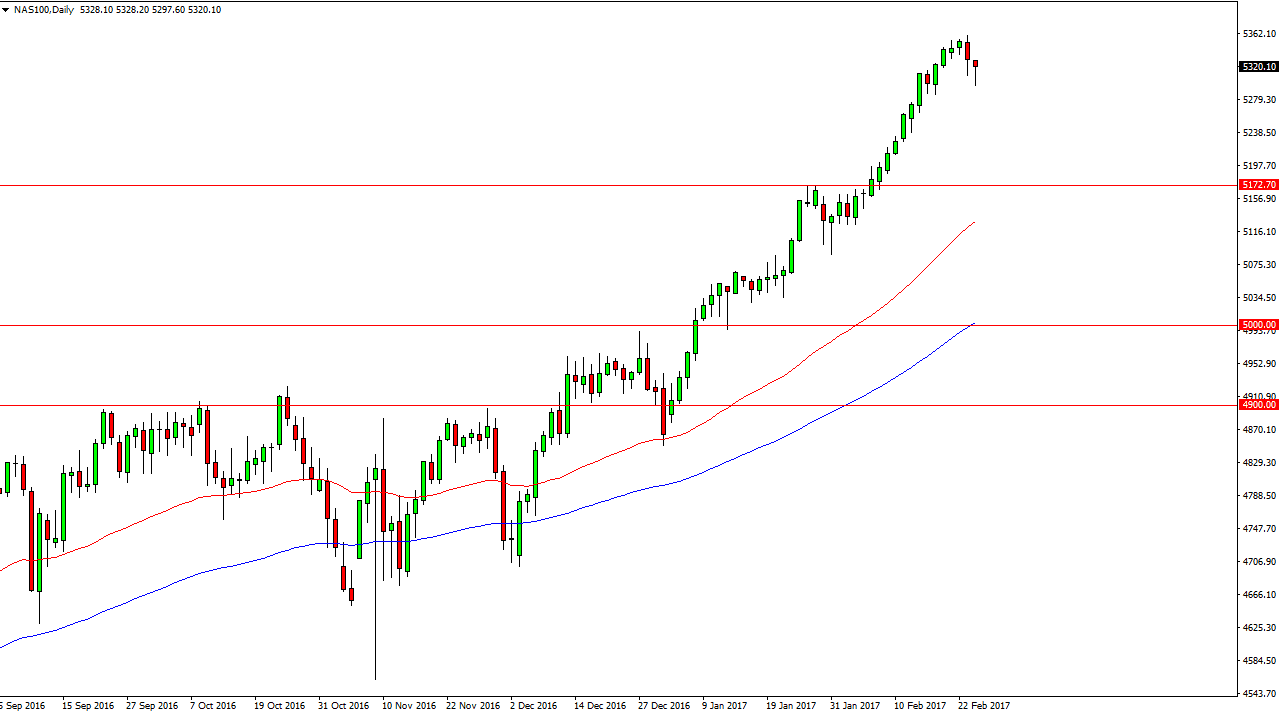

NASDAQ 100

The NASDAQ 100 did the same thing as we fell towards the 5300 level but found enough support to turn things around and form a hammer. The hammer of course is a bullish sign but I am a little bit more concerned about this market, as we have been overbought for some time. I think we could continue to go lower but I think the absolute “floor” is near the 5172 handle. Either way, I have no interest in selling in the lower we go, if we stay above the floor, the more I am interested in buying this market as we should continue to reach towards higher levels, with perhaps a target of 5500.

The NASDAQ 100 has led the other indices in America higher, which by extension have been leading the indices around the world higher. This is an extraordinarily overbought market, but I don’t think that anything’s going to change longer-term anytime soon. Quite frankly, US indices continue to be some of the strongest markets that I watch.