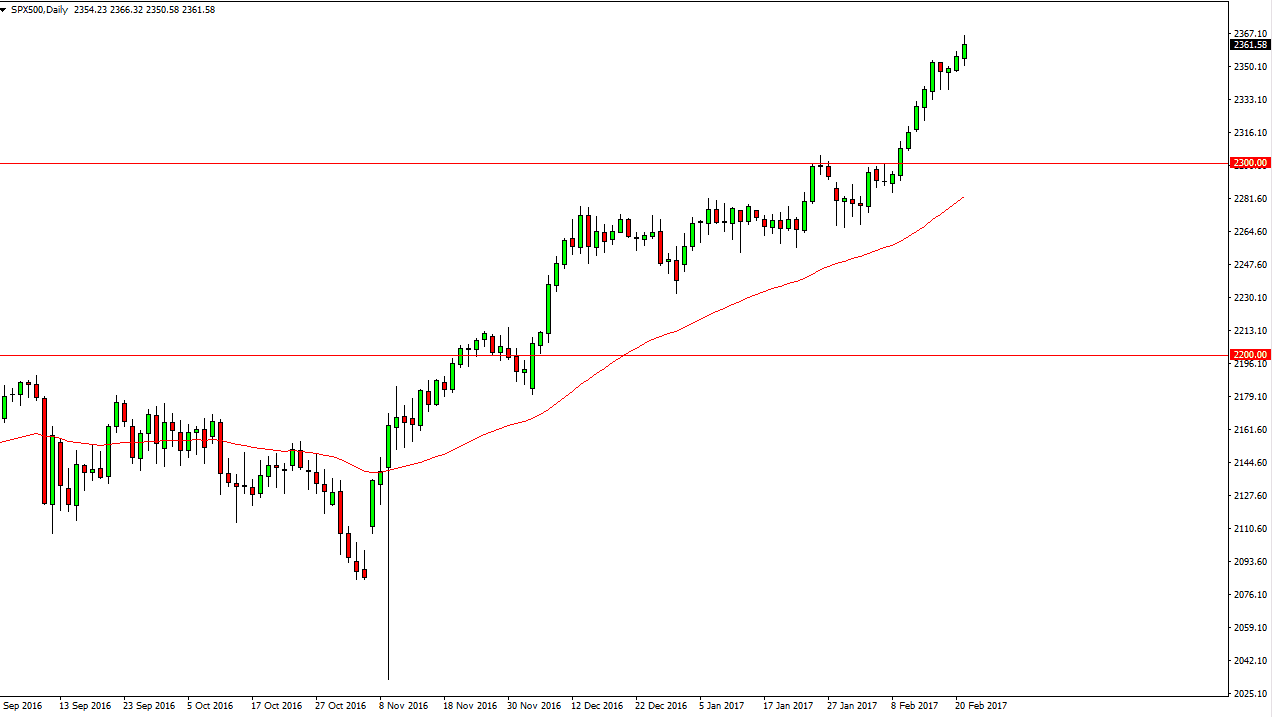

S&P 500

The S&P 500 had a bullish session on Tuesday, as we continue to see buyers jump into the market. It looks as if there’s a short-term support level at the 2350 level, so I think short-term pullbacks might be buying opportunities. However, we are a bit overextended so don’t be too surprised if we see consolidation and choppiness in the short term. I believe that even if we do breakdown, the 2300 level underneath will continue to be the “floor” in this market. I have no interest in shorting this market, US indices continue to be very strong and of course the S&P 500 isn’t going to be any different.

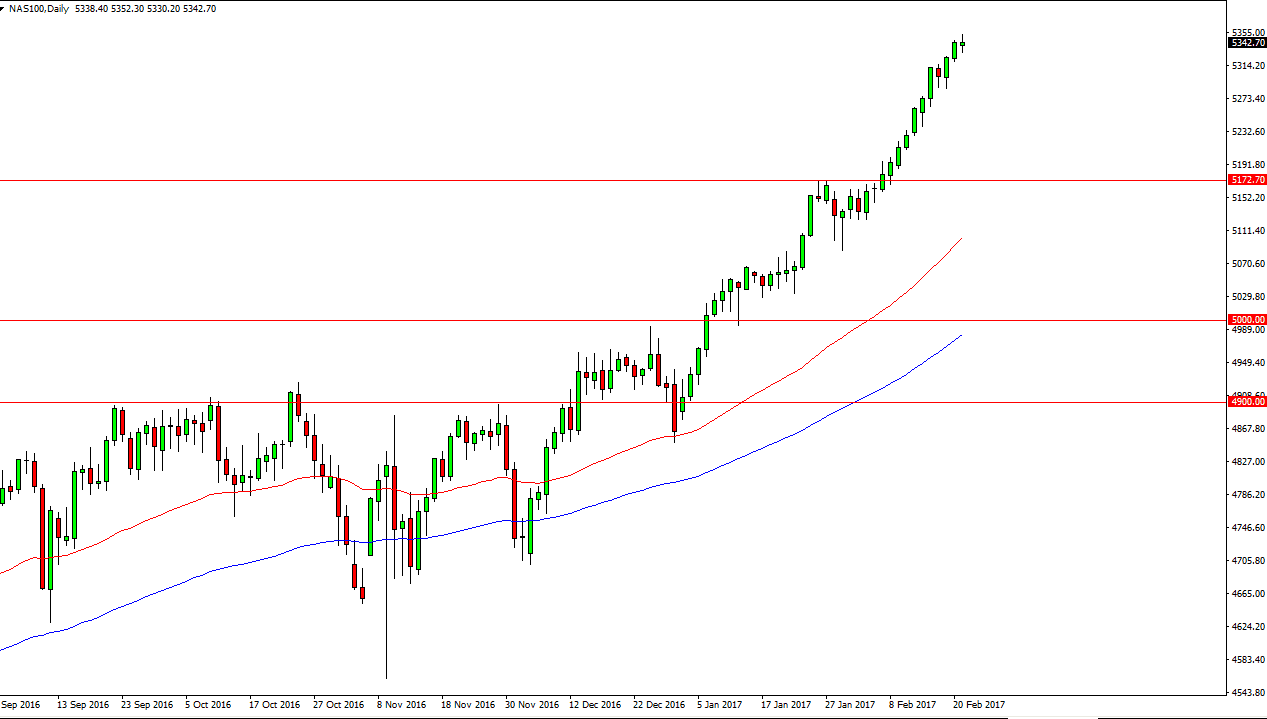

NASDAQ 100

The NASDAQ 100 had a very quiet day, as we went back and forth but couldn’t pick up any traction. That’s not a surprise, this market is overbought to say the least, so I think we need to see a pull back to at least 5300 in order to become trouble going long. The market is parabolic, but the NASDAQ 100 has been a leader when it comes to other indices around the world, so pay attention what’s going on here, and trade the other indices accordingly. Given enough time, this market should then reach towards the 5500 level but I think that we’ve gotten ahead of ourselves.

It’s probably best to let this market pull back significantly before try to put any money to work, as it is foolish to try to jump into this market at these lofty levels. Buying this market up here would be basically “chasing the trade”, which is the easiest way to lose money in financial markets overall. The NASDAQ 100 should continue to be a leader, so as why I think that perhaps we will have a cooling-off period over the next several sessions.