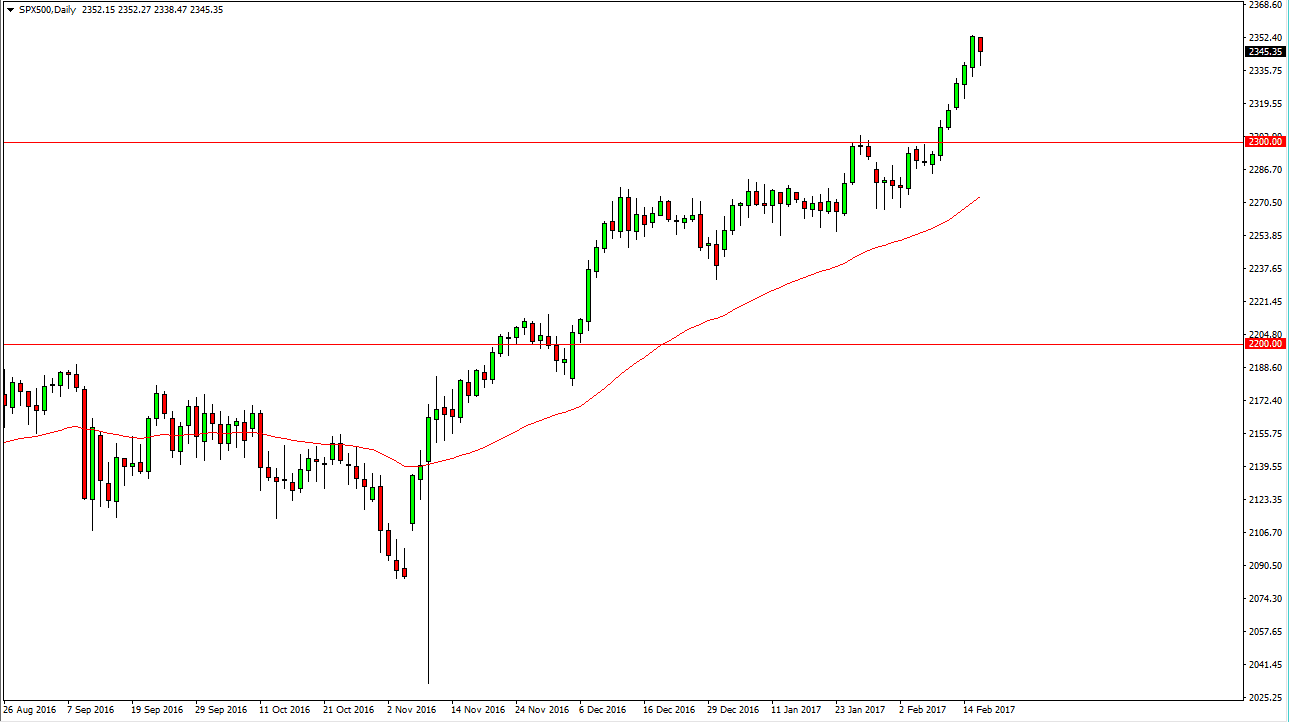

S&P 500

The S&P 500 fell significantly during the day on Thursday but found support to turn around and show signs of life towards the end of the day. This is a market that has plenty of bullish pressure underneath, and I believe that longer-term we continue to go higher. I think that the 2300 level below is massively supportive, and essentially the “floor” in this market. Ultimately, I think that a “buy on the dips” type of attitude should be used for this market, but we are a bit overbought currently. It looks as if we are going to go higher, but I would prefer to see a pull back that shows signs of support, as it offers plenty of reason to take advantage of the longer-term uptrend. The 2300 level will not be broken in my estimation, and I believe we are more than likely going to see 2500 over the longer term.

NASDAQ 100

The NASDAQ 100 initially fell during the day on Thursday, as we continue to show signs of bullish pressure on pullbacks. I believe that pullbacks offer value in a market that is extraordinarily bullish. I think that the 5172 level below is the floor, but ultimately I would be surprised if we even got down to that area. I like the idea of buying dips, as it gives us an opportunity to pick up on value in a market that has obviously taken off to the upside.

I believe that the market is going to reach towards the 5500 level, but it is going to take some time to get there, and a significant pullback is probably needed in order to continue the momentum as we certainly have a lot of buying pressure, but have gotten so ahead of ourselves. Nonetheless, US indices continue to remain strong, and I have no interest in shorting longer term.