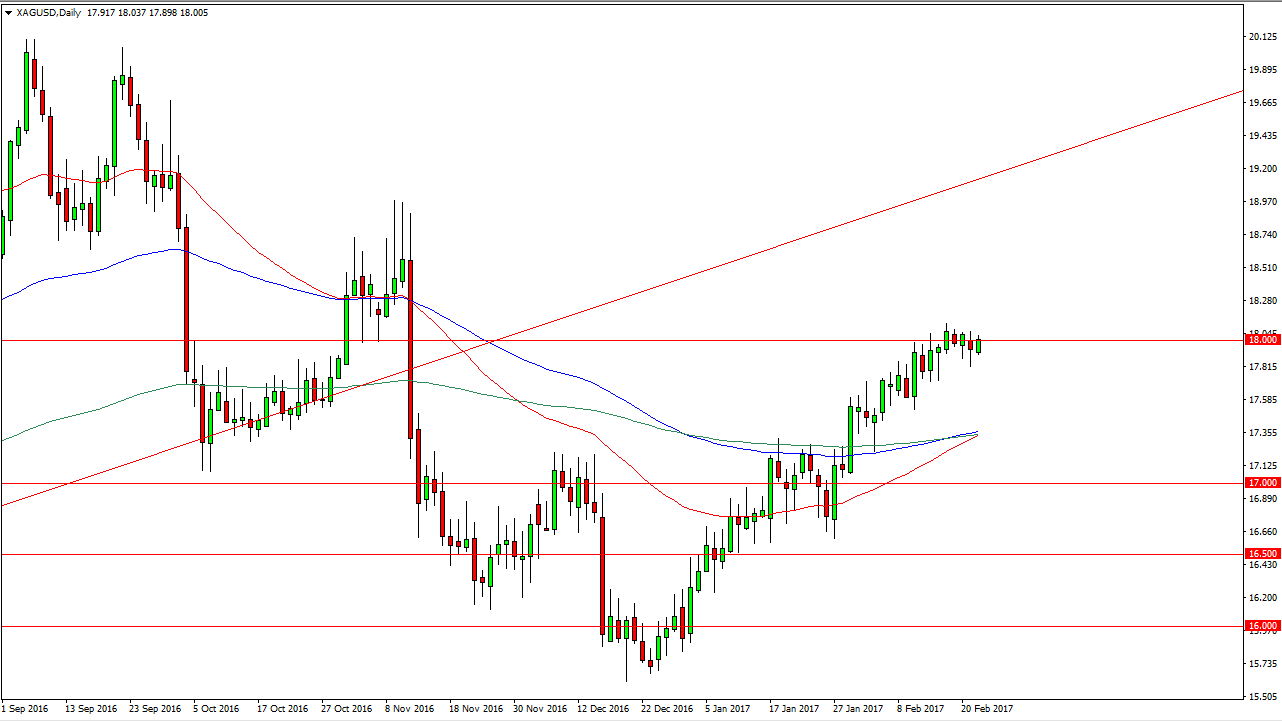

Silver markets initially tried to break above the $18 level during the day on Wednesday, but then pulled back. As I write this article towards the end of the New York trading session, we have peaked back above the $18 level again. If we can break above the $18.10 level, the market should then reach towards the 18.50 level above, and then eventually the $19 level. Eventually, I believe that there is more than enough buying pressure underneath to continue to lift silver. Ultimately, this market is seeing longer-term bullish pressure, and I believe that there is a significant technical signal happening right now.

Major crossing

We have the 50-day exponential moving average, the 100-day exponential moving average, and finally the 200-day exponential moving average all crossing to the upside. Because of this, I believe that the market will then reach into what most traders would consider to be a long-term uptrend. These averages crossing attracts a lot of big money, so I believe every time we pullback people are going to continue to jump into the silver market. Having said that, there are a few things that you need to keep in mind when it comes to the silver market.

The most important thing is that futures markets require a lot of margin and of course can be very volatile. However, I believe that CFD markets or even options might be a way to go. Obviously, if you have the position size availability, you can buy futures, but I just recognize that a lot of traders don’t. There are many silver futures and of course ETFs such as SLV, but the downside of that is it also includes silver related companies, so it’s a little bit of a convoluted play. Either way, it doesn’t matter how you can get involved but I believe that going long the silver commodity will be a nice way to make profits.