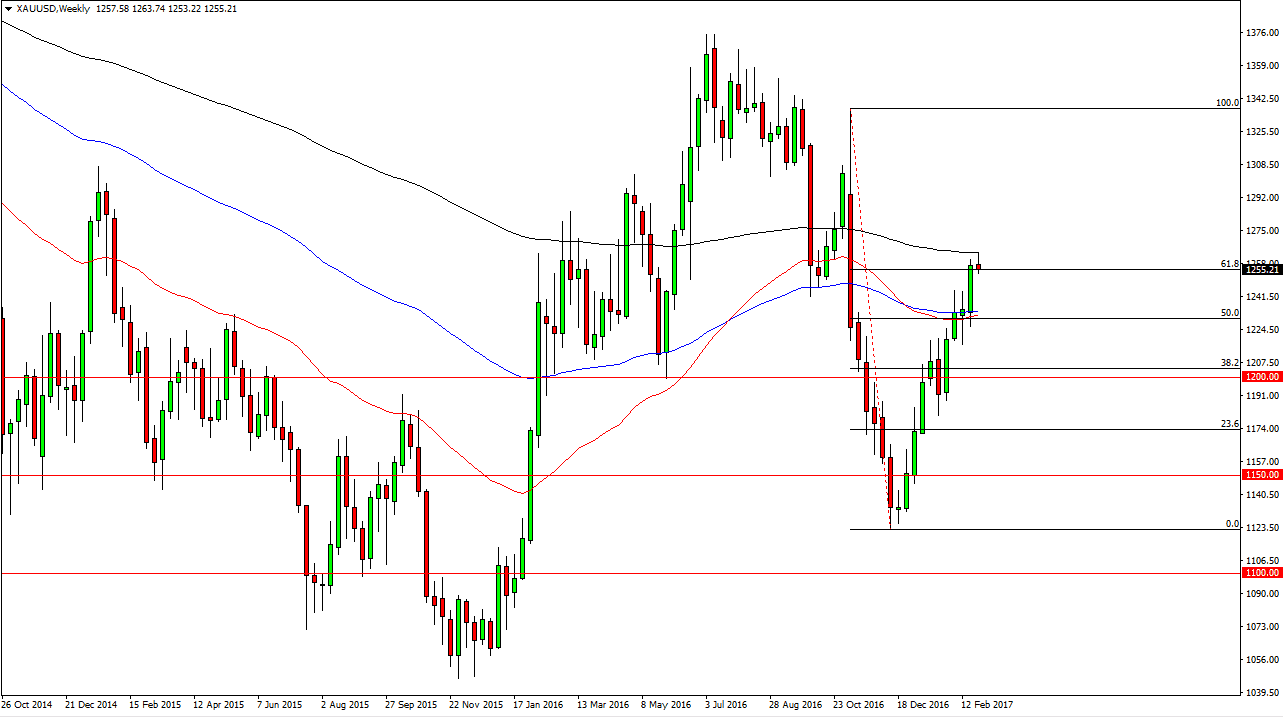

Gold markets have been very strong for some time now, but are starting to run into a little bit of trouble at the 61.8% Fibonacci retracement level. This retracement level is from the surprise Donald Trump election, and that of course was a bit of an overreach on several different levels. It looks as if the market is trying to reverse that move, but the pullback is probably necessary to build up enough momentum to continue going higher. I think the pullback will be short-lived, and that by the time the month is over, we will more than likely be at higher levels.

I also believe that the 50% Fibonacci retracement level should offer support, as the candle from the third week of February looks so healthy. Once we break above the highs from the month of February, the market should be free to go to the $1300 level. I don’t know full get to it during the month of March, but we certainly are going to make an attempt to.

The $1200 level should be the absolute bottom of the market, so I don’t think that were going to break down below there. If we do, that would change everything about this market, and suddenly things would look very bearish. Right now though, I would have to say that I believe the buyers are going to win the day by the time that the month is over. Again though, it’s likely that the sellers will step in during the early days, just because the market is overbought more than anything else. With this in mind, I think by about the 10th and you should be able to start looking to buy this market as gold looks like it has quite a bit farther to go to the upside.

Pay attention to the US dollar it does tend to run counter to the gold markets, but they both can move in the same direction, despite what a lot of people will tell you.