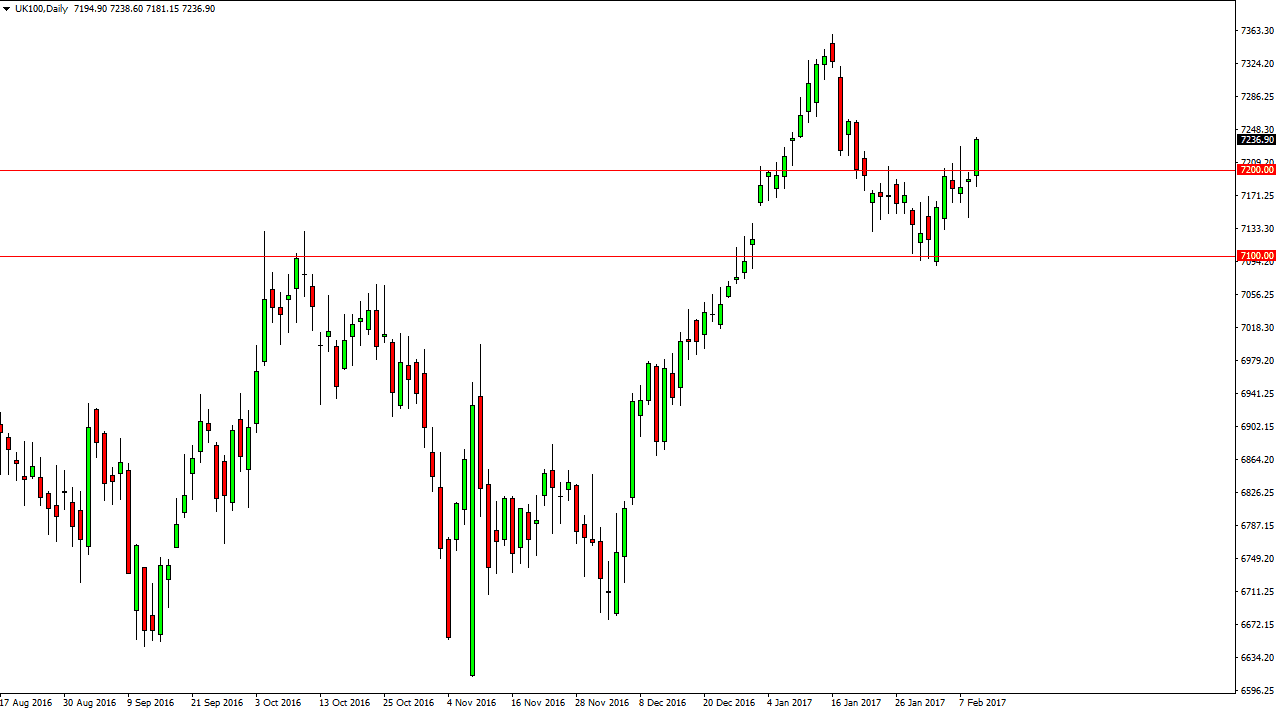

The FTSE 100 initially fell during the day on Thursday, but found enough support below to turn things around and break much higher. The hammer from the Wednesday session of course is very bullish, and the shooting star from the Tuesday session was very negative. The fact that we cracked above that suggests that buyers are in control yet again, and it cannot be overlooked that this formed at the previous gap. Because of this, I believe that the FTSE 100 continues to grind much higher, and of course we been in a longer-term uptrend anyway.

The announcement of the death of the United Kingdom was a bit premature

The British economy has not collapse, as people had feared it would. The exit from the European Union is already factored in when it comes to most markets, and although there will more than likely be a significant reaction when Article 50 finally gets triggered, the reality is that the smart money understands that the UK is the world’s 6th largest economy, and as a result the UK isn’t going anywhere. Remember, was Warren Buffett that said that you should become greedy when others are fearful. I feel this is a perfect analogy for the United Kingdom and the British pound at the moment.

There are careers to be made betting on Great Britain, as the kingdom has been around for much longer than the financial markets. Granted, things may be right from time to time, but ultimately the British economy still remain strong, and quite frankly it’s possible that the British may look back at the exit as a stroke of luck, as the European Union could very well be falling apart longer-term. I remain bullish of all things British, but recognize the volatility will be a mainstay going forward.

The target will be 7350 at first, but I think we go much higher than that given enough time. I look at the 7100 level as the absolute “floor” in the market.