The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 5th February 2017

Last week, I predicted that the best trade for this week was likely to be long USD/JPY. The currency pair fell by 2.19%, a large loss.

The Forex market seems to be staying in a less predictable mode now, with the well-established bullish trend in the USD since 8th November being called into question more and more, yet still being technically intact.

A few major currencies are now starting to move into long-term bullish territory against the U.S. Dollar, most notably the Australian and New Zealand Dollars. Therefore, I suggest that the best trade of the coming week will be long each of these currencies and short of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

There was better-than-expected U.S. jobs data released at the end of last week, yet the U.S. Dollar still did not make a positive move. Fundamental analysts are increasingly taking the opinion that the Trump administration will weaken the U.S. Dollar over the long-term, and in fact the administration did talk the Dollar down. This suggests that despite positive fundamental data, there are fundamental and sentimental factors beginning to work against the U.S. Dollar.

The Bank of England was more dovish than expected in its latest monthly report regarding a future interest rate hike and this seems to have weighed on the British Pound.

Technical Analysis

USDX

The U.S. Dollar printed another bearish candle within the scope of a wider bullish trend that is manifested over both the long term. The bearish candle is quite strong, but the price may find support at the confluence of the supportive trend line and the horizontal level at 122186, as shown in the chart below.

AUD/USD

This week we see a large bullish candle closing near its high, which is significant for its bullishness. This suggests a continuing upwards movement, yet it must be noted that the price has reached an area which has proved to be resistant over a lengthy multi-month period.

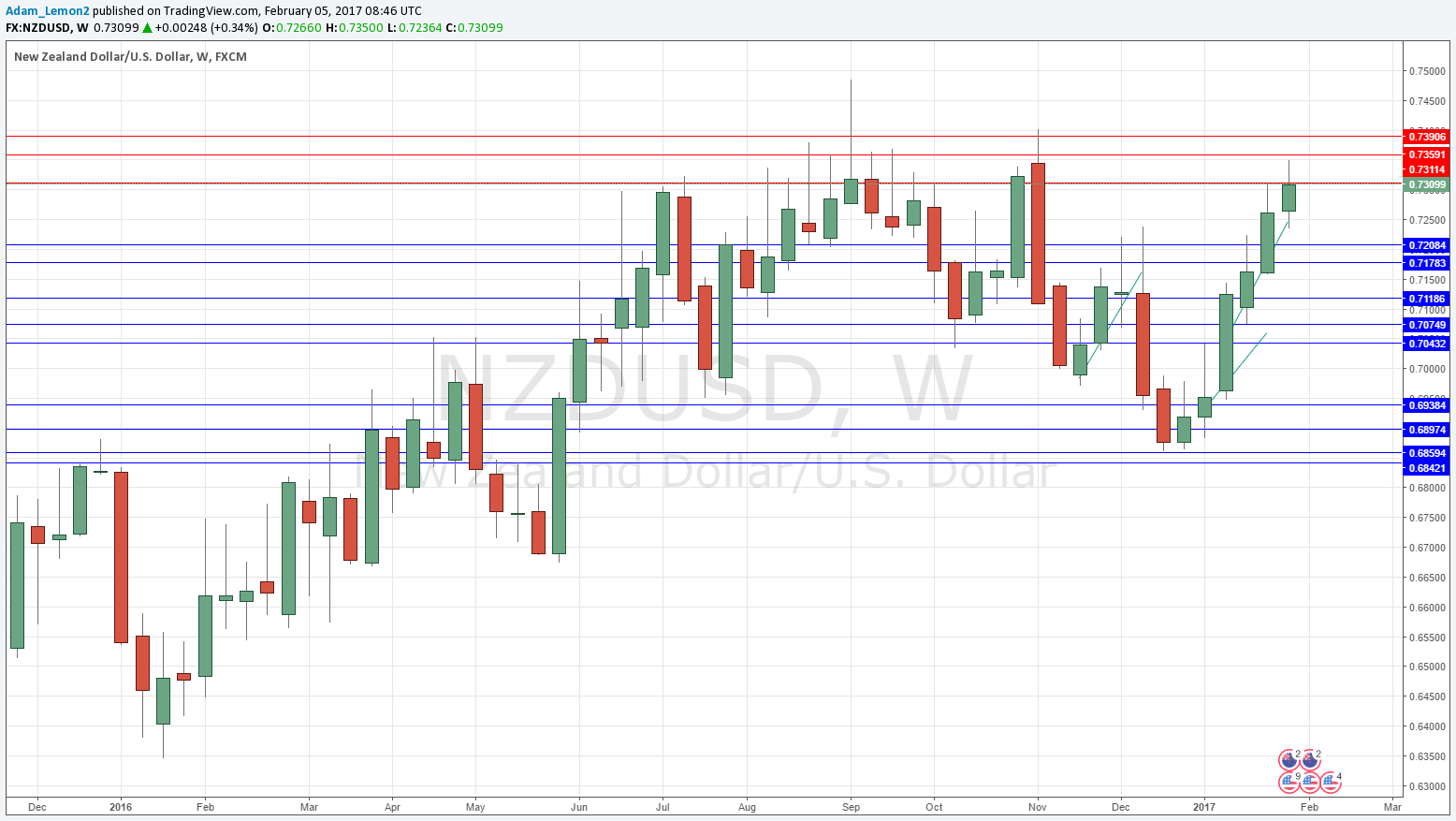

NZD/USD

This week we see a small bullish candle. The long-term trend suggests a continuing upwards movement, yet it must be noted that the price has reached an area which has proved to be resistant over a lengthy multi-month period.

Conclusion

Bullish on the AUD/USD and NZD/USD currency pairs, particularly AUD/USD.