Yesterday’s signals were not triggered as the move up from the support level identified at 1.0565 did not take place until after the end of the London session.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be entered before 5pm London time today only.

Long Trade 1

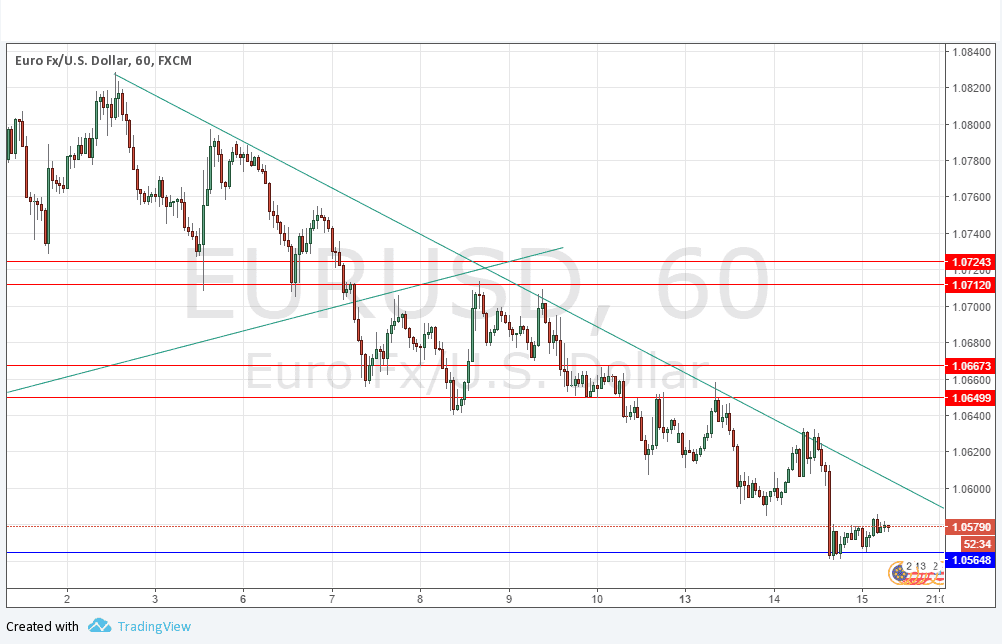

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0565.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.0650 and 1.0667.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

The steep bearish trend line is still holding the price down, with Janet Yellen’s comments sending the price plunging to the closest key support level of 1.0565 which has held so far. After the Asian session pull-back, the current action suggests the price is falling to test the level again.

There are both long-term and medium-term bearish trends dominating.

There is nothing due today concerning the EUR. Regarding the USD, there will be a release of CPI and Retail Sales data at 1:30pm London time followed later by the Chair of the Federal Reserve testifying before Congress at 3pm, and Crude Oil Inventories numbers half an hour afterwards.