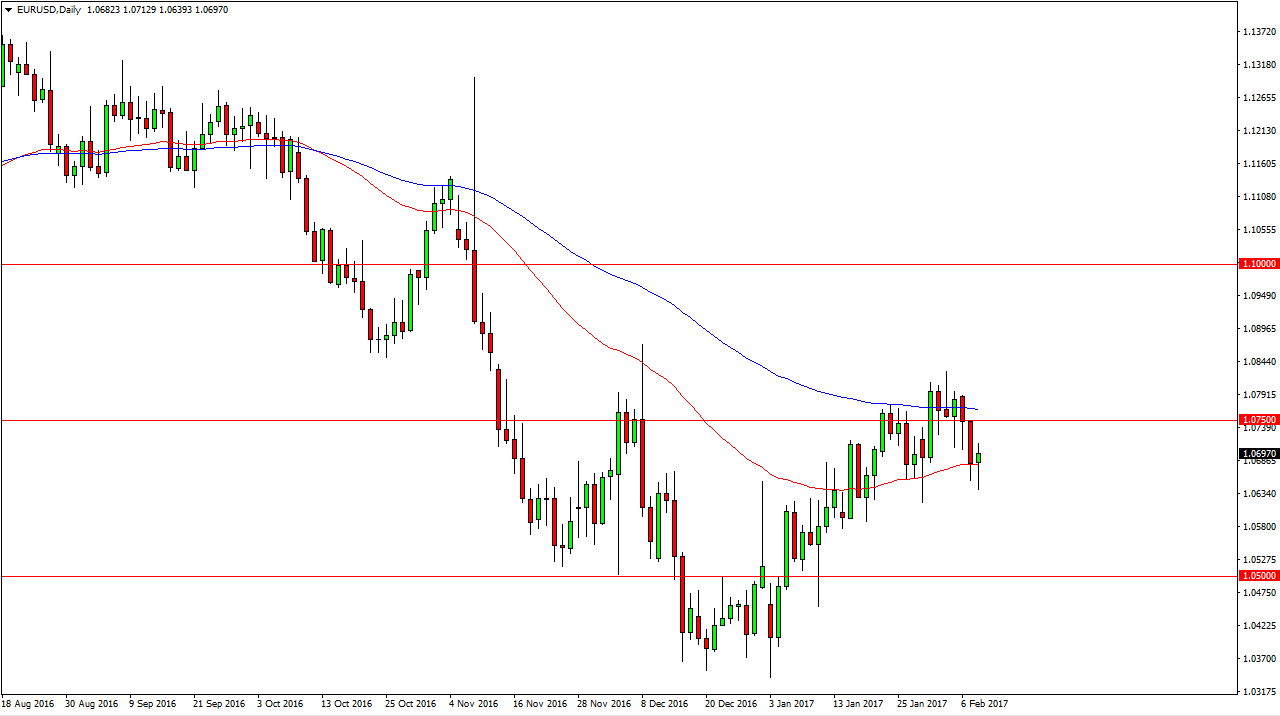

EUR/USD

The EUR/USD pair broke down during the day on Wednesday, slicing below the 50-day exponential moving average. We turned around to form a hammer like candle, and because of this I believe that the market will probably grind to the upside, perhaps reaching towards the 1.0750 level above. Also, there is the 100-day exponential moving average just above there, and I believe that it will offer dynamic resistance. Currently, I believe that the buyers probably have the upper hand but it looks as if we’re going to bang around between these 2 moving averages in general. If we did breakdown below the bottom of the hammer for the session on Wednesday, I believe that the market breakdown would be coming. Volatility remains a mainstay of this market as far as I can see.

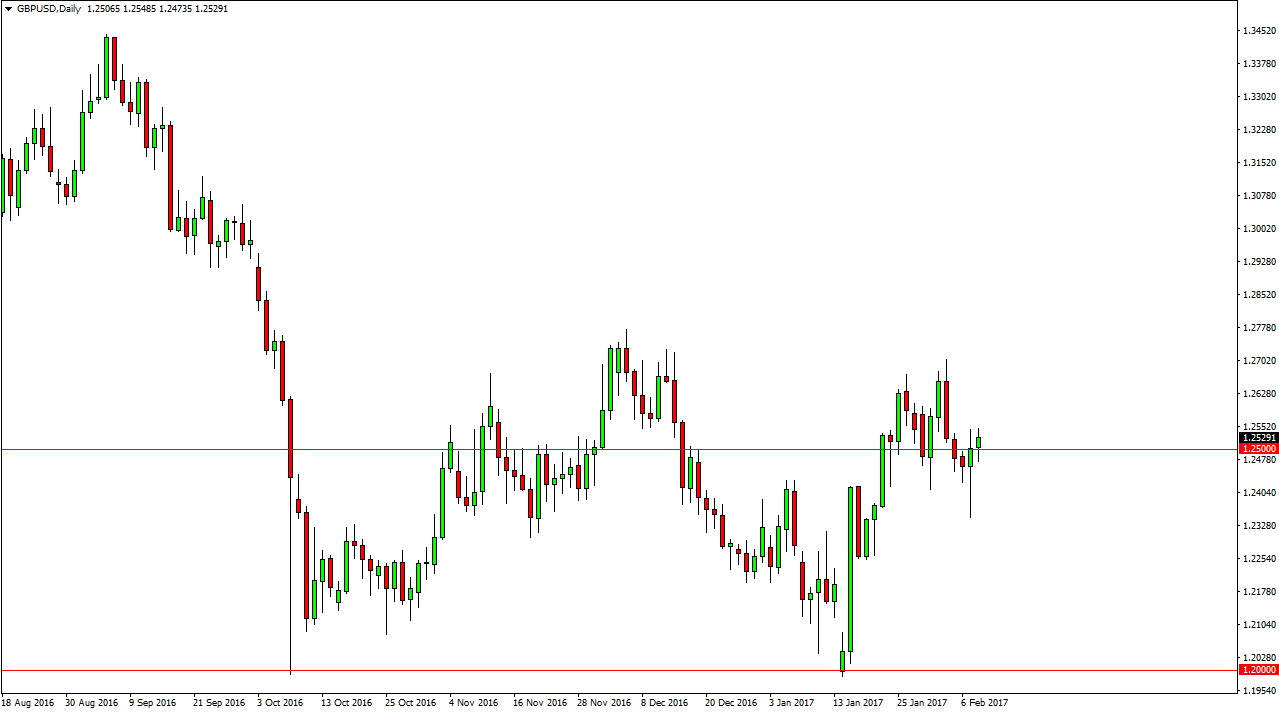

GBP/USD

The British pound fell initially during the day but continues to find support near the 1.25 level. That’s an area that I think will continue to attract a lot of interest, and I am of the thought process the perhaps the British pound has bottomed. Longer-term trend changes are very volatile and messy affairs, so I think the market pulling back from time to time isn’t going to be much of a surprise. If we can break above the top of the candle for Wednesday, the market will more than likely go reaching towards the 1.27 level above. The hammer that formed for the Tuesday session I believe continues to keep this market afloat, so it’s not into we break down below there that I would even think about selling, and even then, I would have to reevaluate the entire situation.

Shorting this market would be very dangerous, but the potential turn around in the British pound is young, so won’t take much to disrupt the bullish pressure.