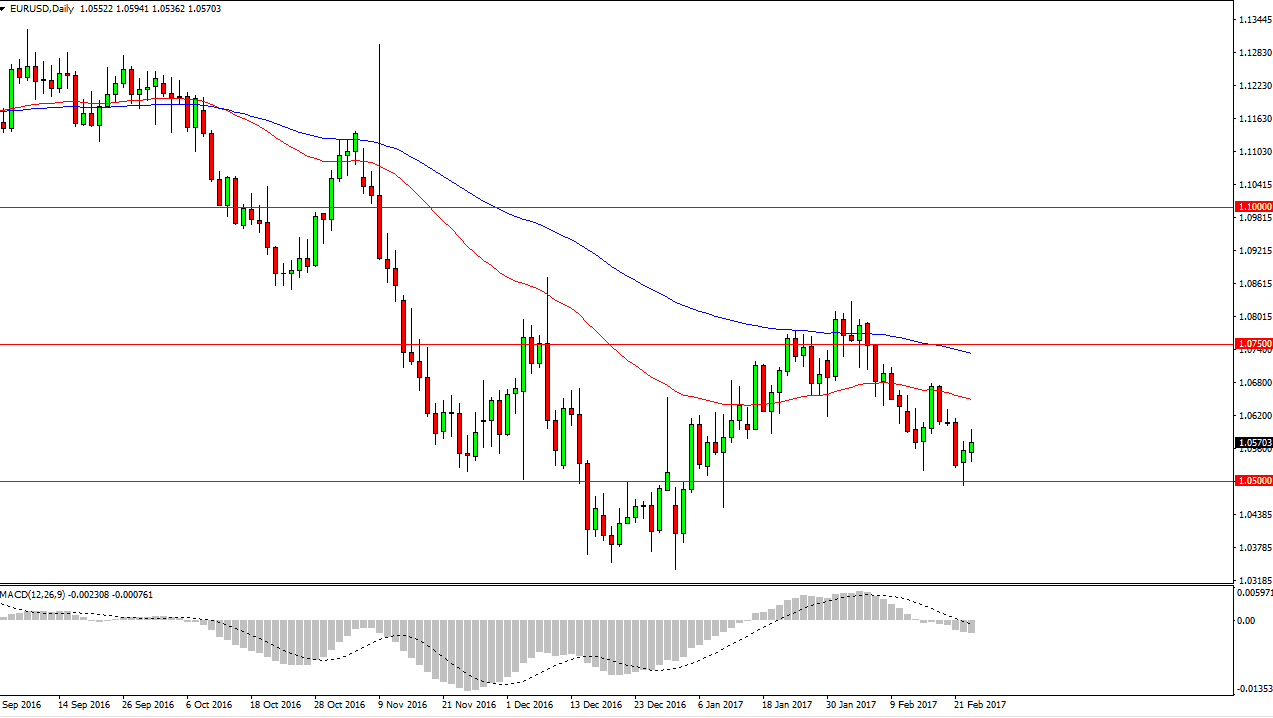

EUR/USD

The EUR/USD pair went back and forth during the day on Thursday, but ultimately I think this shows that the market is ready to sell off every time it rallies, and exhaustive candle should be exactly what we are looking for. The 1.05 level underneath continues to be massively supportive, and with that being the case I think that it’s likely the fight is probably going to be rather difficult. However, I think that was we break down below there the market should then reach towards the 1.0350 level, which has been even more supportive. I do think the traders are starting to be concerned about the French elections, and that it will continue to weigh upon the EUR in general. I have no interest in buying, and I am more than willing to start selling.

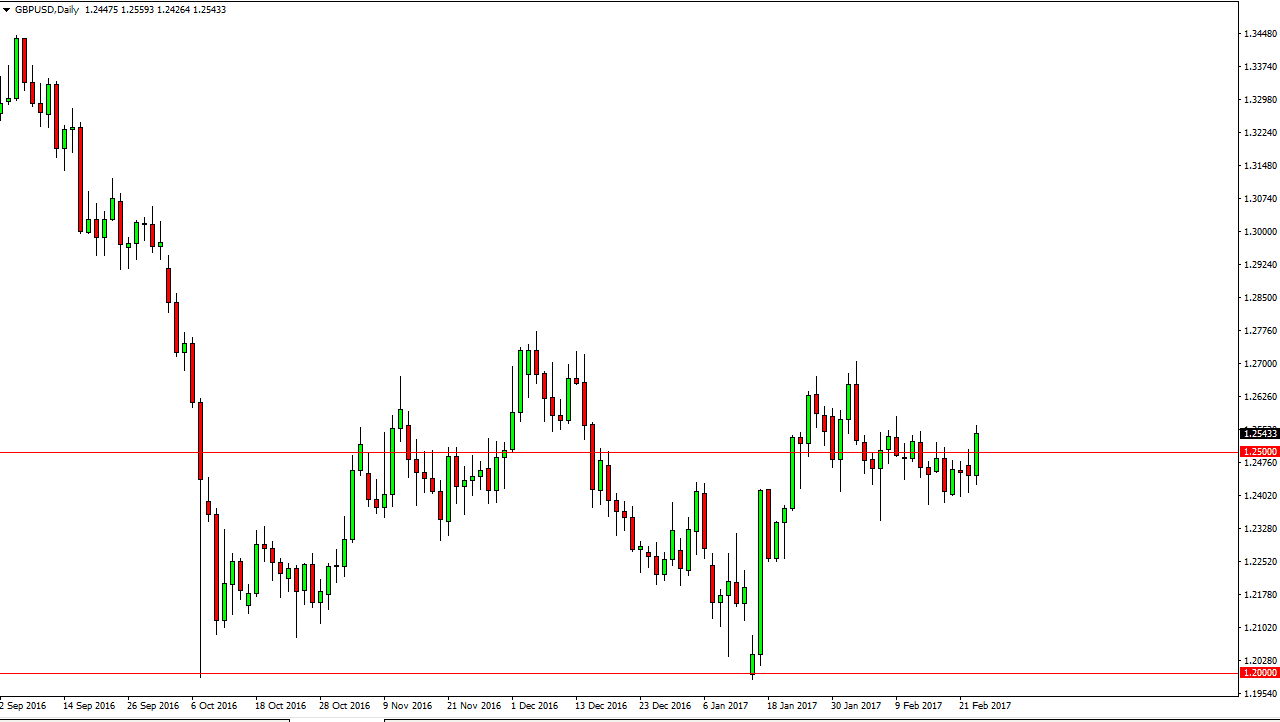

GBP/USD

The British pound rallied during the day on Thursday, breaking above the 1.25 level. I believe that the market will go higher, but we need to pull back and find momentum building buying underneath. I think that the longer-term aspect of this market looks to reach towards the 1.27 level, and then eventually higher than that. I believe that pullbacks will continue to offer value. I think that the 1.24 level underneath continues to be a bit of a floor. However, I think that the triggering of Article 50 may cause another flush lower, but that should be the absolute bottom in this market. The British pound has shown signs of strength against most currencies around the world, and the US dollar doesn’t seem to many different.

Buying on the dips on short-term charts as how I’m going to play this market, I believe that selling is simply looking for a lot of trouble. Even if we break down below the 1.24 level, the market could more than likely find support at the 1.2250 level after that.