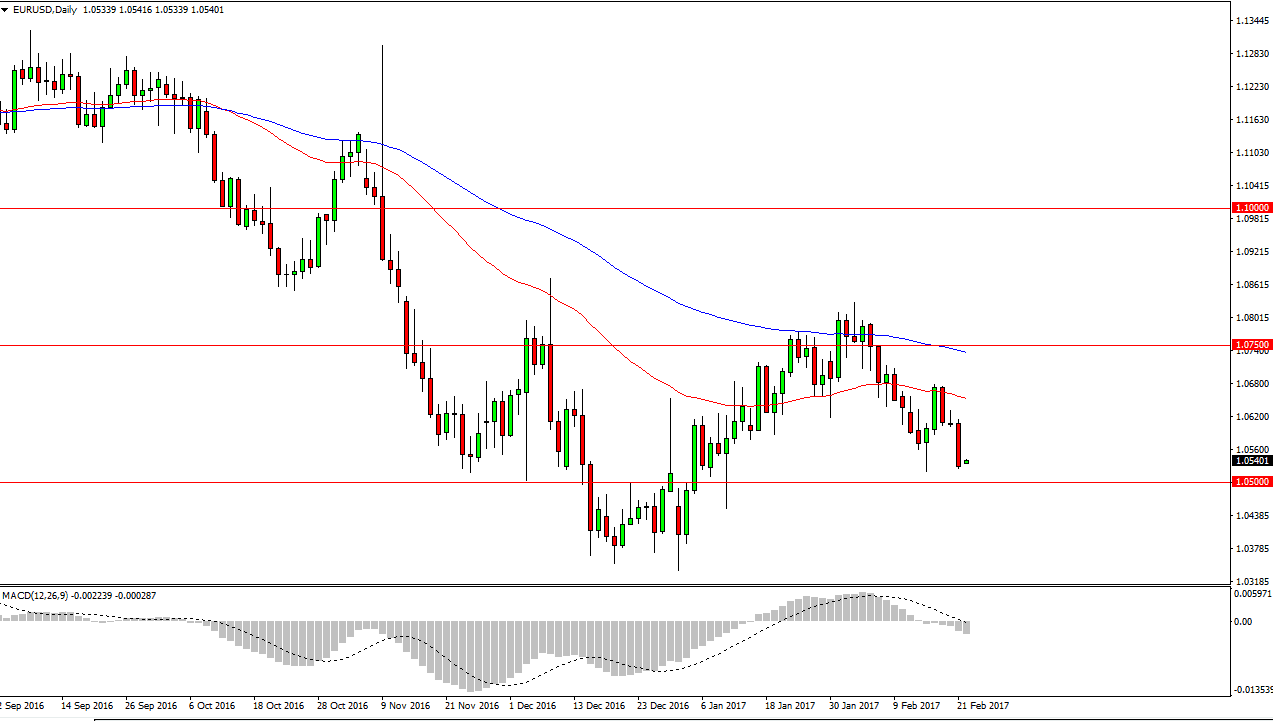

EUR/USD

The EUR/USD pair fell rather significantly during the day on Tuesday, as we reached towards the 1.05 level. There should be a significant amount of support in this area though, so a bounce makes quite a bit of sense. However, if we find ourselves breaking down below the 1.05 handle, the market should then reach towards the 1.0350 level below which had been even more supportive. Anytime a supportive candle or a bounce here could offer short-term buying opportunity but quite frankly I think it can be easier to short this market after the bounce, and signs of short-term exhaustion. I have no interest in buying this pair, so patience will be needed.

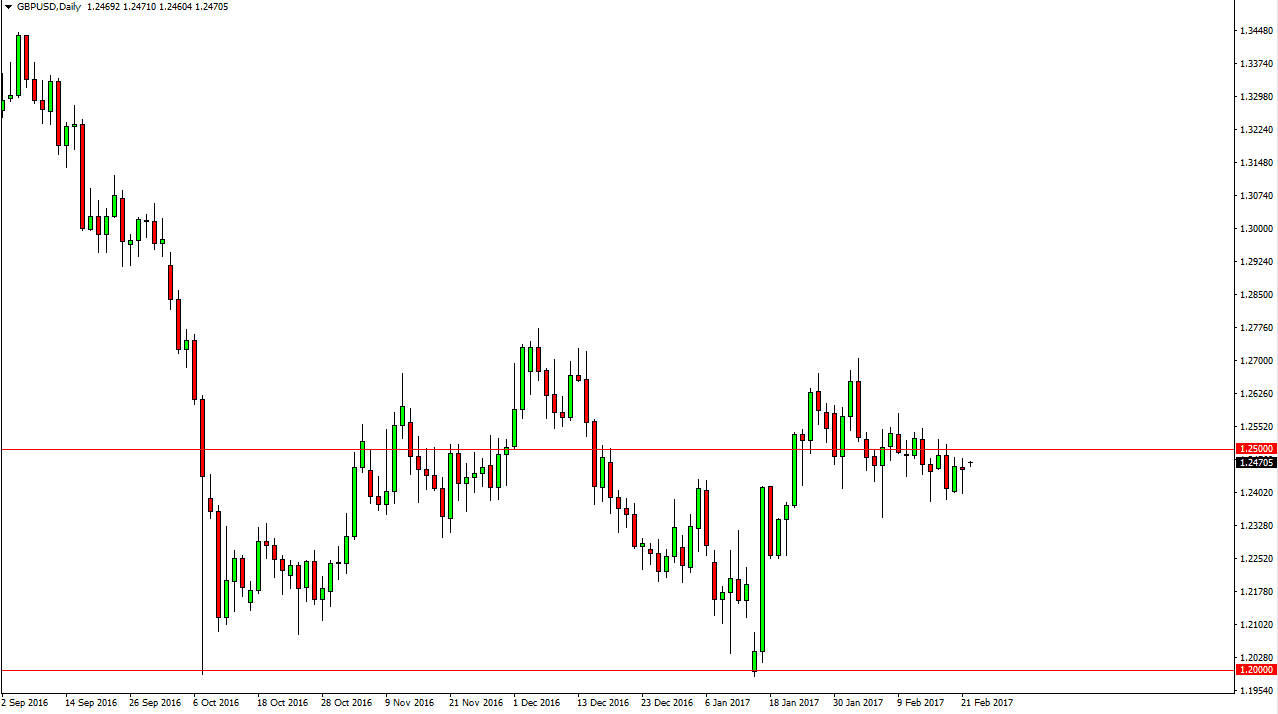

GBP/USD

The British pound fell initially during the day, but turned around to form a hammer. The hammer sits just below the vinyl 1.25 level, an area that has been attracting a lot of attention. If we can break above that area with any type of significance, the market should then reach towards the 1.27 level above. We can reach above there and aim for the 1.2750 level after that as well. The British pound is a currency that’s trend finds its footing, and I think that the recent action only adds more credence to that idea.

If we break down below the 1.24 level, I think we will then go towards the 1.2250 level below which should be supportive as well. The Article 50 claws will be triggered relatively soon, and that could cause a knee-jerk reaction to the downside, but quite frankly that’s going to be a buying opportunity as well. Given enough time, I think that the market will reach towards the 1.30 level but is going to be a serious fight. I think over the next couple of months, the British pound find its footing and change its direction longer term. By the end of this year, I expect to see much higher levels.