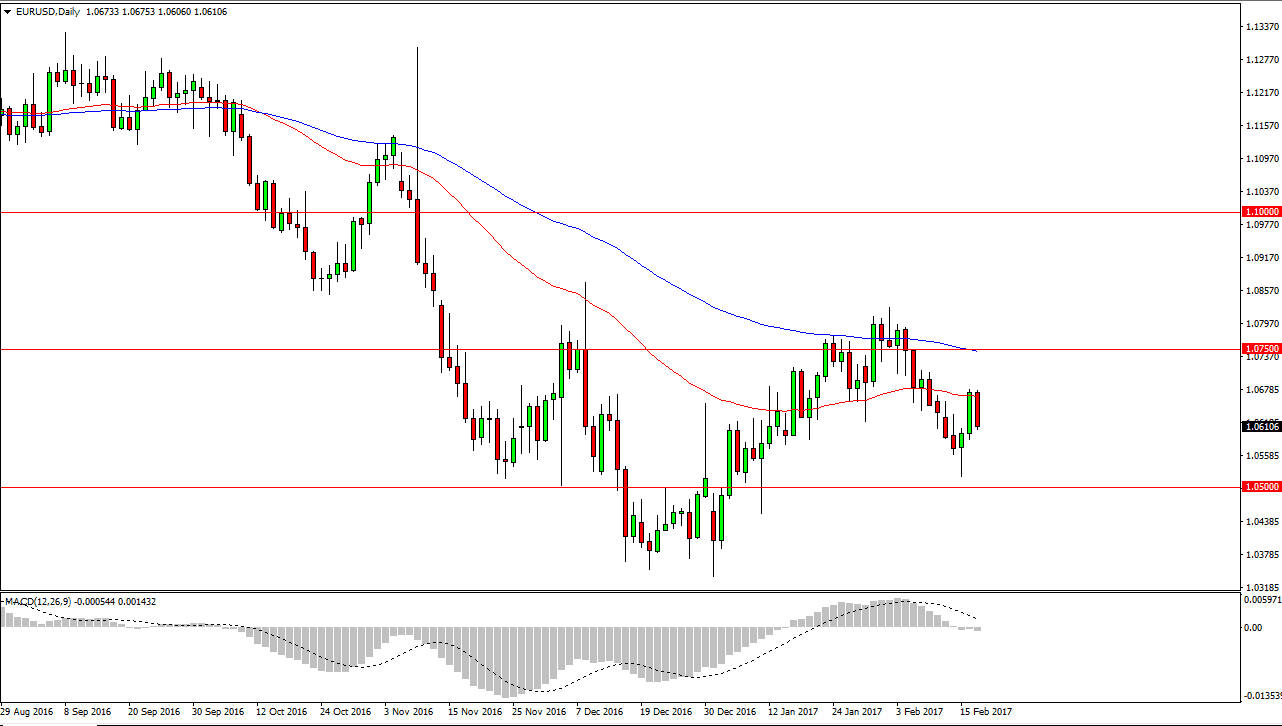

EUR/USD

The EUR/USD pair fell from the 50-day exponential moving average on Friday, showing signs of exhaustion. This is an area that continues to be very volatile, and I believe that the market dropping from here will probably test the 1.05 level underneath for support again. If we do rally from here, there should be significant resistance at the 1.0750 level. Nonetheless, the market should continue to test the nerves of traders, so having said that I am more than willing to step to the sideline as I believe that although we are in a downtrend, it’s going to be a significant fight. If we can break down below the 1.05 level, the market should then reach towards the 1.03 level.

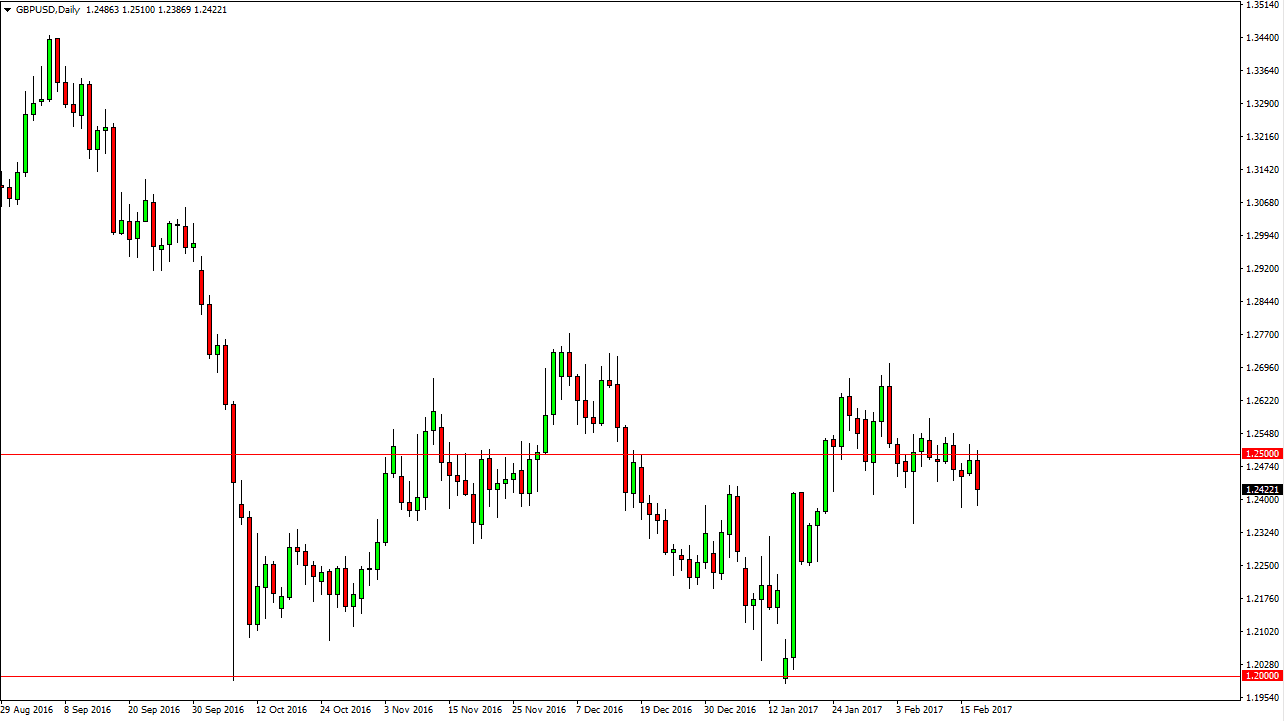

GBP/USD

The British pound fell during the day on Friday, testing the 1.24 level. This is an area that I have been claiming should be supportive recently, and it looks as if that may be the case. The hammer from a week ago obviously offer support as well, so even if we break down I’m a bit hesitant to start shorting. I believe that the 1.2250 level underneath should be massively supportive. A supportive candle or a bounce from here should be a buying opportunity. A break above the 1.25 level should then send this market looking for the 1.27 handle above. I believe that the British pound is trying to form a longer-term bottle, and as a result I believe that the market should continue to fight and try to go higher.

Longer-term, I believe that eventually the market could go to the 1.30 level but in the meantime, it can be very volatile and is can be difficult to deal with. Short-term trades or even binary options might be the way to go in this market. Currently, I believe that the 1.20 level is the absolute floor in the market.