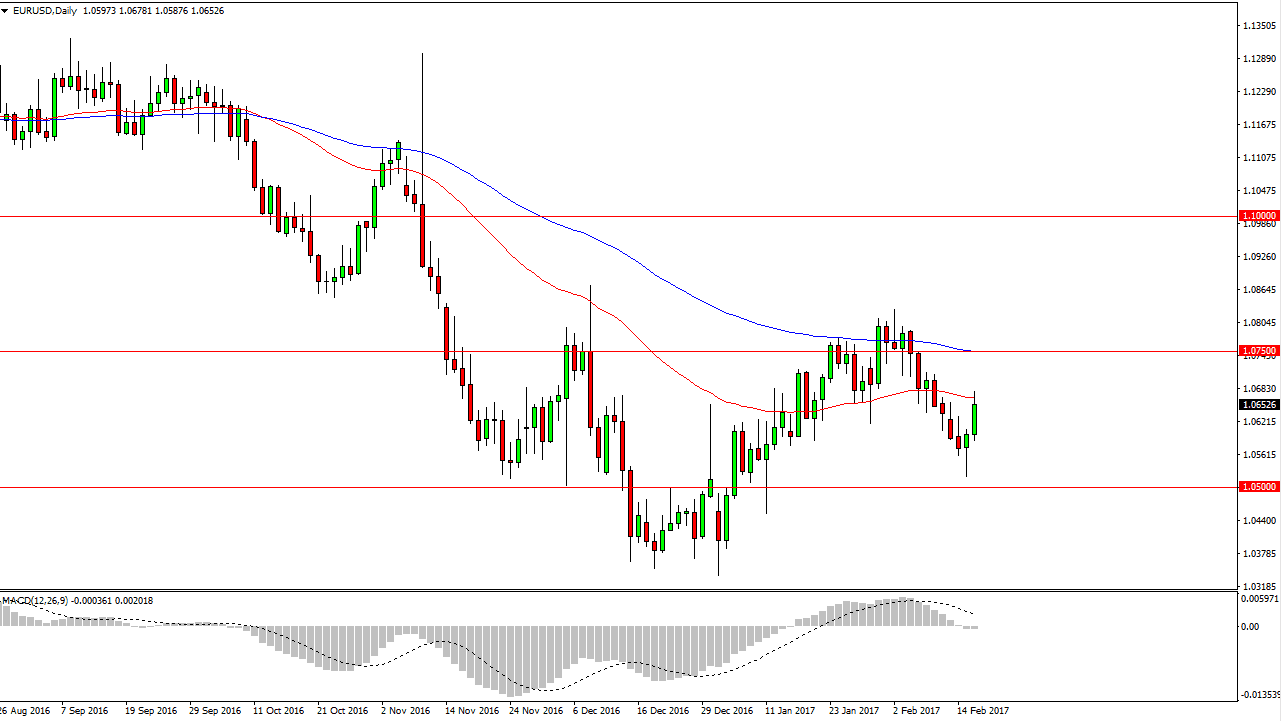

EUR/USD

The EUR/USD pair broke higher during the day on Thursday, touching the 50-day exponential moving average. I believe that the market will eventually pull back from here, as we have seen so much in the way of exhaustion. The market should see a lot of resistance near the 1.0750 level, and because of this it’s likely that the sellers will return sooner, rather than later. If we can break down, I believe that the market is then going to reach down to the 1.05 handle. If we can break above the 1.0750 level, it is possible that perhaps we go higher, but at this point I still believe that this market has quite a bit of bearish pressure.

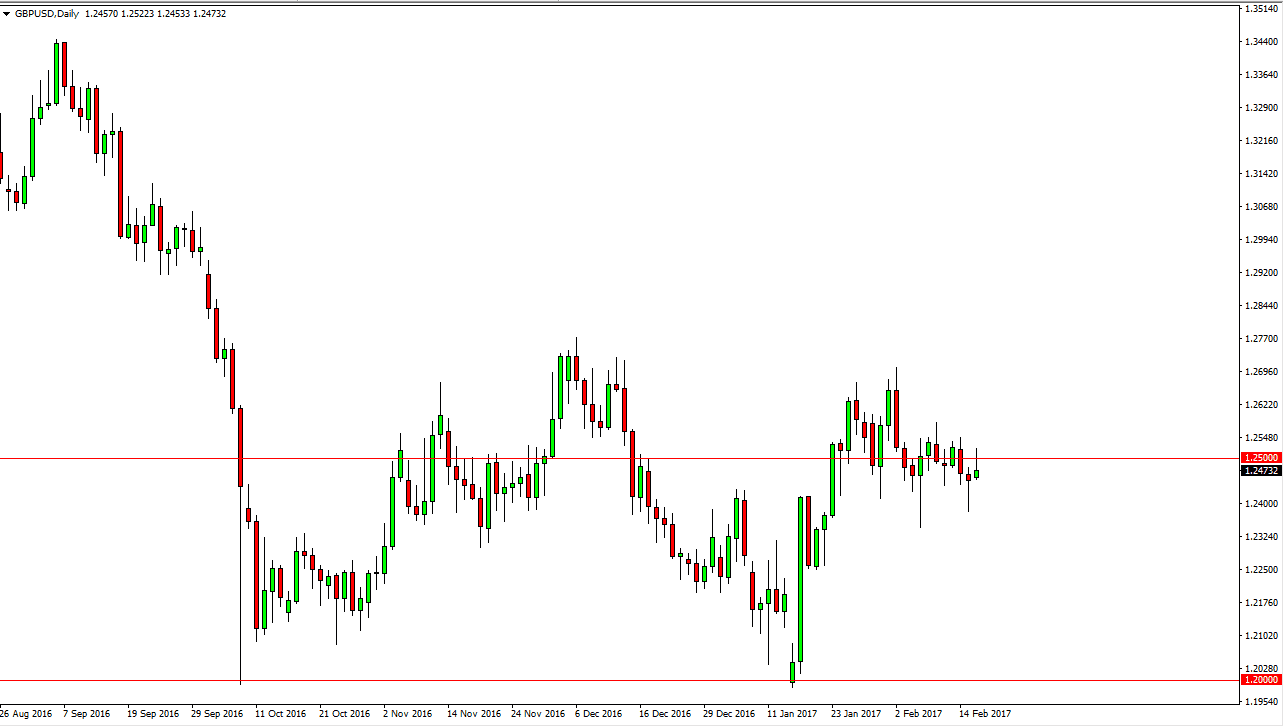

GBP/USD

The British pound rallied initially during the day on Thursday but continues to see quite a bit of resistance above the 1.25 handle. That’s an area where sellers keep returning but I think that the support is stronger longer term. With this in mind, I think it’s only a matter of time before the buyers get involved and push much higher. The 1.2750 level will be targeted over the longer term, but it might be a while before we get there. Because of this, expect what a bit of choppiness but I think ultimately the winners will be the buyers. I think that the 1.24 level below continues to be massively supportive, and because of that it’s likely that the pullbacks will only offer opportunities to take advantage of a currency that has been oversold. If we break down below the 1.24 level, then I could be persuaded that the market should then go down to the 1.2250 level.

The British pound has been oversold, and I believe currently is trying to form a bottom in the marketplace longer term. This is always a messy affair, so the choppiness and volatility does not surprise me at all.