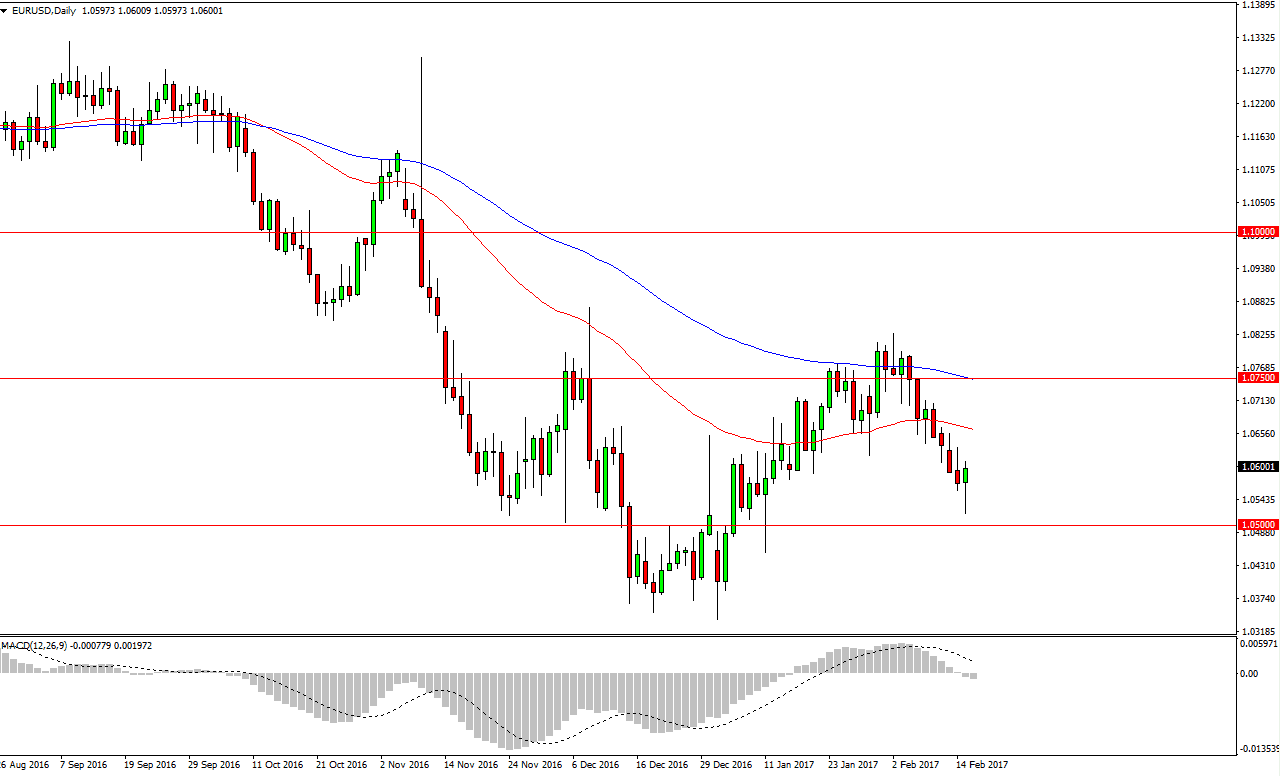

EUR/USD

The EUR/USD pair fell initially during the day on Wednesday, testing the 1.05 level. This is an area that should be supportive, and it makes sense that we bounced from there. The hammer of course is a bullish sign but I think that it’s only a matter of time before the sellers get involved. When I look at the momentum based indicators, we are drifting lower overall, so I think that this will simply be a selling opportunity. The US dollar should continue to strengthen overall, especially with the Federal Reserve all but assured to make several interest rate hikes this year. I have no interest in buying, and believe that being patient will be the best way to trade this market. Alternately, we could break down below the 1.050, and that should send this market down to the lows again.

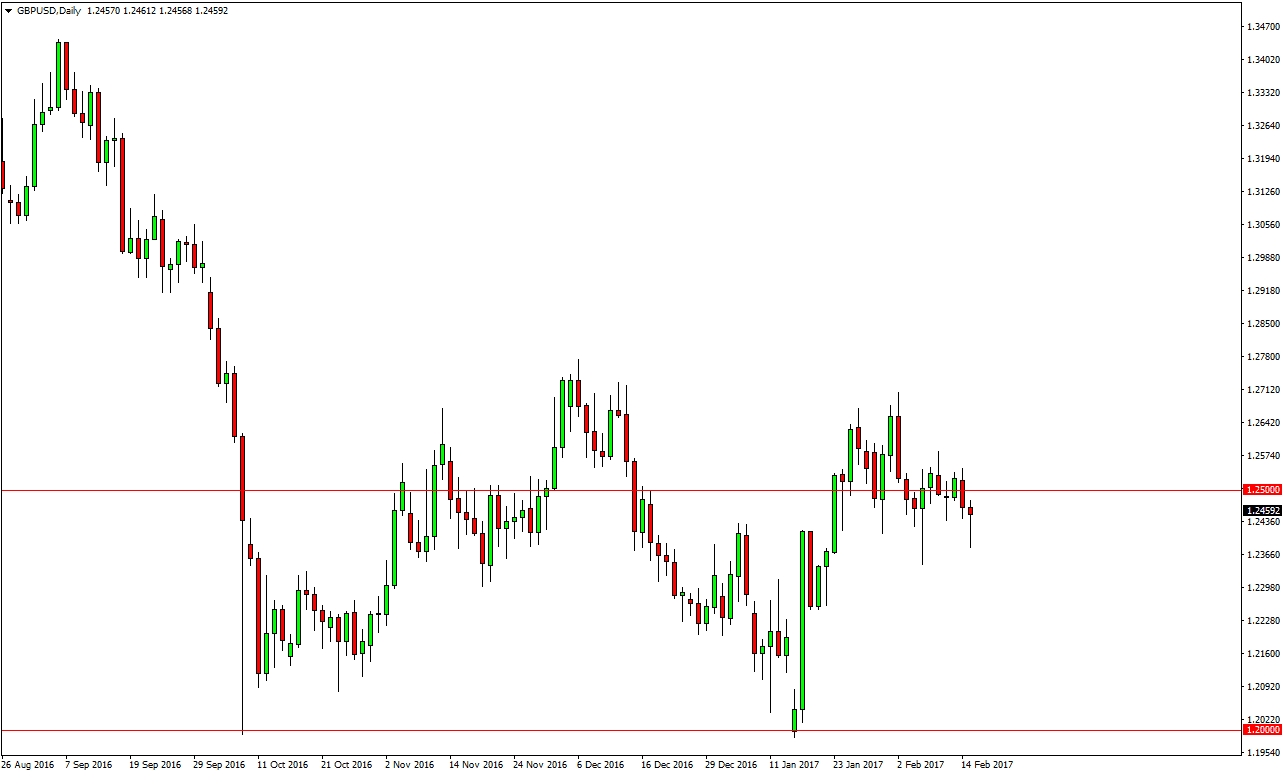

GBP/USD

The British pound fell initially during the day on Wednesday, but found enough support to turn things around and form a nice looking hammer. The 1.25 level above being broken to the upside signifies that we will probably reach towards the 1.27 handle, perhaps even the 1.2750 level after that. I believe that the British pound is trying to form a longer-term bottom, and that is almost always a very volatile circumstance. I think that once we get above the 1.2750 level, the market will then reach towards the 1.30 level. I have no interest in selling this pair, because unlike most other central banks around the world, the Bank of England looks like it may actually be able to raise rates in the future as the economy has been doing reasonably well in the United Kingdom.

It will be very volatile, but if you are patient and can handle this type of volatility, I believe that the market will offer profits for those of you who are willing to stick with the trade.